The past few years have not been kind to commercial property and the companies that own and operate it. UK real estate benchmarks have returned -30 per cent since the end of 2021 and, following a confident start to the year, have wobbled of late on softer UK macro data.

Management teams have again been keen to highlight signs of recovery during recent earnings calls, be it upwards revaluations, increasing demand, or accelerating rental income growth. Yet the sector’s much-desired catalyst of falling bond yields appears increasingly remote, and so investors should instead consider the risks and opportunities facing the various subsectors, and the different ways of playing them.

Offices – prime is still prime

Concerns that remote working would sound the death knell for offices have proved overblown. The central London market – invariably the chief focus of UK office discussions – has seen vacancy rates fall from their recent 10 per cent peak to 8 per cent.

This is still above the pre-pandemic level of 5 per cent, but there are considerable variances within the capital. Demand is strong for ‘prime’ offices – those in desirable locations and designed to high specifications. Vacancies are much lower in prime City and core West End properties than elsewhere.

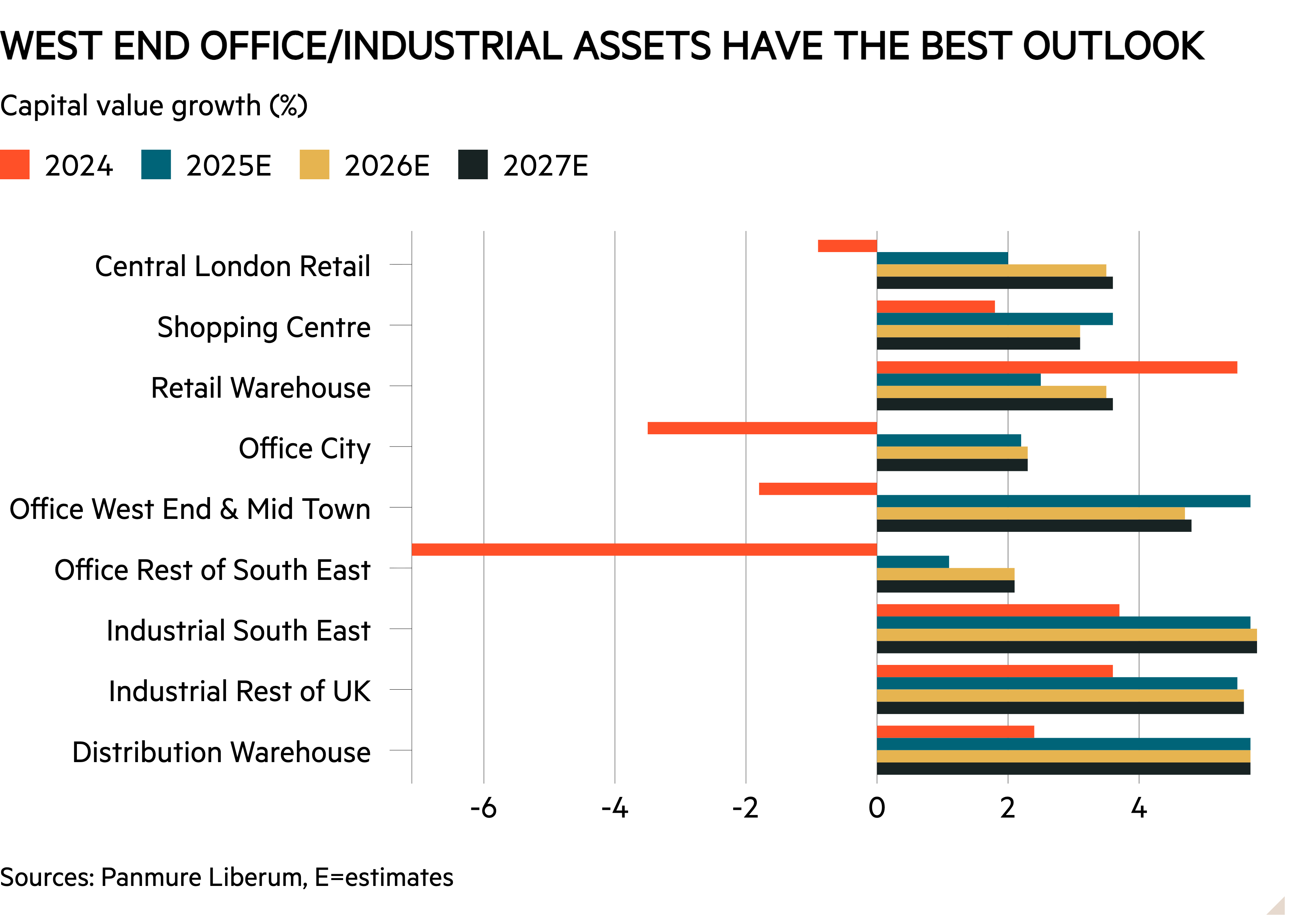

Prime office supply is likely to remain constrained. Real estate broker Savills expects new developments to remain well below the historical average in the next five years. This, in turn, should support continued rental and capital value growth, which has been especially strong in the West End of late. Analysts at Panmure Liberum expect West End and City values to grow at an annual rate of 5 per cent and 2 per cent respectively through to the end of 2027.

