For those looking to get a foot on the property ladder there’s one part of England that could be make owning a first home much more affordable.

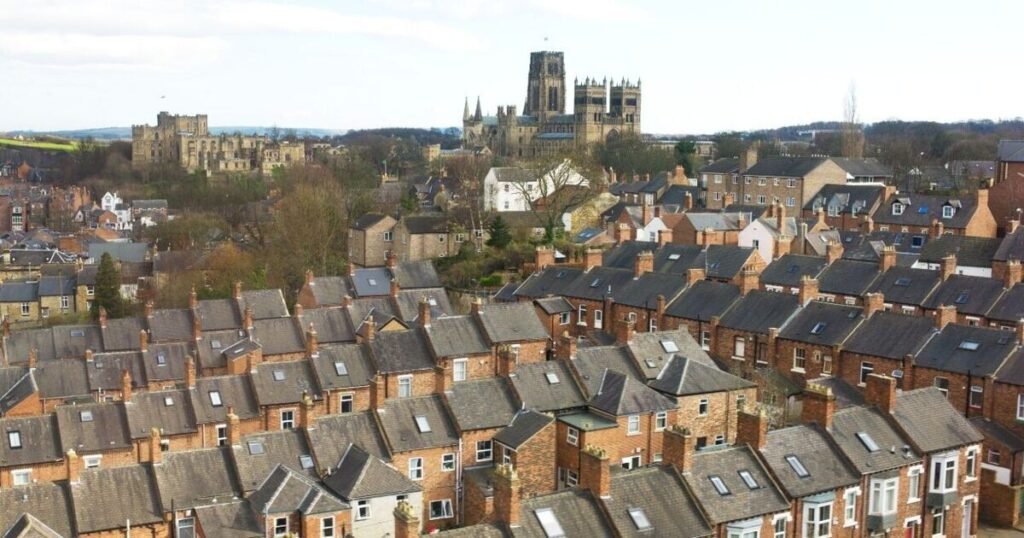

Latest analysis from Halifax shows County Durham in the North East is one of the cheapest places to snap up a new house, with on average just a £7,000 deposit needed for 5% of a mortgage.

Using the comparison of the average earnings in the county, £39,245, to the average first-time buyer property price in the area, £142,248, those getting started on the property ladder need to borrow roughly 3.6 times the average salary.

That’s compared to the least affordable areas in the country, which are in London and the South East. First-time buyers in Hammersmith and Fulham face average house prices of £622,115 at more than 10 times the average salary, £64,646.

Across the UK, average property values for first-time buyers are now around 6.6 times the average UK salary, £46,970.

Amanda Bryden, Head of Mortgages, Halifax said: “Looking ahead we expect modest house price growth in 2025, but upcoming Stamp Duty threshold reductions won’t make things any easier in the short term for first-time buyers.

“However as last year’s figures show, there are ways to make your money go further, with affordable areas in the North of the country, such as County Durham or Burnley, offering more value.

“While the journey to homeownership can look daunting, there are lots of tools and schemes available to help, such as mortgage products tailored for those buying a first home, or Shared Ownership can also be a route to stepping on the property ladder at lower cost.

“The best first step is to speak to a mortgage adviser or broker. By understanding what you need to save and what’s affordable, you can turn the dream of owning a home into reality.”

The proportion of first-time buyers in England and Northern Ireland who will need to pay stamp duty will double from April, according to analysis by a property website.

Zoopla estimates the share of first-time buyers paying the tax will jump from 21% to 42%.

Meanwhile the proportion of existing homeowners buying a new home as their main residence who will be liable to pay stamp duty will increase from 49% to 83%, according to Zoopla’s calculations.

From April, stamp duty discounts will become less generous, with the “nil rate” band for first-time buyers reducing from £425,000 to £300,000 and other home buyers seeing a reduction from £250,000 to £125,000. Stamp duty applies in England and Northern Ireland.

Overall, Zoopla estimates that stamp duty changes could add an extra £1.1 billion annually in tax revenue for government coffers. The website’s analysis was based on buyer inquiries to estate agents and property prices and excludes the impact of those buying additional homes.