Dmytro Synelnychenko/iStock via Getty Images

Introduction

If there’s one thing I love, it’s discussing my favorite long-term investments with readers. Hence, in recent months, I have put a bigger emphasis on articles that include two components: some fundamental background (like economic developments) and actionable ideas.

In this article, things will be similar, as I will present the six dividend (growth) stocks that dominate my account and various family accounts that I “advise.”

However, because I am writing under my real name, I cannot provide more specific details about the owners of these accounts.

What I can tell you is that these are owned by close family members who apply similar strategies, focusing on high-conviction investments and making these a significant part of their portfolio.

As most readers may know, I own 22 individual stocks that currently account for almost 100% of my net worth, which shows how serious I am when it comes to picking these investments.

Moreover, I rarely sell anything, as I have a multi-decade outlook for every company I buy.

Hence, in this article, I’ll present the six stocks that dominate our family accounts. In other words, they are among our highest-conviction selections.

However, before we do that, I want to share my thoughts on Howard Marks’ latest memo, which perfectly fits our investment strategy.

So, let’s get to it!

In The Long-Run, Nobody Knows Anything

I spend a lot of time discussing macroeconomic developments, including supply chains. After all, I believe that by being aware of certain trends, investors can optimize their portfolios and get a shot at generating alpha.

However, when it comes to long-term investing, we simply need to acknowledge that there is no way we can predict what the future holds.

Predicting short-term developments is hard. Predicting long-term developments is impossible.

