Ever felt like you’re speaking a different language to your colleagues in another department? Or maybe you’ve rediscovered the wheel, only to find out another team already solved that problem? As business operations get more complex, sharing technology across departments may be key in supporting better cross-functional alignment and stronger risk and compliance programs, according to new analysis of recently released NAVEX survey data.

Indeed, the indicated sharing of technology systems and data across functional silos appears to share similarities with how risk and compliance (R&C) professionals view the strength of their partnerships with those business units. Published as part of the NAVEX 2024 State of Risk & Compliance Report, surveying appeared to show respondents’ overall ranking of health in cross-departmental relationships aligning similarly with the likelihood those functions were said to share technology systems.

Though surveying did not directly ask respondents to describe the role shared technology plays in the strength of those relationships, findings suggest R&C professionals may have opportunity to enhance their collaborations across the business through better sharing of technology and data.

While technology is no substitute for a strong and cross-functional culture of ethics, compliance and risk management, readers may use these findings as fodder to support conversations internally to foster more effective collaboration across silos.

This is another interesting signal in our data that invites compliance, legal, HR and other practitioners to consider opportunities to improve their programs. It stands to reason that departments that share data and systems are better able to speak a common language, which facilitates better discussions in how to manage risk and foster a more ethical organization.

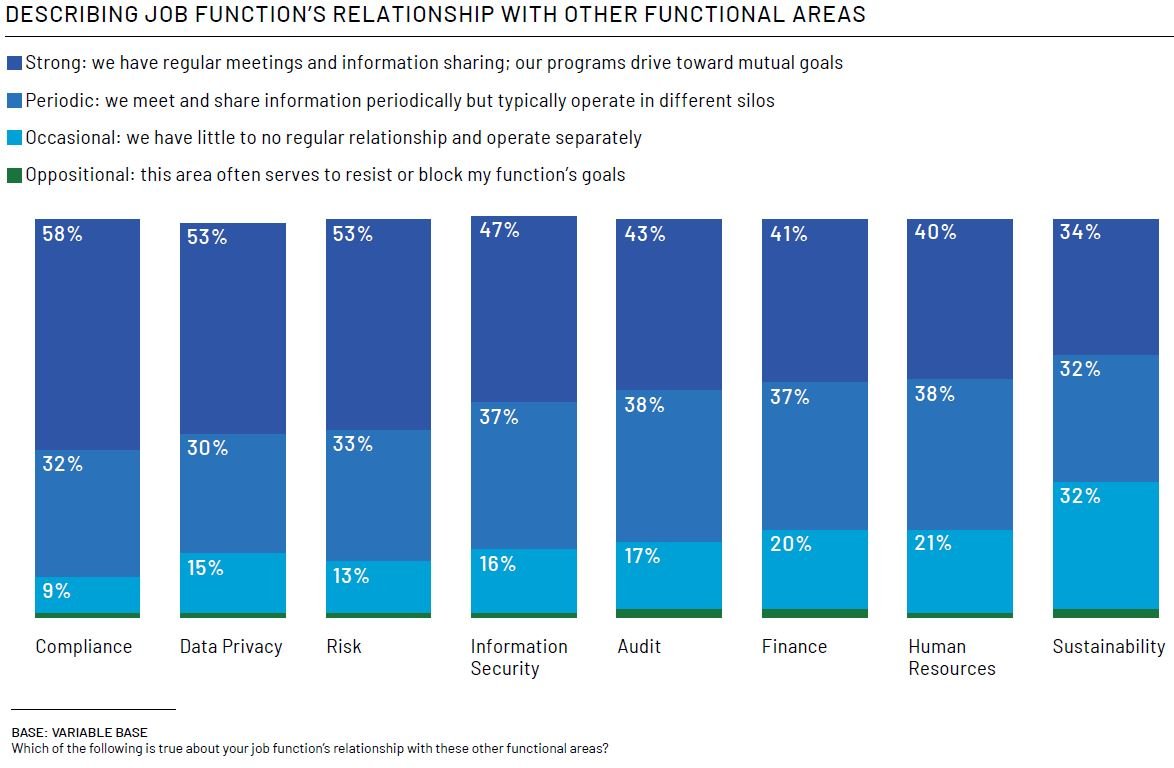

Respondents knowledgeable about risk and compliance were most likely to give high marks to their relationship with Compliance, where 58% said it was “strong.” Fifty-three percent said so for their relationship with Data Privacy, followed by 53% for Risk, 47% for Information Security, 43% for Audit, 41% for Finance, 40% for Human Resources and 34% for Sustainability. Respondents were not asked to rank their relationship with their own department.

