Florida experienced some of the sharpest home insurance premium increases in the entire country last year and had the highest share of insurers transferring risk to reinsurance companies—two factors that are closely connected, a recent study by the National Bureau of Economic Research (NBER) found.

Read more: How Much Is My House Worth? How to Determine Your Home’s Value

While premiums increased by 13 percent in real terms nationwide between 2020 and 2023, areas exposed to climate risks saw much bigger rate hikes, the study found.

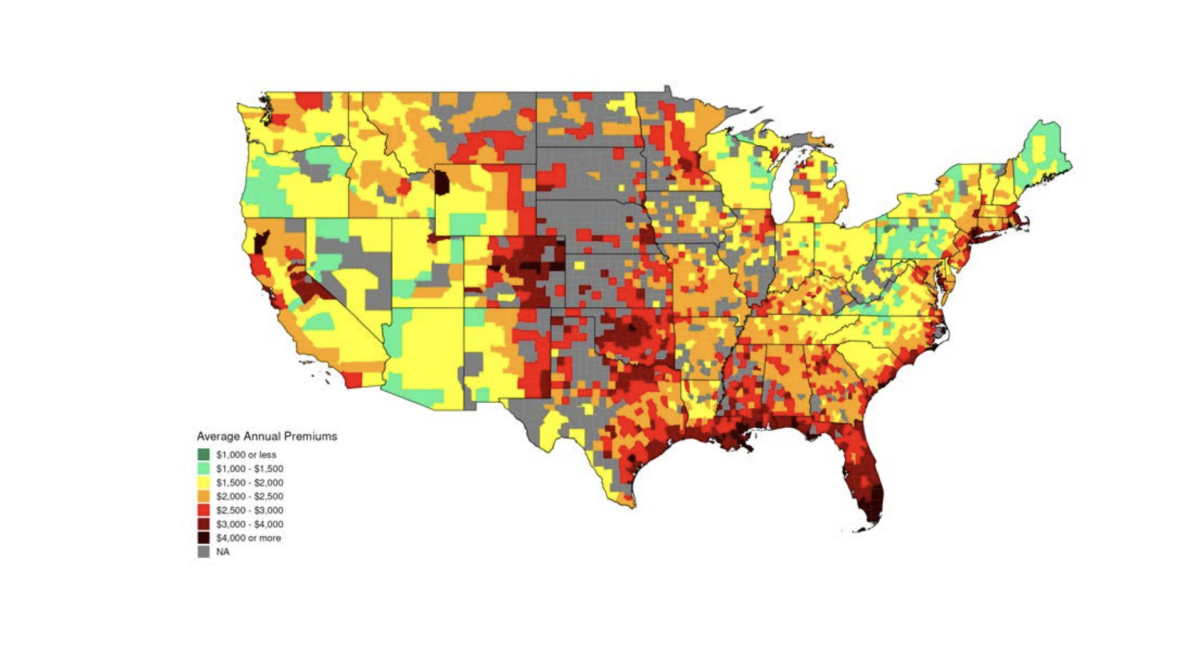

Most premiums across Florida averaged between $2,500-$3,000 and $3,000-$4,000; southern Florida was dark red on the NBER’s map, with average premiums of $4,000 and more.

NBER

The data confirms what homeowners in the Sunshine State are painfully aware of, as they struggle with skyrocketing premiums in the midst of an ongoing crisis of the sector brought about by excessive litigation, widespread fraud and the increased risk of natural disasters in Florida.

Read more: Tips to Help Sell Your Home for the Highest Price

According to a recent study by virtual insurance company Insurify, Florida homeowners paid an average annual premium of $10,996 in 2023—the highest in the country. The national average premium in the same year was $2,377 per year. Insurify expects Florida’s home insurance premiums to continue rising in the coming month, reaching a projected $11,759 by the end of the year.

CHANDAN KHANNA/AFP via Getty Images

NBER’s experts also fear that premiums might continue rising in the state, as well as in the rest of the country. That has something to do with how risky it’s becoming to insure climate change-exposed areas of the country like Florida.