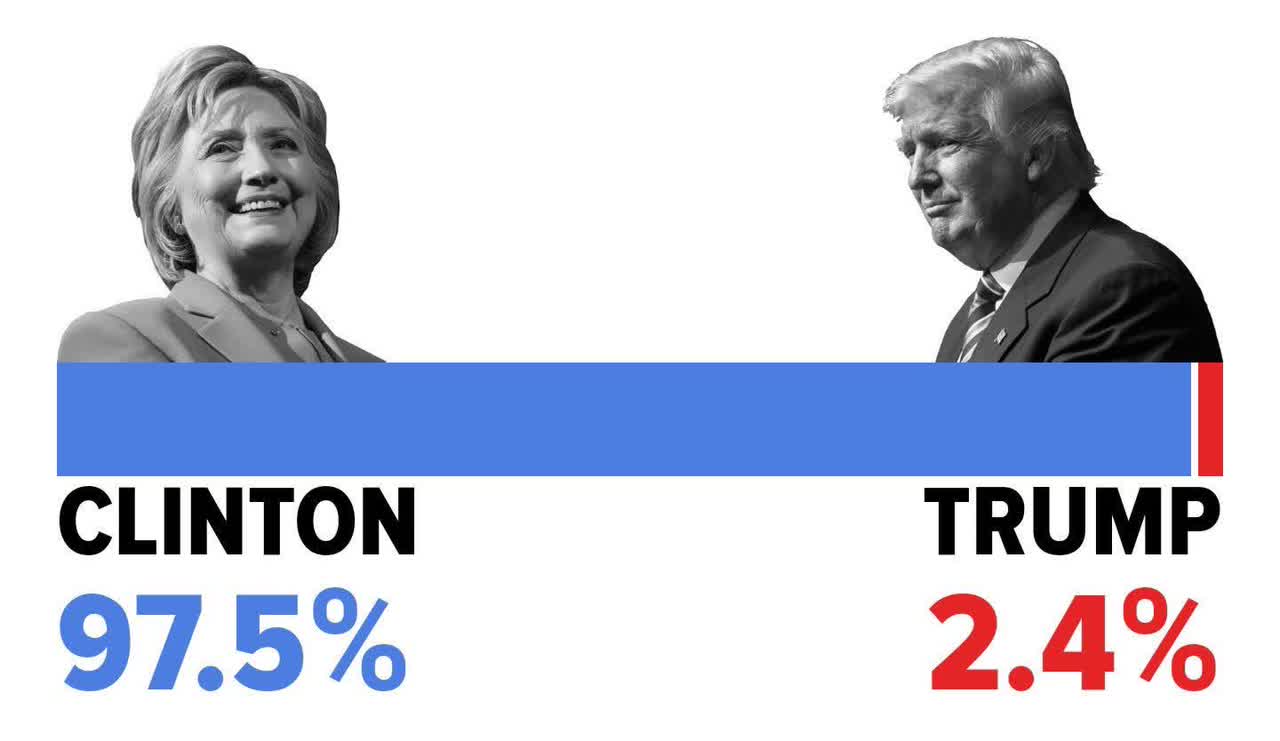

In his most recent memo, titled “The Folly of Certainty,” Mr. Howard Marks talks about the 2016 election between what is now former President Trump and Hillary Clinton.

Back then, the market thought two things were more or less set in stone:

- Clinton would win in a landslide.

- Markets would crash in the event of a Trump victory.

This is what the Huffington Post predicted in 2016:

Huffington Post

The result of the election was a narrow Trump victory that resulted in a massive stock price rally, especially among cyclical companies benefitting from rising economic sentiment.

In other words, the market was dead wrong about both predictions (Clinton’s victory and the stock market crash).

Moving over to macroeconomics, Mr. Marks has more great examples.

Especially after the pandemic, the market was consistently wrong about major developments.

- The inflation surge in 2021 was unexpected for central banks.

- Inflation was not transitory.

- We did not get a recession in 2022/2023.

Although I’m a bit proud of my call that inflation would become an issue in 2020/2021 and remain “higher for longer,” I have to admit that I was too negative (I was wrong) with regard to economic growth last year.

Moreover, while I was right about value stocks outperforming the market again, I missed the massive rally of tech stocks since last year, as I underestimated the power of the AI trend and the internal political fight between the U.S. Treasury and the Fed, which offset a lot of financial tightening (more on that in the future).

Based on this context, the following quote from the memo stood out to me.

There simply is no place for certainty in fields that are influenced by psychological fluctuations, irrationality, and randomness. Politics and economics are two such fields, and investing is another. No one can predict reliably what the future holds in these fields, but many people overrate their ability and attempt to do so nevertheless. Eschewing certainty can keep you out of trouble. I strongly recommend doing so. – Howard Marks

Hence, while I continue to focus on key business trends that could give us a shot at generating alpha, the most important thing in research is finding businesses with the ability to grow on a long-term basis. They need to have something “special” that makes them stand out, potentially allowing them to generate value for shareholders for many decades to come.

In the remainder of this article, I’ll present six of the highest-conviction investments of mine and my family.

I will also add links to in-depth articles and pair investments with similarities, as there is no way I can give each stock the attention it deserves without making this article too long.

We’re Knee-Deep In Energy Royalties

Energy has always been a key theme for us, as we started buying drillers and midstream companies after the pandemic. However, we decided to make energy royalties our largest energy holdings.

As most of my readers may know, this year, I made the Texas Pacific Land Corporation (TPL) my single-largest holding, accounting for roughly 14% of my portfolio value.

Currently, I’m up more than 50% on this investment. My most recent article on this company was written on May 11, when I said, “I’m So Bullish It Hurts.“

What makes TPL special is the fact that it does not produce oil and gas. It is a landowner in the Permian Basin, the biggest oil basin in the United States and the only basin capable of consistent long-term growth – based on current technologies.

Texas Pacific Land Corporation

Not only does it own the mineral rights of roughly 870,000 surface acres, but it also owns the surface and water rights.

In other words, it makes money from every activity on its land:

- Oil and gas drilling/production.

- Water sales and disposal of “produced water.”

- Pipelines.

- Solar/wind.

- Etc.

Because the company is so asset/capital-light, it has consolidated net margins of more than 60%, making it a standout on the market. It also does not have a single penny of debt.