While rental income for non-prime City space fell by a quarter during the first half of the year, the picture is not all doom and gloom here either. “There is an opportunity for [prime rental growth] to trickle down to high-quality Grade B space – particularly for price-sensitive occupiers or in areas of acute shortage,” reckons Matthew Saperia of Peel Hunt.

In terms of Reits’ exposure, Great Portland Estates’ (GPE) portfolio is weighted towards the West End, whereas Derwent (DLN) focuses on buying and regenerating properties in ‘improving’ locations around both the West End and the City.

Diversified landlords British Land (BLND) and Land Securities (LAND) have exposure to the London office market within their portfolios, as well as other subsectors (mixed-use estates, retail parks and urban logistics for the former; shopping centres and residential for the latter).

For those confident in the future of flexible working spaces, there is Workspace Group (WKP) or International Workplace Group (IWG).

https://www.investorschronicle.co.uk/content/

Industrial – logistics at risk of oversupply?

The pandemic was every bit as kind to logistics as it was cruel to offices. The ecommerce boom stimulated demand for warehouses, commonly called ‘sheds’. Rental income growth accelerated to double digits amid falling vacancies as a result.

The trend has since normalised, with vacancies having doubled to 8 per cent and supply at its highest level since 2011, following lots of enthusiastic development in response to the pandemic-era boom. The risk now is that structural oversupply will put downward pressure on price growth. CBRE expects vacancies to rise during the second half of 2025 as more new space becomes available, for instance.

Big warehouse landlords Tritax Big Box (BBOX) and Segro (SGRO), whose higher-quality portfolios have lower vacancy rates, are more optimistic. They point to the slowing pace of ‘speculative’ development (where there is no pre-agreed tenant).

“There is less speculative development today in the market . . . demand for new space will be well matched to supply,” Tritax chief executive Colin Godfrey told Investors’ Chronicle at the time of the company’s interim results. “While availability has increased, particularly in the big box market, this is from very low levels and is not in our view a precursor to a structural oversupply,” says Saperia.

Portfolio value expectations are also more positive for industrial property than for retail and offices, according to Rics’ latest survey.

Data centres are the other opportunity logistics companies are keen to highlight. AI-driven demand for these assets, which also generate higher returns than ordinary warehouses, is surging. Segro has greater exposure, with more than 2GW of existing and future power capacity, versus 1GW for Tritax. The assets require years of development, however, and, given AI’s rapid evolution, may carry obsolescence risk.

One final trend within industrial property is a likely increase in defence demand as government spending increases; Savills estimates up to 3mn square metres over the next seven years. Industrial park operators like Sirius Real Estate (SRE) will try to benefit.

Retail – recovery on?

Few subsectors are as exposed to broader macro trends as retail. Although the sector has performed relatively strongly in the year to date, consumer confidence is fragile and real wage growth is moderating.

The shadow of ecommerce, and its potential to disrupt the sector, still looms large. Online retail penetration reached 28 per cent in June, according to the Office for National Statistics, up a couple of percentage points since the start of 2024, and it would take a brave person to predict where this ends.

That said, just over half of respondents to CBRE’s 2025 consumer survey stated a preference for in-store shopping, and the broker anticipates that “physical retail will remain a core component of occupiers’ [retailers’] business strategies”.

Then there is the question of retail parks versus shopping centres versus the high street. Only in the first of these has rental income recovered to pre-pandemic levels. Vacancies are also lower here.

The outlook for non-prime shopping centres is less positive, but as with offices, there is more optimism around prime space. “The role of high-quality and well-located retail assets in occupiers’ supply chains means evolving demand. This is met with limited supply and therefore rental recovery, albeit only in the best locations,” says Saperia.

Vacancies hover below 5 per cent on prime central London streets, supporting solid rental income growth. Shaftesbury (SHC), nearly three-quarters of whose portfolio is West End retail and leisure, should benefit.

Hammerson (HMSO) owns prime shopping centres in the UK, Ireland and France, and has recently acquired the remaining 50 per cent stake in Birmingham’s Bullring shopping centre. For exposure to regional shopping centres and retail parks, there is NewRiver Reit (NRR).

Operational – positive dynamics

Away from the big three of office, industrial and retail, the London market also offers exposure to several smaller sectors.

As with logistics, student housing – or purpose-built student accommodation (PBSA) – has seen growth moderate from its pandemic peak. For market leader Unite (UTG), annual rental income growth has softened from double digits to 4-5 per cent. Its proposed acquisition of smaller rival Empiric (EMP) will further increase its market share.

Demand for PBSA continues to outstrip supply, a mismatch that will widen if the UK is able to attract any international students deterred from enrolling in the US and Australia due to recent restrictions in those countries. Artificial Intelligence’s potential to disrupt tertiary education creates longer-term uncertainty.

As we wrote in our recent Idea highlighting Big Yellow Group (BYG) (‘This market leader is going from strength to strength’, IC, 22 August 2025), UK self storage is an underpenetrated, immature market, as is the wider continent for pan-European peer Safestore (SAFE). An uptick in housing transactions would benefit the industry in the short term.

Finally, NHS landlord Primary Health Properties (PHP) reckons it will benefit from the government’s focus on neighbourhood health centres in its recent 10-year health plan. The company, which recently acquired smaller peer Assura (AGR) following a bidding war against a KKR-led consortium, hopes to develop and operate such sites.