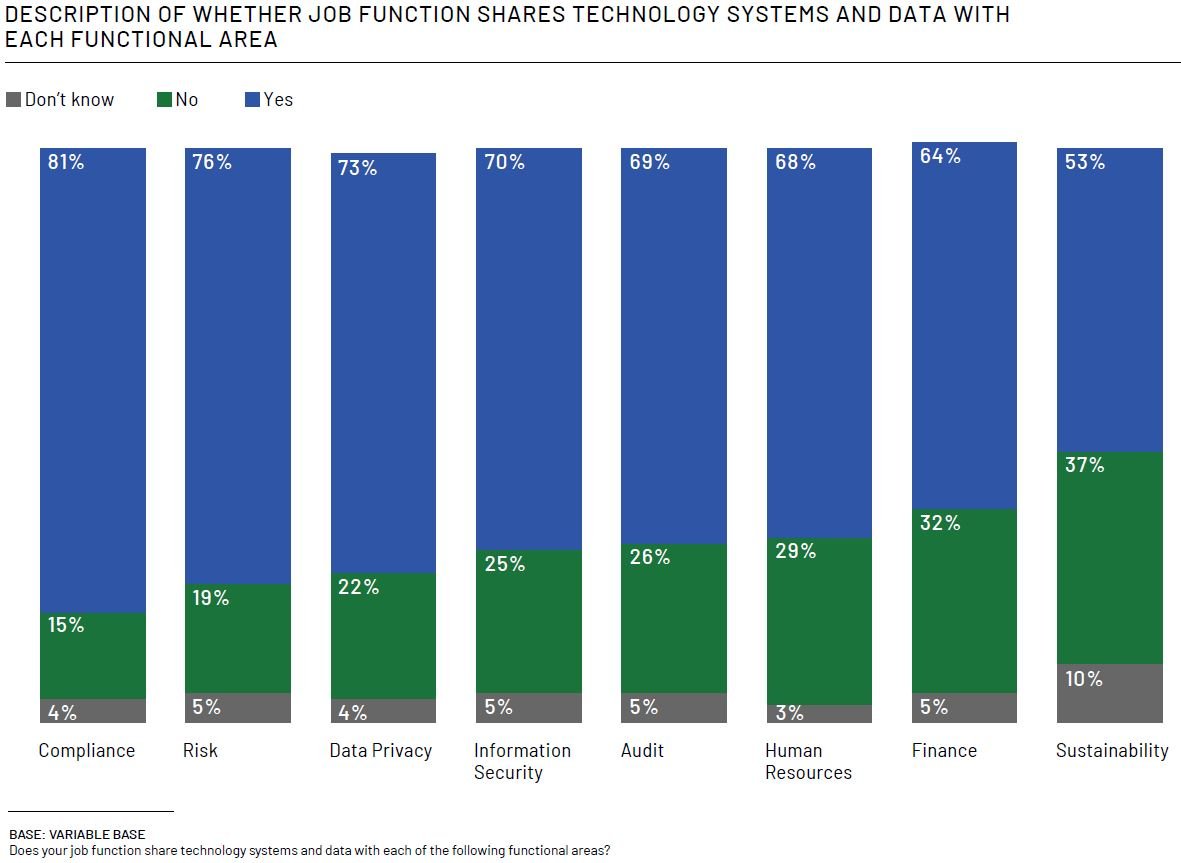

While not a perfect comparison, this ranking appeared similar to the rate at which respondents affirmed they shared technology systems and data with other functional areas. Eighty-one percent said yes for Compliance, 76% for Risk, 73% for Data Privacy, 70% for Information Security, 69% for Audit, 68% for Human Resources, 64% for Finance and 53% for Sustainability.

Viewed another way, on each chart, Compliance, Data Privacy, Risk and Information Security are all grouped together on the “better” half of the grouping, with Audit, Finance, Human Resources and Sustainability occupying the other half.

How do these dynamics play out in the real world? Internal reporting provides one such example. In some cases, Compliance may mark a case as “closed” in their systems upon referral to another department such as Human Resources. This may give a misleading sense to compliance that a case is resolved despite continuing investigation, and may distort reporting of how long it is taking for the organization to close cases.

In a different (and more ideal) scenario, Compliance and Human Resources bridge the gap between their silos and collaborate. Both teams are aware of the actions being taken to investigate and resolve cases. Potentially, both would also share technology systems and data that facilitates a common view of the status of cases and investigations.

It’s easy to envision countless other situations where these dynamics may play out. Are departments sharing data and practices to ensure a common approach to screening new third-party vendors? Does Risk have an accurate view of activities across the business in order to ensure operations are proceeding along the organization’s risk profile? Culture is critical, but technology system and data sharing may be one tool to enable stronger collaboration.

Functional silos are ubiquitous, but there are many opportunities to close the communication gap – and one such opportunity exists between Human Resources and other business areas. In the June 20 State of Risk & Compliance webinar, we conducted a live poll asking, “If you could drastically improve collaboration and communication with one department, what would it be?”

The most common answer was HR, with 35% of respondents, followed by Information Security, with 21%.

Speakers at the time noted that respondents to the broader survey ranked Human Resources toward the lower end of the relationship scale, reflecting what they described as perception of a longstanding disconnect between some HR divisions and the rest of the business. As noted above, Human Resources also ranked lower in the share of respondents who said their function shares technology and data with the business unit. Taken together, these findings might invite readers to open a conversation internally about deepening collaboration, potentially starting with an assessment of whether their business units share technology.

The Harris Poll conducted the State of Risk & Compliance survey online on behalf of NAVEX among 1,066 nonacademic professionals knowledgeable about risk and compliance between February 12 and March 18, 2024.