Investors looking to stuff their stockings with dividend-paying value stocks should take a closer look at these two consumer staples companies.

Stocks are often classified as either growth, value, or a combination of the two.

Value stocks can be viewed as mature businesses with steady earnings, whereas growth stocks are valued for their potential rather than their current performance. But there’s a lot more nuance to it.

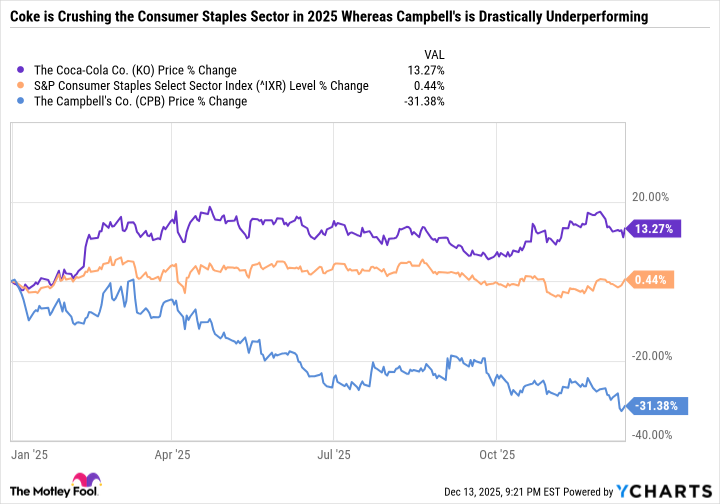

Coca-Cola (KO 0.84%) is a value stock that is praised for its consistency and reliable dividend, whereas Campbell’s (CPB +1.45%) is a value stock because it is cheap compared to its earnings.

By investing $6,500 into each stock, you can expect to earn more than $500 in dividends per year, which can be useful for investors looking to incorporate passive income into their financial plan or supplement income in retirement.

Here’s why Coke and Campbell’s are both excellent buys now, but for completely different reasons.

Image source: Getty Images.

Coke’s dividend is as reliable as it gets

Coca-Cola has been a standout in an otherwise abysmal consumer staples sector.

Coke is performing well because it is navigating cost pressures and weak consumer demand better than its peers. The company’s growth has slowed, but it still expects a 3% increase in non-generally accepted accounting principles (non-GAAP) earnings per share (EPS) and 5% to 6% non-GAAP organic revenue growth in its current fiscal year.

Coke’s forecast for non-GAAP currency-neutral EPS growth is 8%, which is a testament to how well the core business is doing and the impact of currency headwinds.

Coke is generating solid free cash flow, which should help build on its 63-year streak of increasing its dividend. On its October earnings call, Coke CFO John Murphy said, “We’re confident in our long-term free cash flow generation and have ample balance sheet capacity to pursue our capital allocation agenda, which prioritizes reinvesting in our business and returning capital to our shareowners.”

All told, Coke’s results are excellent within the context of the broader industry. Investors can count on its dividend, which yields 2.9% at the time of this writing. Coke has a reasonable valuation, trading at 23.7 times its projected $2.97 in non-GAAP fiscal 2025 EPS.

Today’s Change

(-0.84%) $-0.60

Current Price

$70.37

Key Data Points

Market Cap

$303B

Day’s Range

$70.32 – $71.30

52wk Range

$60.62 – $74.38

Volume

17M

Avg Vol

17M

Gross Margin

61.55%

Dividend Yield

2.90%

Campbell’s brands are too good for the stock to be this cheap

Campbell’s has a streaky track record of boosting its payout. But the yield sits at a whopping 5.4%, with the stock getting pummeled in 2025 and treading water near a 17-year low.

The company has not been able to offset inflation pressures because consumers are resisting price increases. But it believes it can tap into a shift toward cooking from home with health and wellness in mind.

One example is the Rao’s brand of Italian sauces, which is growing faster than its peers even though it is at a premium price. The success of Rao’s shows the nuances of consumer behavior, where it sits at the cross-section of cost savings and elevated at-home experiences, which Campbell’s refers to as premiumization.

Today’s Change

(1.45%) $0.41

Current Price

$28.68

Key Data Points

Market Cap

$8.6B

Day’s Range

$28.20 – $28.95

52wk Range

$27.85 – $43.85

Volume

7.4M

Avg Vol

6.2M

Gross Margin

29.84%

Dividend Yield

5.44%

Another pillar of Campbell’s growth strategy is health and wellness, which Campbell’s is applying to both ready-to-eat meals and snacks. During its first-quarter fiscal 2026 earnings call on Dec. 9, Campbell’s CEO Mick Beekhuizen said, “We are taking steps to further improve the health and wellness benefits of our Snacks leadership brands, for example, by providing consumers with avocado oil in our chips portfolio, and we have an exciting innovation pipeline for both the short and long-term.”

Campbell’s 2018 acquisition of Snyder’s-Lance gave it a massive portfolio of snack brands, such as Snyder’s of Hanover pretzels, Lance crackers, Kettle Brand and Cape Cod chips, and more. Campbell’s also owns the Pepperidge Farm brand of cookies, such as Milano, which is performing well.

The Campbell’s of today is so much more than condensed soup. It has several excellent brands across product categories and is well-positioned to tap into consumer behavior trends, such as eating without compromising on flavor. But investors will likely remain down on the stock until its results improve, as evidenced by Campbell’s dirt cheap valuation — which is just 11.5 times the midpoint of its full-year fiscal 2026 EPS guidance.

Consider a 50/50 split of Coke and Campbell’s

Coke and Campbell’s offer two distinctly different ways to boost your passive income stream.

Coke is the proven winner, with a more expensive valuation, better supply chain, elite marketing, and an ultra-reliable dividend.

Campbell’s is the bargain-bin value play, with a higher yield and a portfolio of brands that is chock-full of potential.

For some investors, buying a 50/50 split of both stocks could be the best overall move for 2026. Equal parts of each stock would yield 4.2% — an excellent rate for generating passive income. Coke and Campbell’s also don’t have overlap, as Coke’s specialty is nonalcoholic beverages, whereas Campbell’s wheelhouse is in snacks and meals.

Coke’s valuation could be tested if its growth slows, but it is also already in favor with investors because it’s delivering solid results. In the meantime, Campbell’s is so cheap that it only needs to produce decent results, and the stock could recover.