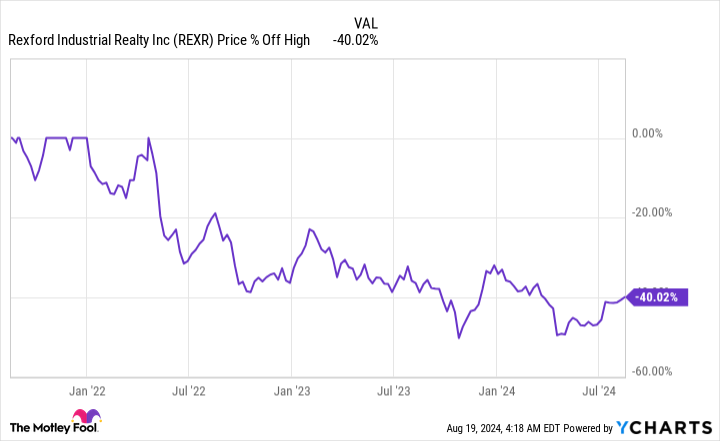

Rexford Industrial (NYSE: REXR) is offering a 3.3% dividend yield today, which is more than twice the yield of the S&P 500 index. It has increased its dividend annually for a decade and at a rapid pace of more than 10% a year. The stock is still 40% below the highs reached in 2022, despite continued strong operating performance. Here’s why you might want to buy this real estate investment trust (REIT) and hold on to it for the long term.

What does Rexford Industrial do?

As Rexford Industrial’s name implies, it owns industrial real estate. The list includes both warehouses and manufacturing assets, which is pretty typical of an industrial REIT. Rexford currently owns over 420 properties and has around 720 buildings. It has roughly 1,600 lessees. It is one of the larger industrial REITs, sporting a market cap of $11 billion.

The biggest difference between Rexford and other industrial REITs is that Rexford is entirely concentrated on a single geographic region, Southern California. For investors who focus on owning diversified businesses, this REIT may be a hard sell. But don’t write it off before you understand a little bit more about the Southern California region.

Southern California is the largest industrial market in the United States. If you pulled it out by itself, it would be the fourth largest industrial market in the world. In other words, it is a highly attractive region in which to operate. Southern California also happens to have the lowest industrial vacancy rate in the United States. If you had to focus on one industrial region, this would probably be the one you would choose.

What’s going on with Rexford’s business?

From a big picture perspective, the industrial real estate sector isn’t doing quite as well as it was just a few years ago. For example, while Southern California has the lowest vacancy rate for industrial assets, the vacancy rate has more than doubled to nearly 4% since hitting a low point in 2023. There has been a similar spike in vacancy rates in other regions as well, which has investors worried about the entire industrial REIT sector.

That could be an opportunity for investors, given that Rexford’s stock has fallen so hard. Indeed, despite the headwind of rising vacancy rates, Rexford’s portfolio was 96.9% occupied in the second quarter. And it was still able to increase lease rates by a huge 67% on leases that were rolling over in Q2. That is a clear indication that demand for its properties remains high.

This strong leasing performance, meanwhile, resulted in funds from operations (FFO) per share rising by an impressive 11% year over year in the quarter. There’s reason to believe that this strong performance will continue. For starters, lease rollovers will likely allow for material rent boosts for several more years. But there’s more.

Rexford has notable plans to upgrade its assets (which will allow it to charge higher rents), and there are rent bumps built into its existing leases, too. On top of that, Rexford continues to acquire new properties, expanding its portfolio. In other words, there are internal and external growth levers that management is using to drive continued strong performance. So, despite the stock drop, Rexford is still operating at a high level.

Rexford is a buy and hold

To be fair, Rexford’s dividend yield might not be high enough to entice investors focused on maximizing current income. But the impressive dividend growth rate here should make it highly attractive to dividend growth investors. While the stock price is down because the industrial sector is, indeed, softening, Rexford continues to operate at a very high level, at least partly because of its unique geographic focus. If you can see the value in this REIT’s approach, Rexford Industrial is the kind of dividend stock you’ll likely be happy you bought while others were selling.

Should you invest $1,000 in Rexford Industrial Realty right now?

Before you buy stock in Rexford Industrial Realty, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rexford Industrial Realty wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Rexford Industrial Realty. The Motley Fool has a disclosure policy.

1 Magnificent Dividend Stock Down 40% to Buy and Hold Forever was originally published by The Motley Fool