The stock market offers various opportunities, and with the right strategy, a modest investment of $100 can grow into $1,000, contributing to long-term wealth building.

One way to achieve such returns is by investing in dividend stocks, which provide both capital appreciation and a steady income stream.

These stocks offer growth potential and generate consistent payouts, making them attractive options for accumulating wealth over time.

In this context, Finbold has identified two equities where an initial $100 investment could grow into a $1,000 portfolio by the end of 2025.

AT&T (NYSE: T)

AT&T (NYSE: T) currently boasts a 4.17% annual dividend yield and offers a compelling growth opportunity. Beyond its dividend, the American telecommunications company is still supported by other fundamental catalysts likely to spur growth.

Notably, the firm has reaffirmed its focus on shareholder returns and core telecom operations after past missteps in entertainment. For instance, after exiting Warner Bros. in 2022 and DirecTV, the firm has cut $25 billion in debt, allowing investment in 5G and fiber expansion.

AT&T also aims to reach 50 million fiber locations by 2029 and complete 5G modernization by 2027. Its fiber and 5G investments have added 10 million subscribers since 2020, boosting annual Mobility Services revenue by $9 billion and nearly doubling fiber revenue in three years.

For Q4 2024, AT&T exceeded expectations, driven by strong demand for its 5G and fiber bundle plans. It added 482,000 postpaid wireless subscribers and exceeded analysts’ forecast of 424,550.

The company reported $32.3 billion in total revenue, a 1% increase, beating estimates of $32.04 billion. Adjusted earnings stood at $0.54 per share, exceeding the expected $0.50.

For the next 12 months, a consensus of 24 Wall Street analysts at TipRanks projects that AT&T will likely reach an average price of $27.54, reflecting a 3.46% upside from its last price. The highest price estimate is $32, while the lowest target is $19.

At the close of the last trading session, AT&T was trading at $26.62, up 1.8% for the day, while the stock has rallied 16% year-to-date.

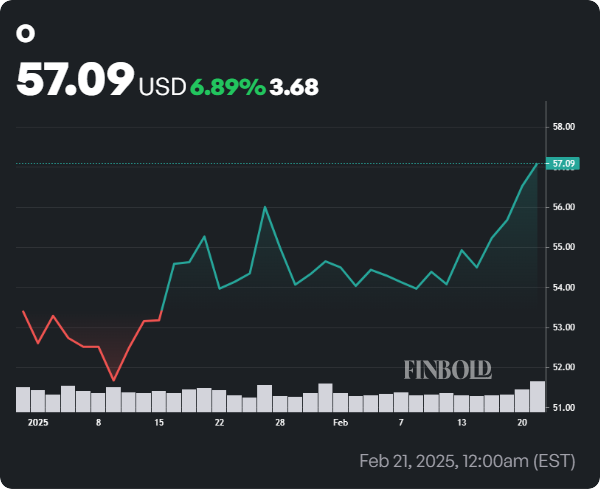

Realty Income (NYSE: O)

Realty Income (NYSE: O), a real estate investment trust (REIT), dubs itself ‘The Monthly Dividend Company,’ with an annual yield of 5.7%. Unlike most stocks with quarterly payouts, Realty Income’s monthly returns offer more frequent opportunities to reinvest.

The company has increased its dividend for over 20 consecutive years, making it an attractive choice for income-focused investors seeking long-term stability.

The real upside lies in Realty Income’s business model: leasing commercial properties to recession-resistant tenants like pharmacies and grocery stores.

Notably, the REIT exceeded expectations in 2024, achieving 5% adjusted funds from operations (FFO) growth and completing the $9.3 billion acquisition of Spirit Realty, expanding its portfolio to 15,457 properties across the U.S., UK, and Europe while maintaining an over 95% occupancy rate.

Meanwhile, 10 Wall Street analysts at TipRanks have set an average price target for Realty Income at $61.25, a potential 7.29% upside from the stock’s last closing price. The highest analyst forecast values the stock at $66.50, while the lowest estimate is $54.

At the time of writing, Realty Income was trading at $57.09, up over 1% since the last session. The stock has rallied 8.54% year-to-date.

It is worth noting that turning $100 into $1,000 in a single year with these two stocks could be challenging, as such returns would require extraordinary price surges. However, growth could accelerate with the right strategy, such as compounding by reinvesting dividends.

Featured image via Shutterstock