Over the last month, at least 3 companies – Intel (INTC), B. Riley (RILY), and Burberry Group (BURBY) – have suspended their dividends. All of these companies had a dividend yield ahead of the S&P 500 Index ($SPX), and B. Riley and Burberry in particular had quite impressive dividend yields.

Here it is worth noting that, unlike interest payments that are contractual in nature, dividends on common shares are discretionary. That means the company’s board decides on the payout, usually every quarter. The company considers several factors, like its current financial condition, the expected cash needs, and the macroeconomic scenario, before declaring a dividend.

There have been instances where companies tried maintaining their payouts even as their earnings dipped. These were unsustainable from the word “go,” and eventually, they had to change their policies. BHP Group (BHP) and Rio Tinto (RIO) are two useful examples here, as they had to ditch their “progressive” dividend policies in favor of a variable policy when global commodity prices plunged in 2016.

High Dividend Yields Are Not Always Sustainable

“Dividend yield” is defined as the annual dividend divided by the stock price, and often a stock’s dividend yield rises because its stock price falls. While stocks with high dividend yields might sound enticing, more often than not, incredibly high dividend yields are not sustainable.

A rapid decline in stock price generally reflects the market’s pessimism over the company’s outlook and earnings, which is almost invariably followed by either a dividend cut or a suspension altogether.

Last week, Piper Sandler listed Walgreens Boot Alliance (WBA), Pfizer (PFE), Dominion Energy (D), Oneok (OKE), and Eversource Energy (ES) as companies whose dividends could be at risk. In its analysis, the firm subtracted preferred dividends and capital expenditures from the cash flows, and then divided it by common dividends. It then arrived at what it called the “ability-to-sustain ratio,” which is “concerning” when it’s below 1.

Will Walgreens Boots Alliance Need to Suspend Its Dividend?

Walgreens Boots Alliance (WBA) cut its dividend by almost half earlier this year, but its yield is still over 9%, thanks to the over 58% YTD fall in its stock price. The company’s dividend still looks to be at risk, as Walgreens hasn’t been generating enough cash flows to cover its dividends. The company is on track to cut its capex and working capital by $600 million and $500 million, respectively, in the fiscal year 2024, which will help improve its cash flows.

However, given its precarious financial position, a further cut in the company’s dividend cannot be ruled out, with some even calling for the pharmacy chain giant to suspend its dividend to strengthen its balance sheet.

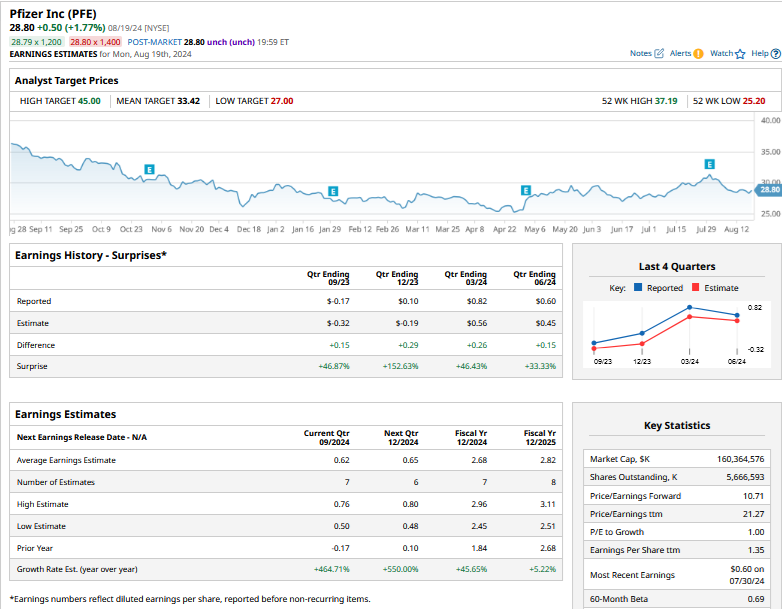

Pfizer’s Dividend Doesn’t Look At-Risk

While Pfizer (PFE) made it to Piper Sandler’s “concerning” list, I believe the company should be able to maintain and grow its dividend. While Pfizer’s profits have nosedived amid the slowing sales of its COVID-19 portfolio, its other businesses continue to churn out decent profits.

Management has put great emphasis on Pfizer’s dividends, and has stressed that growing the dividend is the company’s top capital allocation priority, followed by reinvesting in the business, deleveraging, and share buybacks.

Pfizer’s earnings are expected to keep rising over the next few years, despite the slowdown in the COVID-19 vaccine, Comirnaty, and the Paxlovid pill. While the company’s debt and interest burden have risen after the Seagen acquisition, it should have enough cash to keep paying dividends, given the defensive and stable nature of its business.

Dominion Energy Is Taking Steps to Lower Its Debt

Dominion Energy (D) has a dividend yield of 4.7%, and during the last two earnings calls, management has reiterated its dividend and other financial guidance that it provided in early March.

To be sure, the company is battling a massive debt pile, but is aiming to reduce its debt by $21 billion. In the most recentearnings call management said that it has achieved 72% of that target.

Dominion Energy expects its operating earnings to rise between 5%-7% annually until 2029, which should help the company dole out dividends to investors. I don’t find Dominion Energy’s dividend at much risk, and the utility company should be able to maintain its payouts.

Oneok Looks Like a Good Dividend Stock

To me, Oneok (OKE) looks like a good dividend stock to own, given its yield of almost 4.5%. Notably, the company has the highest score among the stocks that Piper Sandler listed for a possible dividend cut, which implies that its dividend is at the least risk.

The company increased its dividend by 3% earlier this year, while approving a $2 billion share buyback. Management is optimistic about its ability to pay dividends, and during the Q2 2024 earnings call earlier this month, CFO Walter Hulse said, “We’ve clearly demonstrated that we have a very strong dividend that we’ve maintained through some very difficult times over time and continue to grow.”

The energy stock is trading near its 52-week high, and has run ahead of its mean target price. Wall Street analysts are reasonably bullish on OKE stock, though, and it has received a consensus rating of “Moderate Buy” from the 18 analysts in coverage.

Eversource Energy Raises In Line With EPS

Eversource Energy (ES) has the lowest dividend yield of 4.3%, and its dividend is the most at-risk, per Piper Sandler’s analysis. That said, the utility company has a consistent track record of paying dividends. Its earnings per share rose at a CAGR of 6% between 2014 and 2023, and the company is projecting continued EPS growth between 5%-7% annually until 2028.

Earlier this year, ES increased its quarterly dividend by 6%, which was in line with its earnings growth. Given management’s strategy to grow its dividends in line with its earnings, Eversource Energy’s dividends look safe, considering the projected earnings growth.

On the date of publication, Mohit Oberoi had a position in: PFE , INTC . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.