Texas Pacific Land Corporation

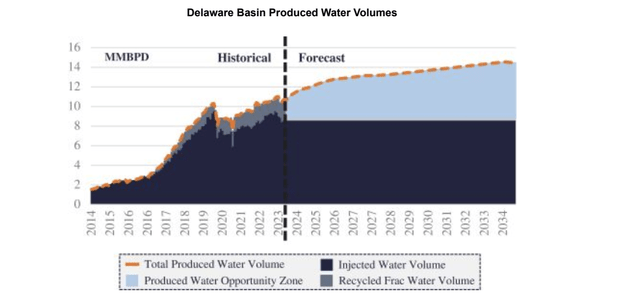

Even better because oil production in the Permian comes with increasing water volumes (oil companies produce roughly 4x more water than oil!), it has opened a new vertical, which is focused on cleaning toxic water from the oil production process.

Texas Pacific Land Corporation

Although it will take a few years until TPL can scale these operations, it is now in a fantastic spot to make money from rising oil prices, rising production volumes, the need to deal with rising water volumes, more pipeline requirements, and other operations.

Currently, TPL yields less than 1%. However, it uses special dividends to distribute excess free cash flow. Its last special dividend was roughly 1.3%, bringing the total annualized yield to 2%.

In addition to TPL, we also bought LandBridge (LB). As I wrote on July 5, LandBridge is a company that went public at the end of June.

It’s a mini-TPL with a bigger focus on non-oil operations. Last year, oil and gas royalties accounted for just a fifth of its revenue. The biggest focus is on its land.

LB was founded to manage the land used by WaterBridge (which shares a management team). WaterBridge is the biggest provider of water services for oil companies.

Given the strong trend in produced water, the company is in a fantastic spot to capitalize on this, as it makes money on every gallon of water that crosses its land.

LandBridge Company LLC

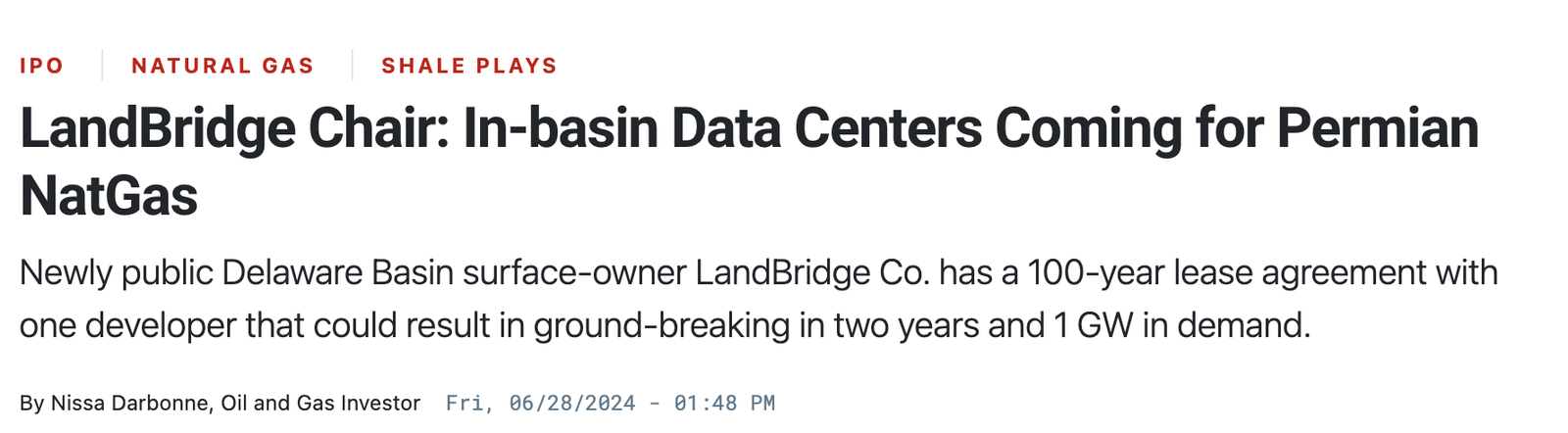

Even better, the Permian has a few advantages (this also applies to TPL):

- Dirt-cheap natural gas due to a lack of takeaway capacity and strong production growth.

- A water problem (too much water).

- Land far away from city centers.

This bodes well for emerging technologies like data centers and hydrogen plants. The Permian has cooling water, cheap energy, and a lot of room for companies to expand.

