As the European economy experiences a boost from the Paris Olympics and hopes rise for interest rate cuts by the ECB, Germany’s DAX has seen a notable uptick. Amid this backdrop of cautious optimism, dividend stocks remain an attractive option for investors seeking stable returns. In this article, we will explore Heidelberg Materials and two other top German dividend stocks that stand out in today’s market environment. These companies offer potential resilience and consistent income streams amidst economic fluctuations.

Top 10 Dividend Stocks In Germany

|

Name |

Dividend Yield |

Dividend Rating |

|

Allianz (XTRA:ALV) |

5.00% |

★★★★★★ |

|

Deutsche Post (XTRA:DHL) |

4.82% |

★★★★★★ |

|

All for One Group (XTRA:A1OS) |

3.23% |

★★★★★☆ |

|

MLP (XTRA:MLP) |

5.21% |

★★★★★☆ |

|

OVB Holding (XTRA:O4B) |

4.71% |

★★★★★☆ |

|

INDUS Holding (XTRA:INH) |

5.42% |

★★★★★☆ |

|

Mercedes-Benz Group (XTRA:MBG) |

8.54% |

★★★★★☆ |

|

Uzin Utz (XTRA:UZU) |

3.35% |

★★★★★☆ |

|

MVV Energie (XTRA:MVV1) |

3.78% |

★★★★★☆ |

|

FRoSTA (DB:NLM) |

3.31% |

★★★★★☆ |

Click here to see the full list of 31 stocks from our Top German Dividend Stocks screener.

Let’s uncover some gems from our specialized screener.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Heidelberg Materials AG, with a market cap of €16.91 billion, produces and distributes cement, aggregates, ready-mixed concrete, and asphalt worldwide through its subsidiaries.

Operations: Heidelberg Materials AG generates revenue from various segments, including €10.90 billion from cement, €4.92 billion from aggregates, and €5.71 billion from ready-mixed concrete and asphalt.

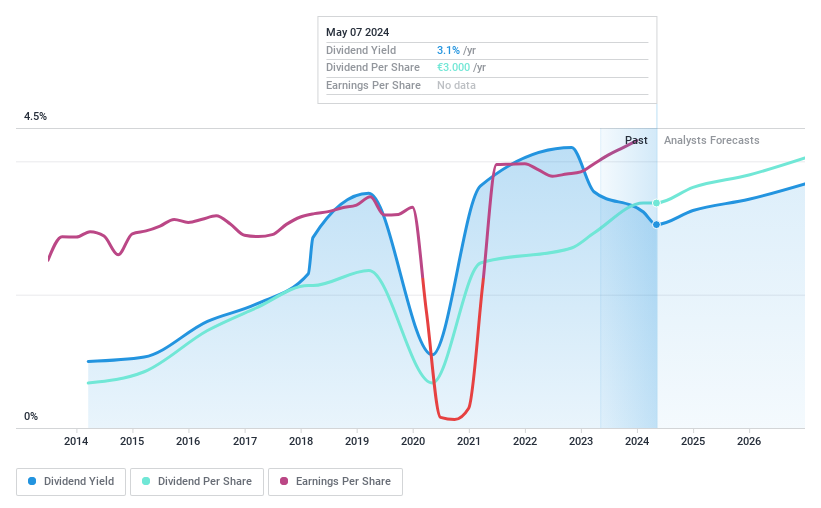

Dividend Yield: 3.2%

Heidelberg Materials has shown a volatile dividend history over the past decade, with payments sometimes dropping by over 20%. Despite this, dividends are well-covered by earnings (payout ratio: 29.6%) and cash flows (cash payout ratio: 27.3%). Recent earnings reports show a decline in net income to €574.3 million for H1 2024 from €718.7 million in H1 2023, which could impact future dividend stability. Additionally, the company is executing a share repurchase program worth up to €1.2 billion through 2026, potentially affecting dividend payouts and stock value.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Deutsche Lufthansa AG operates as an aviation company worldwide and has a market cap of approximately €6.82 billion.

Operations: Deutsche Lufthansa AG generates revenue primarily from Passenger Airlines (€29.04 billion), Maintenance, Repair and Overhaul Services (MRO) (€7.06 billion), Logistics (€2.93 billion), and Additional Businesses and Group Functions (€1.01 billion).

