Headwinds are mounting for Wall Street in the new year.

With less than four weeks to go before we close the book on 2025, it appears as if investors will be celebrating another fantastic year on Wall Street. As of the closing bell on Dec. 3, the iconic Dow Jones Industrial Average (^DJI +0.22%), benchmark S&P 500 (^GSPC +0.19%), and growth-fueled Nasdaq Composite (^IXIC +0.31%) were higher by 13%, 16%, and 21%, respectively, and had all hit several new highs during the year.

The prospect of lower interest rates and the evolution of artificial intelligence (AI) have served as rocket fuel for the stock market in 2025.

However, 2026 could be an entirely different story, with a stock market crash taking center stage.

Federal Reserve Chair Jerome Powell delivering remarks. Image source: Official Federal Reserve Photo.

Before going any further, a couple of things to note:

- Stock market crashes, along with corrections and bear markets, are normal, healthy, and inevitable aspects of the investing cycle. Consider these moves the price of admission to the world’s greatest wealth creator.

- Crashes in equities are often emotion-driven and tend to be short-lived. The COVID-19 crash, which wiped out 33% of the S&P 500’s value in 2020, occurred over the course of 34 calendar days.

- Every stock market crash throughout history has eventually proved to be a surefire buying opportunity for long-term investors.

With the above being said, three catalysts stand out as viable sparks to kick-start a stock market crash in 2026.

“Equity prices are fairly highly valued”

Arguably, the elephant in the room for 2026 is the historical priciness of the stock market.

In September, while delivering a speech in Rhode Island, Federal Reserve Chair Jerome Powell weighed in on equities in response to a query on whether or not the Fed’s Board of Governors considers the performance of stocks when making their monetary policy decisions. Of note, Powell proclaimed, “equity prices are fairly highly valued.”

Mind you, just because Powell has an in-depth understanding of the factors that influence the U.S. economy, it doesn’t mean he can pinpoint directional moves in stocks. Back in December 1996, former Fed Chair Alan Greenspan delivered his now-famous “irrational exuberance” speech to describe a red-hot stock market fueled by internet mania, only to see stocks rally for more than three years following his speech.

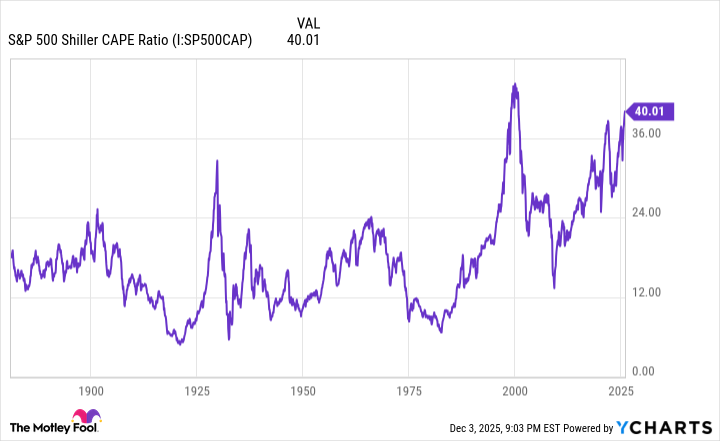

S&P 500 Shiller CAPE Ratio data by YCharts.

Nevertheless, this bull market rally is the second priciest on record, according to the S&P 500’s Shiller Price-to-Earnings (P/E) Ratio, which is also referred to as the cyclically adjusted P/E Ratio, or CAPE Ratio.

When back-tested to January 1871, the average multiple of the Shiller P/E is about 17.3. In late October, when the broad-based S&P 500 hit its all-time high, the Shiller P/E peaked at 41.2. The only time the market has been pricier is in the months leading up to the bursting of the dot-com bubble.

History shows that every time the Shiller P/E has surpassed 30 over the last 155 years, a decline of at least 20% has eventually followed for one or more of Wall Street’s major indexes. While this valuation indicator isn’t a timing tool, it does have a flawless track record of foreshadowing downside for the stock market.

Multiple hyped bubbles burst on Wall Street

A second catalyst that can kick-start or contribute to a stock market crash in 2026 is the potential for one or more hyped bubbles to burst.

For example, AI has been the hottest trend over the last three years. Giving software and systems the tools to make split-second decisions without the need for human intervention or oversight is a leap forward for businesses, which can create trillions of dollars in global economic value.