LandBridge is currently working with data center owners, hydrogen producers, and solar companies (among many others) to turn their land into a gold mine.

It also benefits from the fact that most of its land is connected, which reduces the dependence on other players, who may have different plans for their land.

HartEnergy

Although LB is our most risky play because info is still limited, it’s one of our highest conviction investments.

In fact, I bought more on July 17. My average entry price is $23.30.

While LB does not pay a dividend (it just went public), it plans to pay a dividend in the future. Last year, it had a mind-blowing 86% net income margin and a free cash flow conversion rate of 80%.

This bodes well for future dividends.

Currently, 18% of my portfolio is invested in TPL and LB. That’s how much I trust my thesis.

We Love Transportation

Another thing that is no surprise to many is that I love to own businesses that are critical to modern supply chains. This includes transportation. As obvious as it may sound, without transportation, our economies would collapse.

Our biggest transportation investments are Union Pacific (UNP) and Old Dominion Freight Line (ODFL).

Union Pacific has been a holding in our portfolios since the pandemic. We bought ODFL this year on stock price weakness, and we are up roughly 15%.

Union Pacific is a Class I railroad that dominates the Western two-thirds of the United States with Berkshire-owned BNSF. It has an ultra-wide moat.

As I wrote in my most recent in-depth article, the railroad is thriving under new leadership, as Jim Vena has made it the most efficient railroad in the first quarter, with excess capacity to grow faster without the need for much additional CapEx when cyclical growth rebounds.

Currently yielding 2.1%, UNP has grown its dividend by 9% per year over the past five years. It has a conservative payout ratio of 50%. It had plans to restart buybacks in 2Q24, which the company will shed more light on during the upcoming earnings call.

Going forward, analysts expect annual EPS growth between 7-13% in 2024-2026, paving the road for +12% annual returns using a 22.5x multiple.

