Canadian technology stock Enghouse Systems (TSX:ENGH) just turned heads with a 15.4% dividend hike on Monday, pushing its yield to an attractive 4.5%. The elevated dividend yield is hard to ignore for income-focused investors – especially from a tech company. But with the stock down nearly 68% from its 2020 peak, is this a hidden gem or a value trap? Let’s break it down.

The bull case: 5 Reasons why Enghouse Systems stock’s dividend shines

- 17 years of reliable dividend growth: Enghouse Systems stock isn’t new to rewarding shareholders. The latest raise marks its 17th straight year of dividend increases, with an average annual growth rate above 10%. That track record is rare, even among the constituents of the S&P/TSX Canadian Dividend Aristocrats Index.

- A well-covered payout: Enghouse’s dividends are well covered by free cash flow and earnings. At $0.20 per share, ENGH’s new quarterly dividend is 77.9% of the company’s diluted earnings per share (EPS) during the past 12 months.

- A financial fortress: The software and services company has no long-term debt and sits on $271 million in cash. This gives it flexibility to fund acquisitions, buy back shares, and sustain dividends without risky borrowing. Free cash flow has stayed above $100 million annually for five years, comfortably covering the $1.20 per share annual dividend.

- Recurring revenue is rising: Nearly 71% of revenue now comes from software-as-a-service (SaaS) and maintenance contracts, up from 70% a year ago. This predictable income stream supports steady dividend payments during periods of heightened economic uncertainty.

- Growth through acquisitions: Enghouse uses its cash pile to buy smaller tech firms, like December’s purchase of AI-focused Aculab and March’s deal for transit software provider Margento. These deals diversify its offerings and could reignite growth.

The risks: Why caution still matters

Enghouse Systems’ margins are shrinking: Gross margins have slipped from 72% in 2021 to under 65% today, while operating margins continued to shrink during the past quarter. The shift to lower-margin SaaS products and higher cloud costs are partly to blame. If this trend continues, earnings growth – and perhaps dividend safety – could suffer.

Slow revenue recovery: While revenue grew 10.7% in 2024, that followed two years of declines. Recent sales growth is modest (2.9% last quarter) and partly fueled by currency swings. The post-pandemic slump in demand for video conferencing tools (like its Vidyo platform) remains a headwind.

Acquisitions dependency: Buying smaller companies carries risks. Overpaying, integration challenges, or cultural mismatches could strain cash reserves without delivering desired returns.

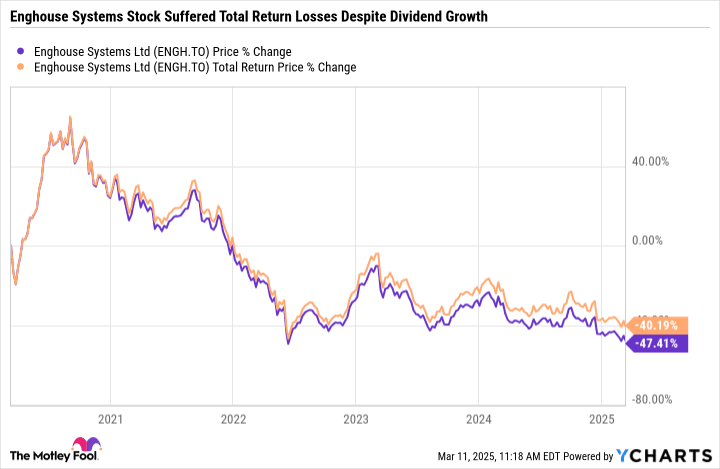

A history of poor stock performance: Despite improving fundamentals, Enghouse Systems stock hasn’t recovered. Investors may need patience as the market waits for clearer signs of a turnaround.

Total returns potential: A look beyond the ENGH dividend

For long-term oriented investors, the real question is whether Enghouse Systems stock can deliver both juicy passive income and price appreciation. The stock trades at a reasonable 17 times its forward earnings, well below its historical average. If acquisitions boost revenue and margins stabilize, a re-rating could occur. However, if growth stays sluggish, the dividend might remain the primary driver of returns.

For now, dividends have failed to lift ENGH stock into positive return territory since 2021.

Since past performance doesn’t predict future returns, there’s still hope for better outcomes.

That said, while a 77% earnings payout ratio leaves room for further dividend hikes, it’s not bulletproof. Investors should watch for improvements in organic growth and SaaS profitability.

The Foolish bottom line

Enghouse Systems suits investors who prioritize dividend income and can tolerate uncertainty. The dividend is well-supported today, and the company’s debt-free balance sheet reduces downside risk. However, investors seeking rapid capital growth or worried about margin pressures might look elsewhere.

If you believe Enghouse’s acquisitions will pay off and SaaS margins can stabilize, this tech stock offers a rare mix of high yield and turnaround potential. But if you’re risk-averse or prefer faster-growing tech plays, the 4.5% yield alone might not justify the investment.

In conclusion, ENGH stock isn’t a sure thing – but for dividend hunters willing to bet on a long-drawn recovery, it’s worth a closer look.