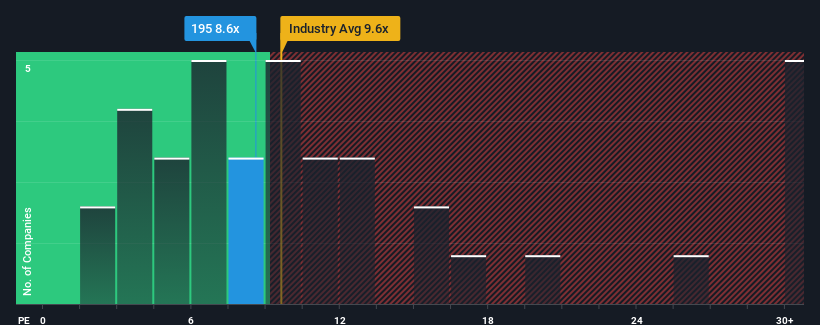

There wouldn’t be many who think Greentech Technology International Limited’s (HKG:195) price-to-earnings (or “P/E”) ratio of 8.6x is worth a mention when the median P/E in Hong Kong is similar at about 9x. Although, it’s not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

As an illustration, earnings have deteriorated at Greentech Technology International over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Greentech Technology International

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Greentech Technology International will help you shine a light on its historical performance.

How Is Greentech Technology International’s Growth Trending?

There’s an inherent assumption that a company should be matching the market for P/E ratios like Greentech Technology International’s to be considered reasonable.

If we review the last year of earnings, dishearteningly the company’s profits fell to the tune of 68%. Unfortunately, that’s brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn’t have been overly satisfied with the unstable medium-term growth rates.

Comparing that to the market, which is predicted to deliver 21% growth in the next 12 months, the company’s momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it’s curious that Greentech Technology International’s P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren’t willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Final Word

We’d say the price-to-earnings ratio’s power isn’t primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Greentech Technology International revealed its three-year earnings trends aren’t impacting its P/E as much as we would have predicted, given they look worse than current market expectations. Right now we are uncomfortable with the P/E as this earnings performance isn’t likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it’s challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we’ve spotted 2 warning signs for Greentech Technology International you should be aware of.

You might be able to find a better investment than Greentech Technology International. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.