Image source: Getty Images.

But history has been quite clear that all next-big-thing trends need ample time to mature and evolve. Although we’ve observed significant demand for AI infrastructure (e.g., Nvidia‘s graphics processing units are flying off the proverbial shelf), most businesses haven’t yet optimized their AI solutions or figured out how to generate a positive return on their AI investments. AI stocks are being priced as if growth will occur in a straight line, while history shows that growth ramps for next-big-thing technologies are filled with twists and turns.

However, AI isn’t the only bubble that could burst in 2026. The excitement surrounding quantum computing stocks has also been tangible, with some pure-play stocks skyrocketing by around 700% over the trailing year. Quantum computing relies on specialized computers and the theories of quantum mechanics to tackle complex problems that are not suitable for classical computers.

While the long-term utility of quantum computers is exciting, it’s likely to be years before this technology offers practical or broad-based applications. Some quantum computing pure-play stocks are being valued at north of $10 billion with minimal sales. This is a particularly clear instance of investors overestimating the early adoption, utility, and optimization of a hyped technology.

If the bubble bursts for any combination of artificial intelligence, quantum computing, or even Bitcoin treasury companies, we can witness an elevator-down move for stocks.

Fed dissent pushes the stock market over the edge

The final catalyst capable of sparking a stock market crash in 2026 is the potential for upheaval and dissent within the nation’s central bank.

Arguably, the biggest macro event of the new year is the end of Jerome Powell’s term in May 2026 and the appointment of a new Fed chief by President Donald Trump. The current Director of the National Economic Council, Kevin Hassett, is believed to have the inside track to the nomination. Hassett has a generally dovish view on monetary policy and would be more likely than Powell is at the moment to support lowering interest rates.

But the arrival of a new Fed chief brings with it the potential for market unrest. Although investors typically cheer the prospect of rate cuts, as it makes borrowing less costly for businesses and can ignite corporate growth rates, reducing interest rates amid an uptick in the U.S. inflation rate is a potentially dangerous recipe.

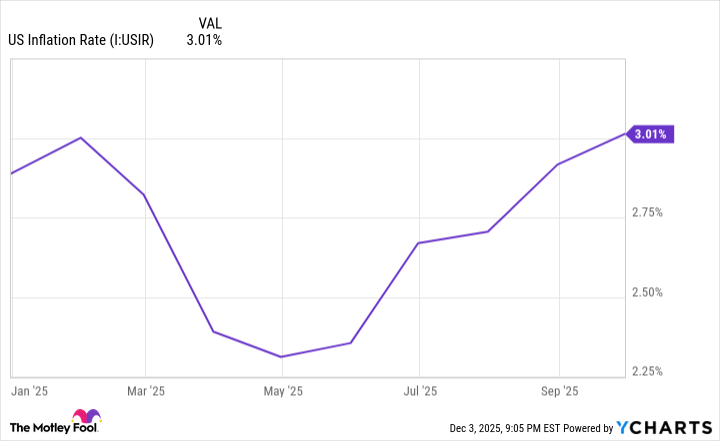

The U.S. inflation rate has been modestly climbing since President Trump implemented global tariffs. US Inflation Rate data by YCharts.

President Trump’s tariff and trade policy, which was introduced in early April, hasn’t done a particularly good job of differentiating between output and input tariffs. The former is a duty assessed to a finished product that’s imported into the country, while the latter is a tax added to an unfinished imported good used to complete the manufacture of a product domestically.

Input tariffs have modestly increased domestic prices and contributed to a higher U.S. inflation rate. Lowering interest rates risks further increasing an inflation rate that’s running above the central bank’s long-term target of 2%.

Furthermore, we’re witnessing rare dissent within the Fed’s Board of Governors. When the Federal Open Market Committee (FOMC) voted 10-2 to reduce the federal funds rate range by 25 basis points to 3.75%-4.00% in late October, one member dissented in favor of a 50-basis-point cut, while another dissented in favor of no reduction. This is only the second time since 1990 that two members of the FOMC have dissented in opposite directions.

Wall Street and investors demand continuity and transparency. A new Fed Chair taking the helm next year, coupled with an apparent lack of policy cohesion, spells trouble for the stock market.