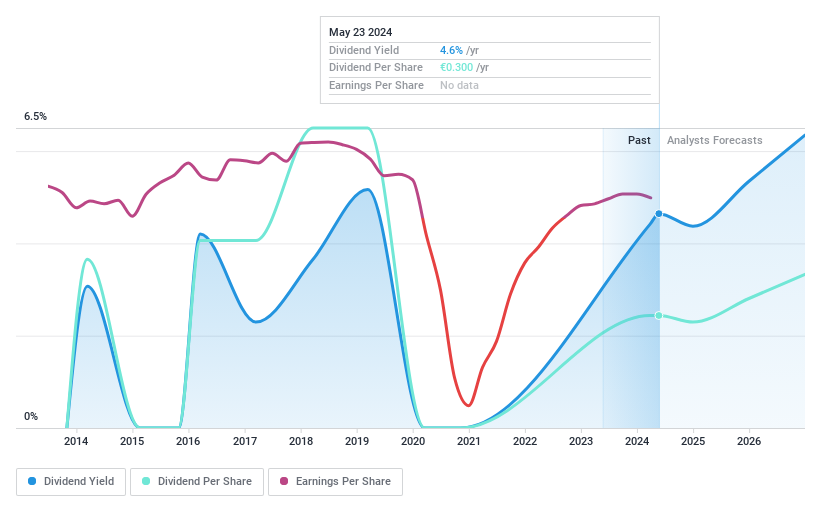

Dividend Yield: 5.3%

Deutsche Lufthansa’s dividend payments have been volatile and unreliable over the past decade, with a significant drop in Q2 2024 earnings to €469 million from €881 million a year ago. Despite this, the company’s dividends are covered by both earnings (payout ratio: 29.8%) and cash flows (cash payout ratio: 60.9%). Trading at a low price-to-earnings ratio of 5.7x compared to the German market average of 16.6x, it offers good relative value for investors seeking dividend income.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wacker Neuson SE manufactures and distributes light and compact equipment in Germany, Austria, the United States, and internationally with a market cap of approximately €991.66 million.

Operations: Wacker Neuson SE’s revenue is primarily derived from three segments: Services (€502.60 million), Light Equipment (€480.20 million), and Compact Equipment (€1.53 billion).

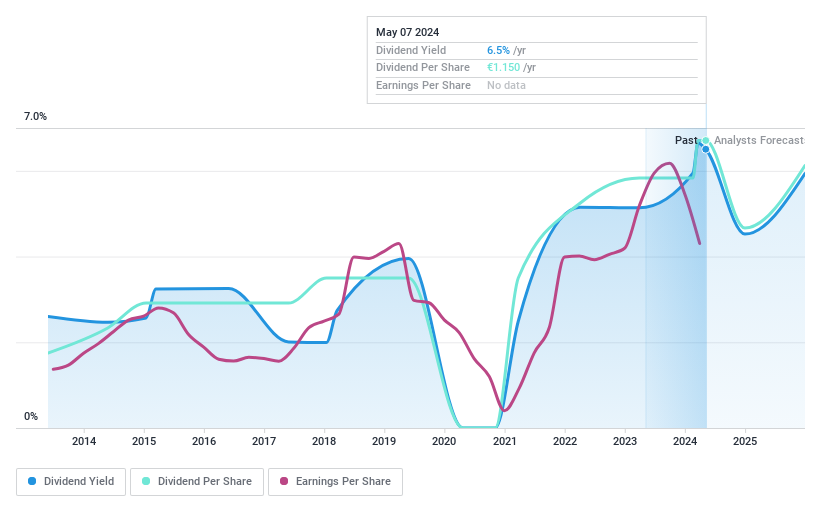

Dividend Yield: 7.9%

Wacker Neuson’s dividend yield of 7.89% is among the top 25% in Germany but is not well covered by cash flows or earnings, with a high cash payout ratio of 418.3%. Recent earnings reports show a decline, with Q2 2024 net income at €31.4 million compared to €63.6 million last year. Despite past volatility in dividend payments, the company has increased dividends over the past decade and trades at a favorable P/E ratio of 8.7x against the German market average of 16.6x.

Seize The Opportunity

-

Reveal the 31 hidden gems among our Top German Dividend Stocks screener with a single click here.

-

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio’s performance.

-

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:HEI XTRA:LHA and XTRA:WAC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com