FAST Graphs

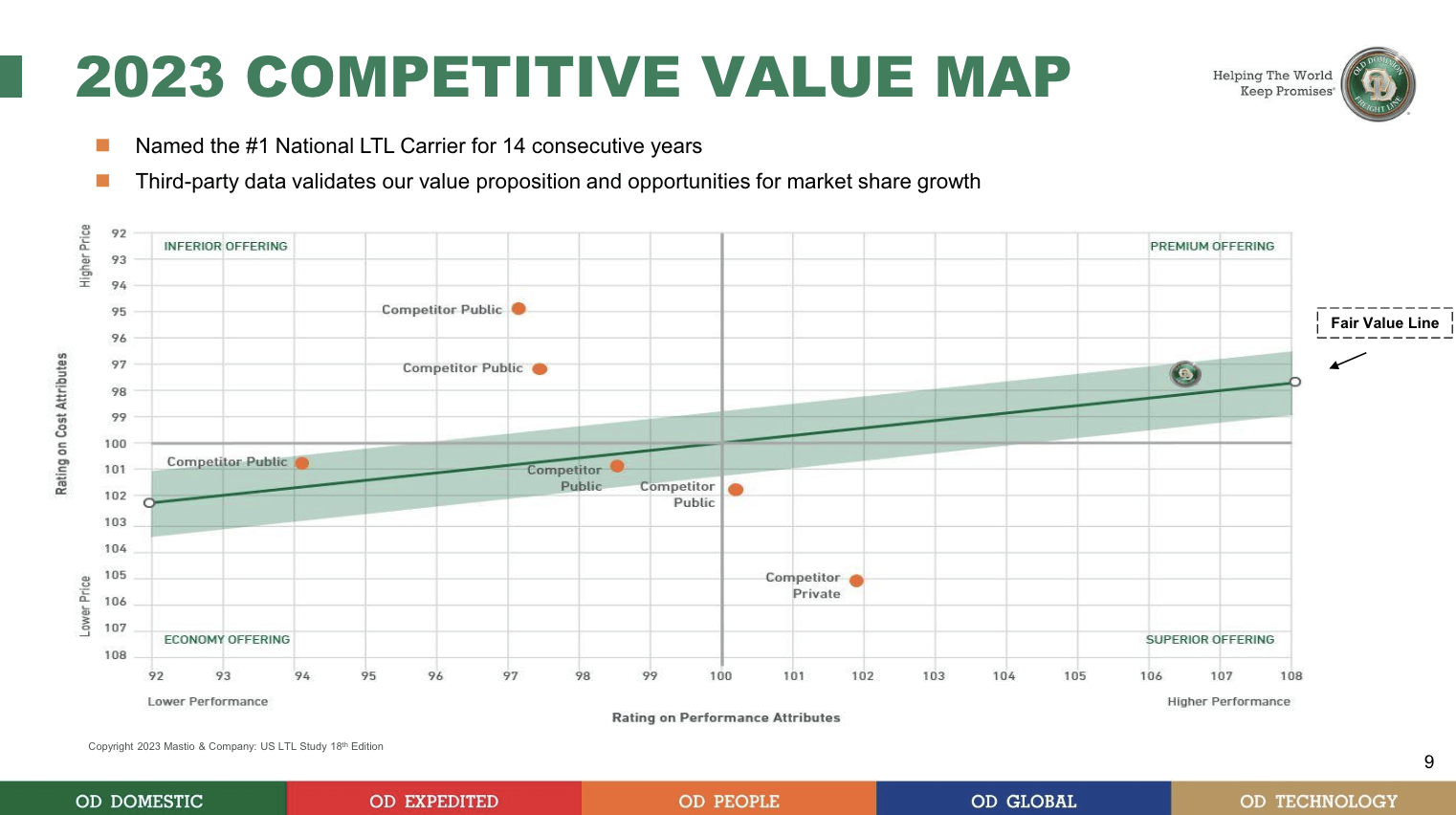

ODFL is different, yet not less impressive.

Earlier this month, I wrote an in-depth article calling the stock “One Of My Favorite Dividend Growth Stocks.“

Although I have been bullish on ODFL for many years, I never pulled the trigger, as I underestimated the company’s ability to build a moat in a highly competitive industry.

See, ODFL is no truckload company. It’s a less-than-truckload (“LTL”). These companies have trailers filled with pallets from multiple customers. This puts an emphasis on operating efficiencies, as it needs to coordinate shipping routes and the most efficient ways to get goods from point A to point B.

Old Dominion Freight Line

For that, it uses a network of mostly self-owned service centers that have allowed the company to offer superior service.

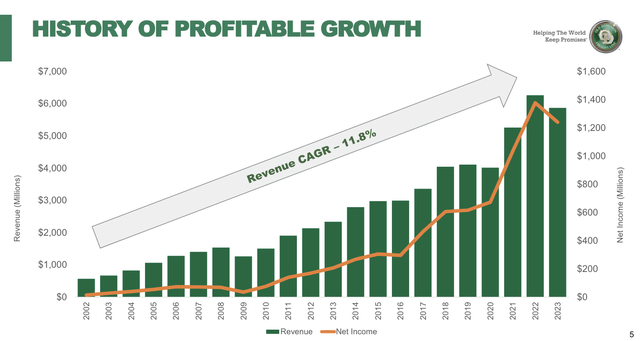

Between 2002 and 2023, it has grown its revenue by 11.8% per year, boosting its market share from 3% to 12% – almost entirely organic.

Old Dominion Freight Line

With regard to its dividend, while it yields less than 1%, it has grown its dividend by 36% per year since 2017 and still has a payout ratio of just 15%.

It has also bought back 12% of its shares since 2017.

Since 2004, ODFL has returned 24% per year. Going forward, I expect elevated double-digit annual returns to last – yet not north of 20% due to ODFL being more mature.

Two Long-Term Plays With Geopolitical Tailwinds

While we did not buy them for geopolitical purposes, both our investments in RTX Corp. (RTX) and Cheniere Energy (LNG) have geopolitical tailwinds.

