The Hershey Company (NYSE: HSY) makes many of the candy brands you’ll find in every convenience store, but historically high cocoa prices are taking a toll on the business. Cocoa prices have nearly tripled since 2022, making it more costly to make candy, which is hurting Hershey’s bottom line. Hershey expects full-year earnings to be flat this year, and the weak outlook for growth has caused the stock to fall 28% from previous highs.

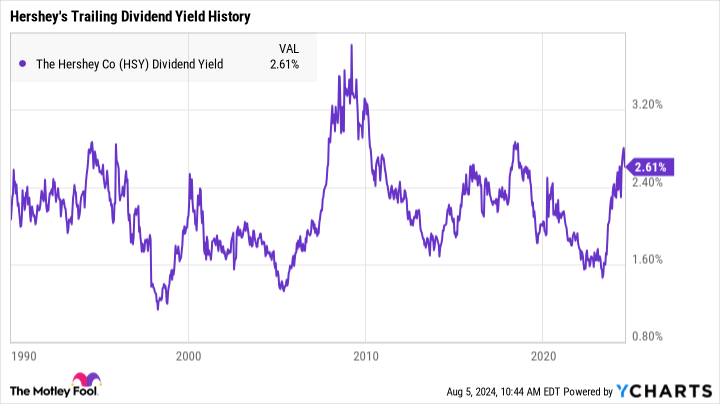

Still, Hershey is a profitable business that continues to make dividend payments. The lower share price has sent the dividend yield well above Hershey’s historical average yield of 2.15% and more than double the S&P 500 average of 1.32%. Here are three reasons to buy this magnificent dividend stock now and hold it forever.

1. Hershey will bounce back

While the increase in cocoa prices has had a negative impact on the business, management’s guidance suggests Hershey can navigate this environment just fine.

Hershey reported a year-over-year sales decrease of 16% in the second quarter, but excluding one-time items that impacted the top line, management said its base business saw a low-single-digit decline in sales, while international sales were up mid-single digits.

Hershey expects full-year sales to be up approximately 2%, with adjusted earnings slightly down over 2023. It sees underdeveloped sales channels like e-commerce as an opportunity to improve top-line growth, in addition to new products for Halloween and the holiday season that is expected to strengthen sales in the near term.

2. The confectionery market will grow over the long term

The confectionery market is estimated to be worth $133 billion and expected to grow at a compound annual rate of nearly 5% through 2029, according to Statista. Hershey owns several top brands to grow with the market and potentially gain market share over the long term.

Hershey’s brands include Cadbury, Reese’s, Twizzlers, KitKat, and Jolly Rancher, as well as top snacks like Skinny Pop. These brands cast a wide net for sales around holidays. Owning such a large portfolio of brands helps build relationships with retailers that can assist Hershey in marketing and driving higher sales.

3. Excellent dividend record

Despite a challenging year, Hershey generated $1.8 billion of net profit on $11 billion of revenue over the last four quarters. Its net profit translated to adjusted earnings per share of $8.96, out of which the company currently pays a quarterly dividend of $1.37. This brings the stock’s forward dividend yield to 2.75% — the highest in five years.

Hershey’s quarterly dividend has increased 77% over the last five years, and it has paid 378 consecutive dividends going back decades. The company’s long record of paying dividends means it has a sound business model that has survived numerous recessions over the last century.

Keep in mind that the recent spike in cocoa prices will likely continue to weigh on Hershey’s earnings into 2025. Wall Street analysts currently expect Hershey to report adjusted earnings of $9.53 this year before falling slightly to $9.46 in 2025. Because of these expectations, the stock may not rebound anytime soon.

But if you’re mostly interested in the dividend, Hershey is a safe investment. Cocoa prices may remain elevated, but investors should expect management to make adjustments to lower manufacturing costs to keep earnings up and continue paying dividends.

Should you invest $1,000 in Hershey right now?

Before you buy stock in Hershey, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Hershey wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $606,079!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

John Ballard has no position in any of the stocks mentioned. The Motley Fool recommends Hershey. The Motley Fool has a disclosure policy.

1 Magnificent S&P 500 Dividend Stock Down 28% to Buy and Hold Forever was originally published by The Motley Fool