As global markets experience volatility and mixed economic signals, the Swedish market has shown resilience, with key indices managing to claw back some of their earlier losses. In this context, dividend stocks remain an attractive option for investors seeking steady income and potential capital appreciation. A good dividend stock typically offers a reliable payout history, solid financial health, and a sustainable business model—qualities that are especially appealing amid current market uncertainties.

Top 10 Dividend Stocks In Sweden

|

Name |

Dividend Yield |

Dividend Rating |

|

Bredband2 i Skandinavien (OM:BRE2) |

4.54% |

★★★★★★ |

|

Betsson (OM:BETS B) |

5.79% |

★★★★★☆ |

|

Nordea Bank Abp (OM:NDA SE) |

8.87% |

★★★★★☆ |

|

Zinzino (OM:ZZ B) |

4.01% |

★★★★★☆ |

|

HEXPOL (OM:HPOL B) |

3.62% |

★★★★★☆ |

|

Axfood (OM:AXFO) |

3.14% |

★★★★★☆ |

|

Duni (OM:DUNI) |

4.98% |

★★★★★☆ |

|

Skandinaviska Enskilda Banken (OM:SEB A) |

5.59% |

★★★★★☆ |

|

Avanza Bank Holding (OM:AZA) |

4.78% |

★★★★★☆ |

|

Bahnhof (OM:BAHN B) |

3.94% |

★★★★☆☆ |

Click here to see the full list of 23 stocks from our Top Swedish Dividend Stocks screener.

Let’s dive into some prime choices out of the screener.

Simply Wall St Dividend Rating: ★★★★★☆

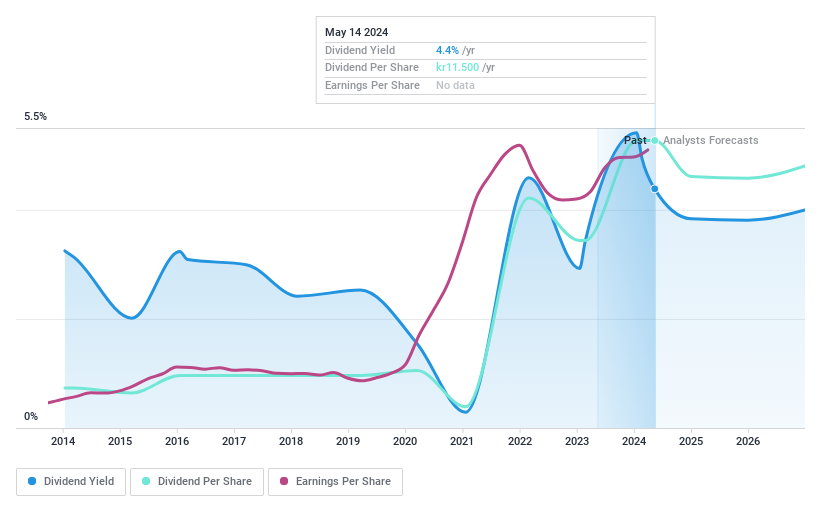

Overview: Avanza Bank Holding AB (publ) and its subsidiaries provide various savings, pension, and mortgage products in Sweden, with a market cap of SEK37.82 billion.

Operations: Avanza Bank Holding AB (publ) generates revenue primarily through its commercial operations, amounting to SEK3.96 billion.

Dividend Yield: 4.8%

Avanza Bank Holding’s dividend payments are covered by earnings (87.3% payout ratio) and free cash flows (55.8% cash payout ratio), making them sustainable despite a historically volatile track record. The company’s dividend yield of 4.78% places it in the top 25% of Swedish market payers, though past payments have been unreliable with significant drops over the last decade. Recent earnings growth and customer acquisition indicate potential stability for future dividends.

Simply Wall St Dividend Rating: ★★★★★☆

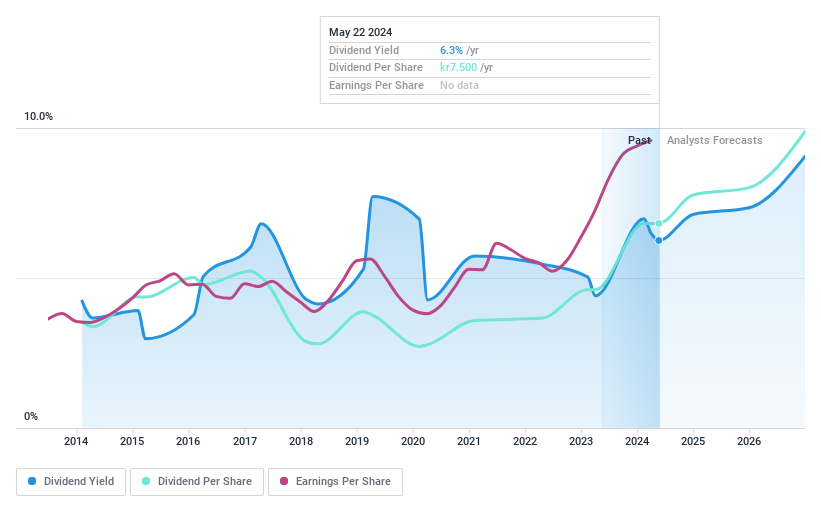

Overview: Betsson AB (publ) operates and manages online gaming businesses across the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally with a market cap of SEK17.75 billion.

Operations: Betsson AB (publ) generates revenue primarily from its Casinos & Resorts segment, which amounted to €1.01 billion.

Dividend Yield: 5.8%

Betsson AB’s dividend yield of 5.79% ranks it in the top 25% of Swedish market payers, with a payout ratio of 50.3% and a cash payout ratio of 50.8%, indicating sustainability. However, its dividend history has been volatile over the past decade despite recent increases. The company’s earnings grew by 12.2% last year, and recent expansions into Peru could bolster future revenue streams, though net income slightly declined in Q2 2024 to €45.5 million from €50.2 million the previous year.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Solid Försäkringsaktiebolag (OM:SFAB) offers non-life insurance services to private and business customers across several countries, including Sweden, Denmark, Norway, Finland, Germany, and Switzerland, with a market cap of SEK1.59 billion.

Operations: Solid Försäkringsaktiebolag (OM:SFAB) generates revenue through three primary segments: Product (SEK320.51 million), Assistance (SEK351.63 million), and Personal Safety (SEK435.09 million).

Dividend Yield: 5.2%

Solid Försäkringsaktiebolag’s dividend yield of 5.17% places it in the top 25% of Swedish market payers, supported by a payout ratio of 49.1% and a cash payout ratio of 73.7%, indicating coverage by earnings and cash flow. However, the dividend history is too short to assess reliability or growth trends. Recent buybacks totaling SEK 66.57 million could enhance shareholder value, while Q2 net income increased to SEK 40.95 million from SEK 39.21 million year-over-year.

Make It Happen

-

Unlock more gems! Our Top Swedish Dividend Stocks screener has unearthed 20 more companies for you to explore.Click here to unveil our expertly curated list of 23 Top Swedish Dividend Stocks.

-

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

-

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:AZA OM:BETS B and OM:SFAB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com