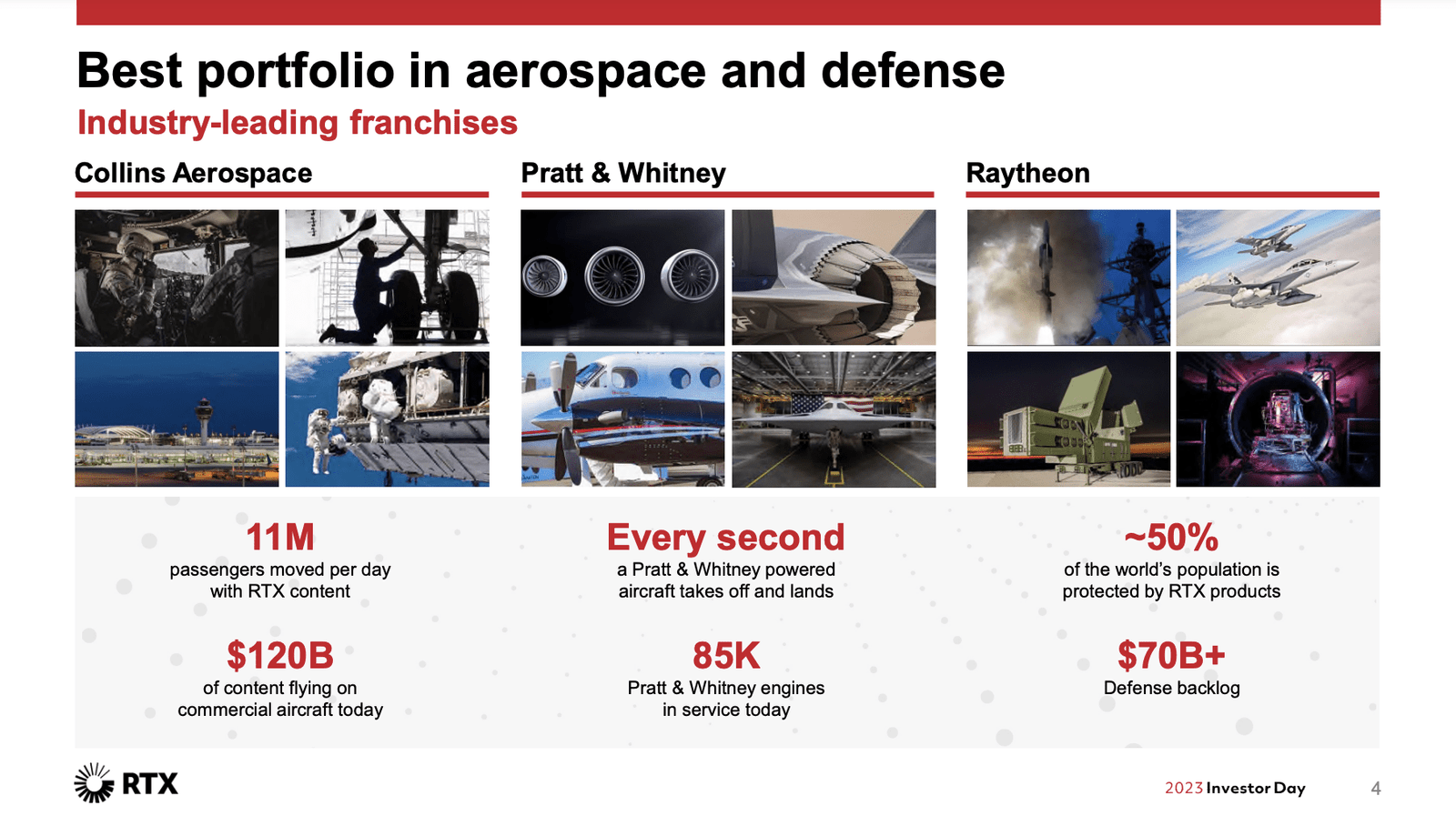

Formerly known as Raytheon Technologies, we bought RTX because it offers an almost superior mix of defense and commercial aerospace exposure.

It owns Collins Aerospace, which produces what feels like a limitless range of aerospace products (including landing gears, advanced materials, and bathroom lights), Pratt & Whitney, which produces aerospace engines (including the F-135 engine for the F-35), and Raytheon, known for advanced missiles and defense systems.

