Over the last 7 days, the Indian market has dropped 4.0%, yet it remains robust with a 40% increase over the past year and earnings forecasted to grow by 17% annually. In such a dynamic environment, dividend stocks like Coal India can offer stability and consistent returns, making them attractive options for investors seeking reliable income streams.

Top 10 Dividend Stocks In India

|

Name |

Dividend Yield |

Dividend Rating |

|

Castrol India (BSE:500870) |

3.10% |

★★★★★★ |

|

Balmer Lawrie Investments (BSE:532485) |

3.56% |

★★★★★★ |

|

D. B (NSEI:DBCORP) |

5.36% |

★★★★★☆ |

|

HCL Technologies (NSEI:HCLTECH) |

3.28% |

★★★★★☆ |

|

VST Industries (BSE:509966) |

3.65% |

★★★★★☆ |

|

Indian Oil (NSEI:IOC) |

8.38% |

★★★★★☆ |

|

Redington (NSEI:REDINGTON) |

3.25% |

★★★★★☆ |

|

Canara Bank (NSEI:CANBK) |

3.07% |

★★★★★☆ |

|

Bank of Baroda (NSEI:BANKBARODA) |

3.17% |

★★★★★☆ |

|

PTC India (NSEI:PTC) |

3.85% |

★★★★★☆ |

Click here to see the full list of 20 stocks from our Top Indian Dividend Stocks screener.

Let’s explore several standout options from the results in the screener.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Coal India Limited, along with its subsidiaries, is involved in the production and marketing of coal and coal products in India, with a market cap of ₹3.08 trillion.

Operations: Coal India Limited generates revenue primarily through its coal mining and services segment, which amounted to ₹1.35 trillion.

Dividend Yield: 5.1%

Coal India, trading at 11.4% below its estimated fair value, offers a dividend yield of 5.1%, placing it in the top 25% of Indian dividend payers. However, its dividends have been volatile and are not well covered by free cash flows or earnings, despite a low payout ratio of 42%. Recent earnings growth (38.6%) is positive, but sustainability concerns remain due to high cash payout ratios (1226%). Recent news includes a joint venture with GAIL for synthetic natural gas production.

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HCL Technologies Limited provides software development, business process outsourcing, and infrastructure management services globally, with a market cap of ₹4.28 trillion.

Operations: HCL Technologies Limited generates revenue primarily from IT and Business Services ($9.91 billion), Engineering and R&D Services ($2.16 billion), and HCL Software ($1.42 billion).

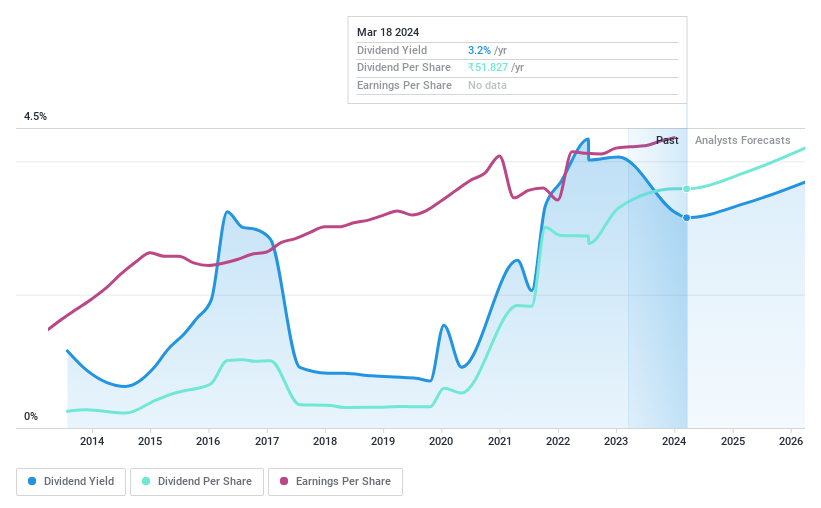

Dividend Yield: 3.3%

HCL Technologies’ dividend yield of 3.28% ranks among the top 25% in the Indian market, but its dividend history has been volatile. Recent earnings growth and a reasonable cash payout ratio (64.3%) support current dividends, though a high payout ratio (85.7%) raises sustainability concerns. The company recently declared an interim dividend of ₹12 per share and reported Q1 sales of US$3.36 billion with net income at US$496 million, reflecting steady financial performance amidst board changes and strategic expansions.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Uniparts India Limited, with a market cap of ₹22.06 billion, manufactures and sells engineering systems, solutions, assemblies, and components primarily for off-highway vehicles across India and internationally.

Operations: Uniparts India Limited’s revenue primarily comes from its Linkage Parts and Components for Off-Highway Vehicles segment, which generated ₹11.40 billion.

Dividend Yield: 4%

Uniparts India’s dividend payments are covered by earnings and cash flows, with a payout ratio of 62.6% and a cash payout ratio of 53.9%. The company recently started paying dividends, making it too early to assess reliability or growth trends. Despite a drop in full-year net income to ₹1.25 billion from ₹2.05 billion, its dividend yield is in the top 25% of Indian market payers, supported by a favorable P/E ratio of 17.7x compared to the market’s 33.5x.

Summing It All Up

-

Explore the 20 names from our Top Indian Dividend Stocks screener here.

-

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

-

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:COALINDIA NSEI:HCLTECH and NSEI:UNIPARTS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com