Seattle named 9th most expensive city in U.S.

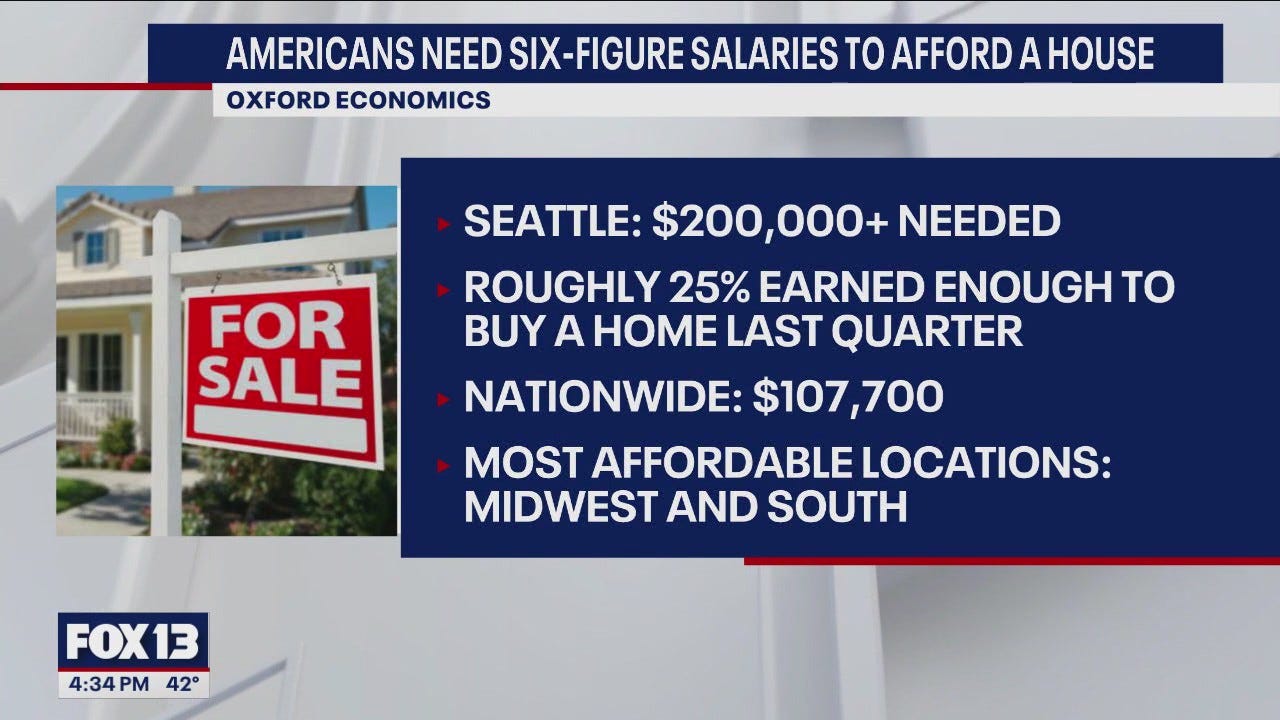

According to a report from Oxford Economics, it takes a household income of $200,000 to afford a new home in Seattle, including property taxes and insurance costs.

Fox – Seattle

Property taxes are a thorn in the side of homeowners. While many of us wish we didn’t have to pay them, we don’t have a choice. Just how much you pay depends on where you live, as taxes fluctuate from state to state and from town to town.

In New Jersey, property taxes are significantly higher than those in the rest of the country. In fact, it has the highest real estate tax rate in the nation, according to a recent report from WalletHub.

With an estimated effective real estate tax rate of 2.23% and a median home value of $427,600, the report found that New Jersey residents pay an average of about $9,541 annually in property taxes. WalletHub — which ranked all 50 states and the District of Columbia by their real estate tax rates — placed New Jersey in the report’s 51st spot.

Story continues below photo gallery.

How do property taxes compare across other states?

Illinois has the second-highest real estate tax rate in the nation at 2.07%. Homeowners there pay about $5,189 in property taxes annually on a home with a median value of $250,500, according to the report.

Ranking third, Connecticut has a real estate tax rate of 1.92%, with homeowners paying about $6,575 on a home with a median value of $343,200. New Hampshire and Vermont round out the remaining top five states, at 1.77% and 1.71%, respectively.

Kentucky ranks about in the middle of the report from WalletHub with a real estate tax rate of .77%. Homeowners in the bluegrass state are paying about $2,322 on a home with a median value of $192,300.

The report found that Hawaii has the lowest real estate tax rate in the nation at 0.27%. For a home with a median value of $808,200, homeowners pay about $2,183 in property taxes.

Alabama (0.38%), Nevada (0.49%), Colorado (0.49%) and South Carolina (0.51%) were also among the top five states with the lowest real estate tax rates in the nation.

“Americans who are considering moving and want to maximize their take home pay should take into account property tax rates, in addition to other financial factors like the overall cost of living, when deciding on a city,” said WalletHub Analyst Chip Lupo.