Both have increased their payouts at a terrific pace over the past decade.

Few stocks are worth holding onto forever. Those that do tend to have certain traits, including a strong position in an industry with excellent growth prospects and strong, consistent financial results.

Many are also dividend payers. Although it’s not a requirement, companies that can maintain dividend programs for a long time tend to have exceptional underlying businesses. That’s why dividend stocks have outperformed their non-dividend-paying peers over the long run.

With that said, let’s consider two excellent dividend stocks that are worth sticking with for good: Mastercard (MA -1.34%) and Zoetis (ZTS -1.60%).

Image source: Getty Images.

1. Mastercard

Mastercard operates one of the world’s leading payment networks, boasting an ecosystem of millions of customers who own cards bearing its logo and thousands of businesses that accept it as a payment method.

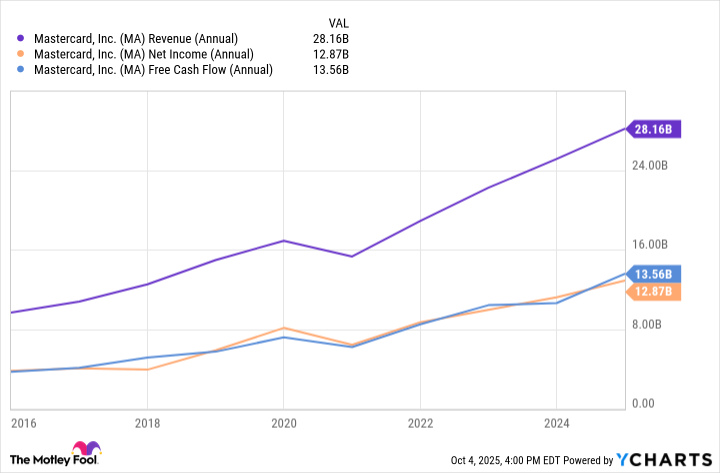

In fact, it’s a significant disadvantage not to do so in today’s day and age, considering how widespread Mastercard’s footprint is — a testament to the company’s network effects. Mastercard has benefited from the trend of cash displacement. The company’s revenue and earnings have been growing steadily for years.

MA Revenue (Annual) data by YCharts.

Although it faces stiff competition from Visa, which might have it beat in terms of sheer size and market share, Mastercard has several advantages over its main competitor. One of the most important is its greater exposure to international markets. Mastercard isn’t the number one in the U.S., but its stronger international footprint grants it access to less-penetrated and faster-growing markets. This factor could also increase Mastercard’s exposure to higher-fee, cross-border transactions, a significant potential growth driver.

The card displacement phenomenon is still in full swing, driven by the fact that cards are easier, more convenient to carry around, not to mention the growing need for digital payment methods in a world that increasingly relies on e-commerce. These aren’t short-term tailwinds. To put things in context, although the U.S. is among the top-10 countries in the world by e-commerce penetration, it has still not reached 20%.

Most countries, then, are well below that level, and in the coming decades, as e-commerce continues to grow, Mastercard should benefit. The company estimates a total of $12.5 trillion in cash and check transactions around the world. Meanwhile, its trailing-12-month revenue is a comparatively measly $30.3 billion. There is a massive amount of whitespace for the stock. Finally, Mastercard generates plenty of free cash flow and has been increasing its dividend at an incredibly rapid pace. The company’s payouts have increased by 375% over the past decade while maintaining a conservative cash payout ratio of 18.1%.

Even with an unimpressive forward yield of 0.5% — the S&P 500‘s average is 1.3% — Mastercard’s excellent business, long-term prospects, and track record of dividend growth make it a top income stock to buy and hold for good.

2. Zoetis

Zoetis is one of the world’s leading animal health companies. It boasts a diversified lineup of products that spans multiple categories, including livestock, companion animals, and poultry. Zoetis has 17 products that generate over $100 million in annual revenue. The company has not performed well this year, primarily due to increased competition for one of its biggest growth drivers, Apoquel, a medicine that treats allergic itch in dogs. However, this should be a short-term issue for Zoetis.

Apoquel’s sales may not grow as fast as expected this year, but Zoetis will overcome this challenge in the same way it has always done — by developing new products that will fill the gap. Some of the company’s newer launches, which are currently experiencing strong momentum, include Librela and Solensia. These products treat osteoarthritis (OA) pain in dogs and cats, respectively. Zoetis routinely expands its portfolio. That’s one of the reasons why it has grown its revenue and earnings faster than the industry averages for years.

Zoetis’ biggest growth driver is its companion animal unit, and that should prove to be an important long-term tailwind. Even as younger people in many countries are having fewer children, they are helping drive the “humanization of pets” trend, which has important implications regarding how much they are willing to spend on caring for them. As spending on companion animals increases, Zoetis will benefit.

Lastly, Zoetis is a terrific dividend stock, having increased its payouts by 502.4% over the past 10 years. The company’s cash payout ratio is just 34%. Investors should look past its modest forward yield of 1.4%: Zoetis is an excellent forever candidate for dividend seekers.