RTX Corporation

On July 11, I wrote an article titled “RTX: Buying A $140 Stock For $100.”

In addition to a strong commercial aviation rebound, the company is a key player in the modernization of NATO forces, supplying key systems like the Patriot air defense system, AMRAAMs, and the advanced LTAMDS system.

FAST Graphs

This bodes well for its dividend and buybacks:

Currently yielding 2.5%, this implies RTX has a cash payout ratio of less than 50%, with a lot of room to grow its dividend.

Over the past three years, the dividend has been hiked by 7.4% annually. I expect that number to be substantially higher in the next three years, supported by aggressive buybacks.

The company, which has an investment-grade credit rating of BBB+ and a 2024E net leverage ratio of 2.7x EBITDA, announced a $10 billion buyback program last year, enough to buy back more than 7% of its current share count. – July 11 Article

In some family accounts, RTX is the single biggest holding.

Cheniere Energy is the other pick we started buying this year. Although it is currently not a holding of my personal portfolio, we bought it in a number of other accounts because it’s a highly attractive energy stock.

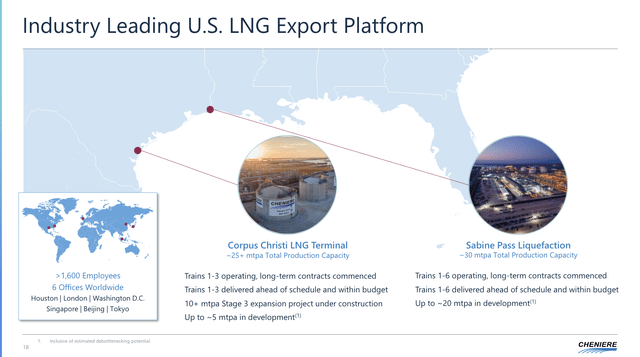

As I wrote in an in-depth article on May 8, Cheniere is a wide-moat player that buys natural gas. It turns this natural gas into liquified natural gas (“LNG”). This LNG is shipped to countries all over the world, making Cheniere a cornerstone of America’s dominance in global energy exports.

Its contracts allow it to eliminate natural gas price risks while benefitting from potentially rising global LNG prices.

Especially in light of China’s hunger for LNG and the war in Ukraine, the U.S. has become an important market for affordable energy.

Operating Corpus Christi and Sabine Pass, the company is consistently expanding its footprint with one major difference compared to smaller LNG peers: Cheniere is already highly profitable, with the ability to use free cash flow to invest in growth, reduce debt, grow its dividend, and buy back stock.

Cheniere Energy

Since my May 8 article, Cheniere shares are up 15%, as the market has realized just how much value this stock offers.

While its yield is just 1%, it is growing this dividend by 10% annually until it is finished with the expansion of Corpus Christi Stage 3 in the mid-2020s. After that, the floodgates will likely open for accelerated buybacks and dividend growth.

Even better, the company is expected to grow free cash flow to $3.4 billion in 2026. That’s almost 10% of its market cap.

In other words, the company is in a fantastic spot to handsomely reward shareholders through aggressive dividend growth (potentially well beyond 10% per year) and massive buyback programs.

Speaking of its expansion plans, the company aims to achieve its first LNG at Corpus Christi Stage 3 by the end of this year. The goal is to bring all seven trains online by the end of 2026. – May 8 Article

I also stick to my call that Cheniere is worth at least $277 per share, 52% above its current stock price.

Takeaway

Investing is both an art and a science, and long-term success relies on recognizing the unpredictable nature of the market.

By focusing on businesses with unique qualities and long-term growth potential, we can navigate uncertainties.

My family and I have high-conviction investments in six key stocks, including energy royalties like Texas Pacific Land, key transportation companies like Union Pacific and Old Dominion Freight Line, and companies with geopolitical tailwinds like RTX and Cheniere Energy.

Essentially, these picks reflect our commitment to building resilient portfolios with the ability to outperform the market on a long-term basis.

Going forward, I’ll shed more light on our holdings and strategies.