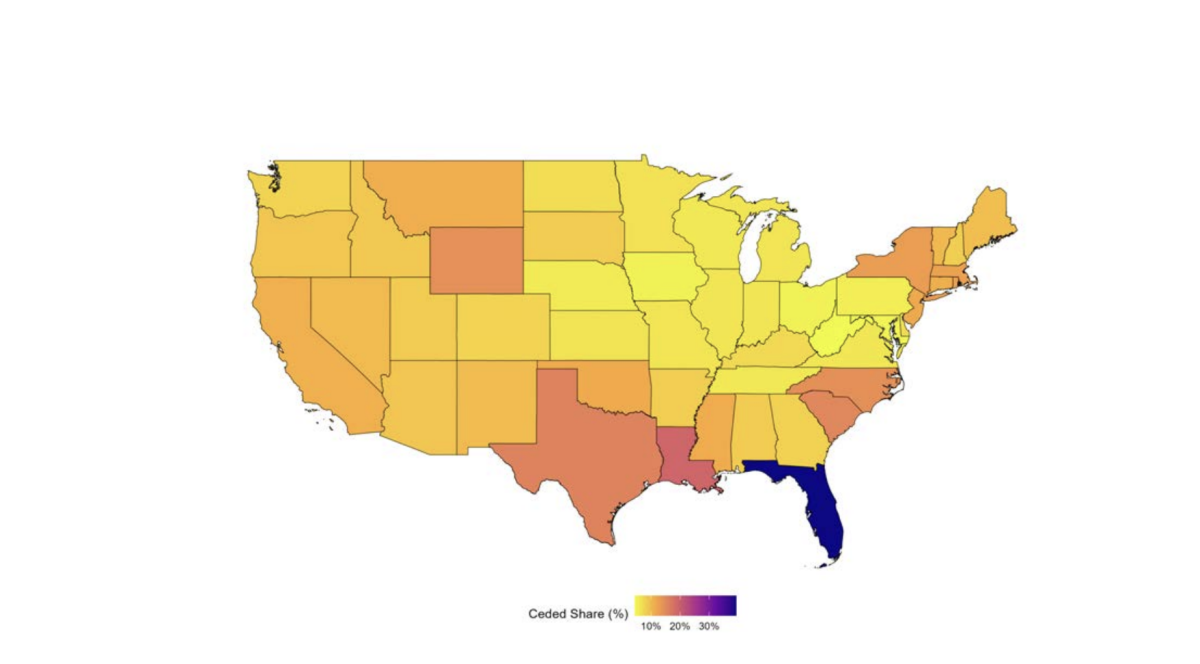

The Sunshine State, according to the NBER’s study, has the highest rate of reinsurance exposure in the country, at 40 percent, while most of the country reports rates between 10 and 20 percent.

NBER

Reinsurance exposure indicates the level of risk exposure in a reinsurance treaty—the maximum possible loss suffered should the very worst happen. Reinsurance is a form of insurance for insurance companies, who pass on the risk to another party, the reinsurance company. It’s normally linked to severe risks like hurricanes and wildfires.

As nearly all of Florida is hurricane-exposed, it makes sense for the level of risk transferred by insurance companies to reinsurers to be so high, as insurers try to manage potentially catastrophic scenarios. But some of these increased reinsurance costs are being passed on by insurers to homeowners in the form of higher premiums.

According to NBER, reinsurance prices have increased by 100 percent over the past five years, “potentially due to a number of factors, including inflation, a ‘climate epiphany’ as reinsurers reassess climate exposure, increasingly concentrated disaster exposure as Americans move into harm’s way, and the end of a low interest rate environment that led to a capital crunch.”

Newsweek contacted the study’s authors for comment by email on Tuesday morning.

However, the reinsurance market is showing signs of softening in 2024, and NBER experts expect reinsurance exposure to remain fixed this year. But volatility in reinsurance prices could lead to volatility in premiums, they warn, with both being closely linked to climate change and how the reinsurance market will “diversify catastrophic risk” and rise to the challenge.

“By 2053, we estimate that climate-exposed homeowners will be paying $700 higher annual premiums due to increasing wildfire and hurricane risk,” the study said. In Florida, the situation would likely be worse.

“However, these premium increases are highly sensitive to reinsurance prices. If insurance costs revert to their 2018 levels, then premium increases will be reduced by one-third,” the NBER research found.