Toronto, Ontario–(Newsfile Corp. – October 21, 2024) – New Break Resources Ltd. (CSE: NBRK) (“New Break” or the “Company”) is pleased to announce that it has commenced an Induced Polarization (“IP“) survey at its Moray property, located approximately 49 km south of Timmins, Ontario and 32 km northwest of the Young-Davidson gold mine, operated by Alamos Gold Inc. The high-resolution Gradient Array IP survey is intended to test for high chargeability sulfides that may be associated with the gold mineralization, and high resistivity associated with quartz veining and silica flooding, within and on the margins of the Moray syenite intrusive, displayed below in Figure 1.

Figure 1 – Geological Interpretation of the Moray Syenite Intrusive

Figure 1 – Geological Interpretation of the Moray Syenite Intrusive

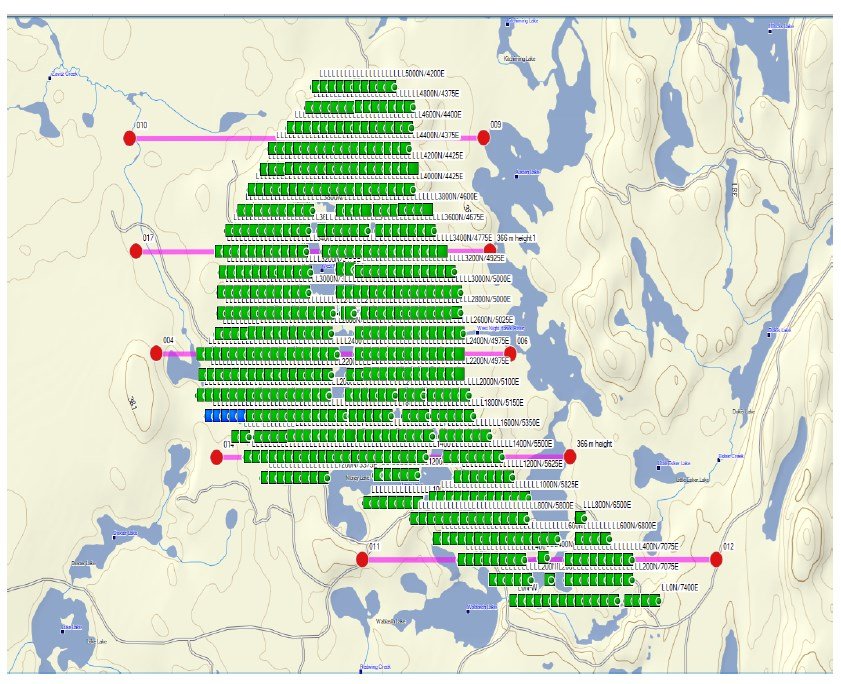

The IP survey will encompass 62.5 line-kilometers of survey lines as shown in Figure 2. Gradient Array IP surveys offer greater depth penetration and better penetration of conductive overburden than conventional IP surveys. High chargeability results could indicate the presence of pyrite, chalcopyrite and galena (lowest chargeability of the three sulphides) which, in the case of the surface results at Trench 1 within the Moray syenite, also carries gold.

This IP survey will be the first of its kind to cover the entire interpreted extent of the gold-mineralized Moray syenite intrusive and will represent the last major exploration program prior to New Break undertaking a drilling program expected to focus exclusively on the syenite intrusive.

Gold mineralization at the Young-Davidson gold mine is contained principally within a syenite intrusive which hosted mineral reserves as at December 31, 2023, of 3.261 million ounces of gold, contained in 43.911 million tonnes at an average grade of 2.31 g/t Au (source: Alamos Gold mineral reserve table as at December 31, 2023). Disclaimer: The mineralization style and setting associated with the Young-Davidson gold mine is not necessarily indicative of the mineralization observed on the Moray property. The syenite target at Moray is three times the size by area, of the syenite intrusive at Young-Davidson. Beginning in 1964, multiple historical drilling programs have been conducted on the Moray property by various operators, including Noranda, Rio Tinto and Newmont. However, over the past 60 years not a single drilling program targeted the syenite intrusive as its primary focus.

Figure 2 – Survey Setup – Distributed Gradient Array IP

Figure 2 – Survey Setup – Distributed Gradient Array IP

Qualified Person

Peter C. Hubacheck, P. Geo., consulting geologist to New Break, and a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical disclosure in this news release.

About New Break Resources Ltd.

New Break is a Canadian mineral exploration company with a dual vision for value creation. In northern Ontario, New Break is focused on its Moray Project, in a well-established mining camp, within proximity to existing infrastructure, while at the same time, through our prospective land holdings in Nunavut that include the Sundog and Esker gold properties, we provide our shareholders with significant exposure to the vast potential for exploration success in one of the most up and coming regions in Canada for gold exploration and production. New Break is supported by a highly experienced team of mining professionals committed to placing a premium on Environmental, Social and Corporate Governance. Information on New Break is available under the Company’s profile on SEDAR+ at www.sedarplus.ca and on the Company’s website at www.newbreakresources.ca. New Break began trading on the Canadian Securities Exchange (www.thecse.com) on September 7, 2022 under the symbol CSE: NBRK.

No stock exchange, regulation securities provider, securities commission or other regulatory authority has approved or disapproved the information contained in this news release.

CAUTIONARY NOTE REGARDING FORWARD LOOKING INFORMATION

Except for statements of historic fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to receipt of regulatory and stock exchange approvals, grants of equity-based compensation, renouncement of flow-through exploration expenses, property agreements, timing and content of upcoming work programs, geological interpretations, receipt of property titles, an inability to predict and counteract the effects global events on the business of the Company, including but not limited to the effects on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains etc. Forward-looking information addresses future events and conditions and therefore involves inherent risks and uncertainties, including factors beyond the Company’s control. Accordingly, readers should not place undue reliance on forward-looking information. The Company undertakes no obligation to update publicly or otherwise any forward-looking information, except as may be required by law. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company’s financial statements and management’s discussion and analysis (the “Filings”), such Filings available upon request.