The extended deadline for filing local property tax returns passed at 5:30pm on Wednesday, but hundreds of thousands of homeowners have yet to update the market value of their homes with Revenue.

These valuations, setting out what the properties were worth on November 1st, will determine how much local property tax households will pay each year between 2026 and the end of 2030.

Almost one in four, or around 500,000, owners of the 2.1 million homes across the State missed the deadline. Some will have got snared in recurring technical glitches that bedevilled Revenue’s local property tax portal over recent weeks, others are among the 100,000 or so queries that Revenue is still sifting through.

So what happens now if you are one of those 500,000 homeowners?

What happens if I have missed the deadline?

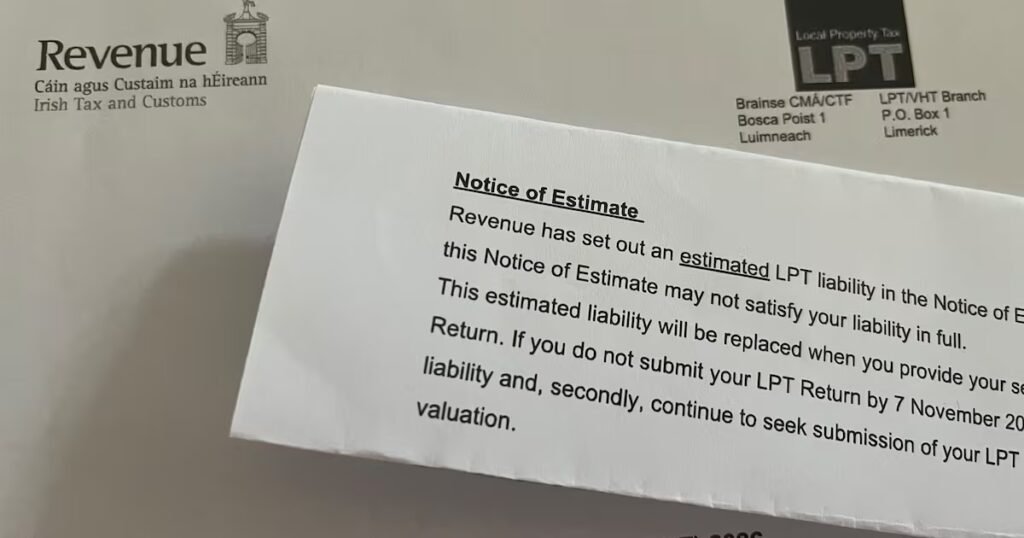

Revenue still expects you to file a valuation. Until then, it will work off the estimate it included in the letter it sent you in recent weeks with your property ID and PIN. But it notes in that letter that it will “continue to seek submission of your LPT return and confirmation from you of your property valuation”.

[ Cantillon: LPT returns overwhelm Revenue portalOpens in new window ]

And, unless you pay by direct debit, you’ll also need to tell Revenue how you want the tax collected.

If Revenue has their estimate, can I just leave it at that?

No, you can’t. Revenue’s estimate is based on average property prices in your area and may not accurately reflect your property’s value. Your home could be worth less or, more likely, more.

In any case, as the Revenue letter you received made clear: “Regardless of whether you accept the estimate, or you determine that it should change based on your own self-assessed valuation of your property, you are required to submit an LPT return.”

Around 330,000 of the holdouts do actually have arrangements in place to pay their bill, Revenue says. Most of those are likely to be on direct debts. But Revenue has made clear that this does not absolve anyone from also filing a return.

What happens if I just keep the valuation the same as last time?

The valuation bands have changed since you were last required to update the market value of your home back in November 2021, as has the tax rate. The bands are wider and the tax rate lower.

That has been designed very specifically to ensure that the increase in your property tax bill will be modest.

But the rise in property values over the four years since you were last required to update the value of your home means most people are likely to find themselves at least one point higher on the valuation scale.

If you submit the same valuation figure as last time, your bill will fall. However, that will be a red flag for Revenue and will almost certainly lead to them challenging you to defend your valuation at some point over the coming years. And it could lead to a bill for arrears.

Remind me of those valuation bands again

There are 19 valuation “bands”. The first now covers all homes worth up to €240,000, the second covers properties between that figure and €315,000. After that, the bands go up in amounts of €105,000 as far as €2.1 million.

The tax bill will range from €95 for those in the lowest band to €3,110 for homes worth between €1.995 million and €2.1 million. If your home is worth more than €2.1 million, you’ll pay 0.3 per cent of any value above that level.

I don’t agree with local property tax. What happens if I simply ignore the whole thing?

That would be building up trouble for yourself. First, Revenue has its estimate for your property. Of course, if you don’t engage at all, it has no way of collecting on that estimate but it will almost certainly pursue you for compliance and arrears.

And if you go to sell the property, there will be no escape. Revenue will not clear the sale of any property where there is outstanding local property tax due, or where your LPT returns are not up to date.

In addition, you will need Revenue clearance. Any property selling for more than €400,000 (€500,000 in Dublin) requires specific Revenue clearance. The same is true if your property sells at a price more than 25 per cent above the upper limit of whatever valuation bands you declared in your return.

In either case, you’ll be asked to fill out an LPT5 form. And for properties selling at a price more than 25 per cent ahead of their stated value, you can expect a revaluation and a bill for arrears before the sale is allowed to close.

Can I defer payment?

In certain circumstances, you can defer payment of local property tax fully or in part. However, this is deferral, not an exemption. The money is still owing and interest is charged currently at 3 per cent annually until the bill is paid.

Grounds for deferral include low income. A single person earning less than €25,000 can seek a full deferral; if they earn less than €40,000, they can seek deferral of half of their LPT bill. For couples, the relevant figures are €40,000 and €55,000.

Those limits rise for people paying mortgage interest – by 80 per cent of your mortgage interest bill.

Other grounds for deferral include personal insolvency, hardship and where you are dealing with the assets of the property owner who has died.

If you want a deferral, you will need to apply for it. Don’t just assume it applies.

What happens if I am waiting for an answer from Revenue on a query?

Revenue says it is working through approximately 100,000 pieces of correspondence, including calls to its helpline, postal queries and paper returns. Reassuringly, it says that property owners who have submitted a query to Revenue about their 2026 local property tax returns will be treated as compliant if they file their return promptly once they receive a response.

So anyone who has engaged with Revenue will be considered compliant even if an answer to their query is still outstanding.

You can contact us at OnTheMoney@irishtimes.com with personal finance questions you would like to see us address. If you missed last week’s newsletter, you can read it here.