Annaly Capital Management has a shockingly large dividend yield of 13%, but that’s not why you should buy it.

The S&P 500 index is currently offering a slim little 1.2% yield. The average real estate investment trust (REIT) is yielding around 3.9%. Annaly Capital Management (NLY 0.05%), a mortgage REIT, is offering an over 13% dividend yield today! While you shouldn’t buy Annaly Capital if you are looking for a reliable income stream, it can still be a key part of a millionaire-maker portfolio. Here’s what you need to know.

Annaly Capital is not a reliable income investment

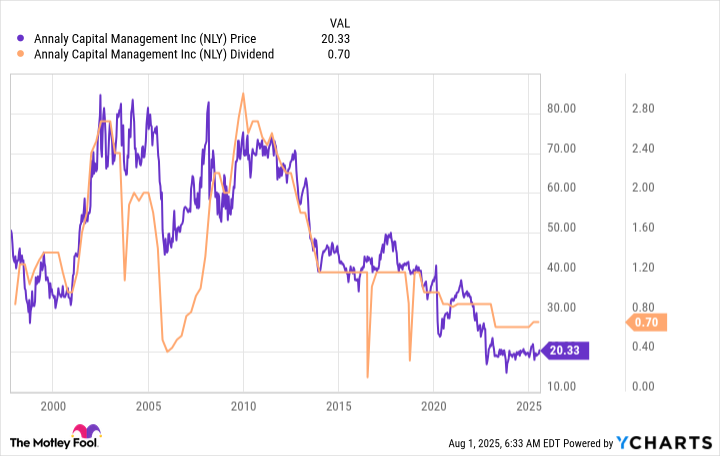

Annaly Capital will probably pop up on most dividend screens given the huge yield it offers. But yield alone is not a good reason to buy this stock, particularly if you need the income your portfolio generates to pay for living expenses. A simple graph can illustrate the issue.

Notice the volatility of the dividend and how the stock price tends to track along with the dividend, up and down. Although the dividend was just increased, the longer trend here is downward. So, dividend investors who bought a decade ago because of a lofty dividend yield have ended up with less income and less capital. Not ideal for a dividend-focused investor.

The problem is with the fact that Annaly is a mortgage real estate investment trust (REIT). This is a fairly complex niche of the broader REIT sector. Annaly basically buys mortgages that have been pooled into bond-like securities. Mortgages get repaid over time, with a portion of the payment covering interest expenses and a portion reducing the principal of the mortgage. So the huge yield here effectively results in the shrinking of the REIT’s portfolio over time, thanks to the principal repayments. On top of that, you can add the impact of interest rates, housing market dynamics, and even mortgage repayment trends.

Image source: Getty Images.

Annaly is not a bad investment

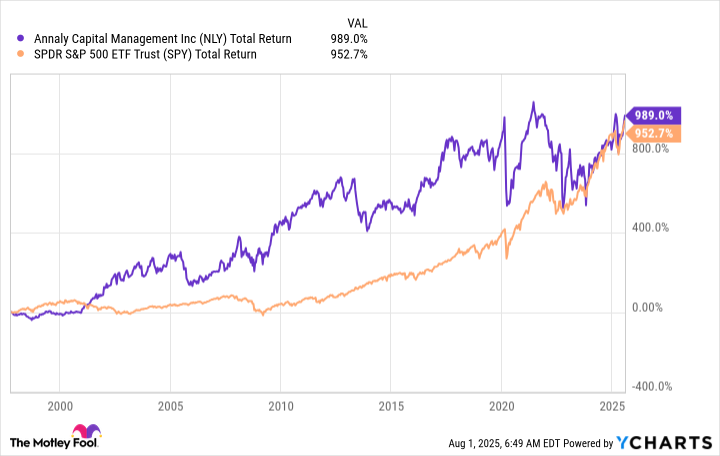

Here’s the thing — Annaly Capital actually does a fairly good job of achieving its goal. That goal, however, is generating an attractive total return. It is not focused on income, even though the dividend plays an important part in the story. The key is that in order to fully benefit from this REIT’s approach, you have to reinvest the dividend, not spend it.

NLY Total Return Level data by YCharts.

As the chart above shows, Annaly’s total return is roughly similar to that of the S&P 500 index over time. However, the chart highlights that the return profile has been different. That makes Annaly a very attractive option for investors looking to create a diversified asset allocation portfolio.

Essentially, adding Annaly to an asset allocation portfolio can provide investors with returns that aren’t directly tied to the general performance of the stock market. Or, to put it a different way, when stocks zig, Annaly could be zagging. The end result is a better total return for the overall portfolio. But if you spend the income this REIT throws off, you won’t be able to fully benefit from this fact.

Is Annaly a millionaire-maker stock?

Annaly Capital probably isn’t a millionaire-maker stock all on its own. But as a part of a larger asset allocation portfolio, this total return-focused mREIT could help you build a seven-figure nest egg. The other big takeaway here, however, is that Annaly is far more complex than a property-owning REIT, and most income-focused investors should probably avoid it despite the huge dividend yield it offers.