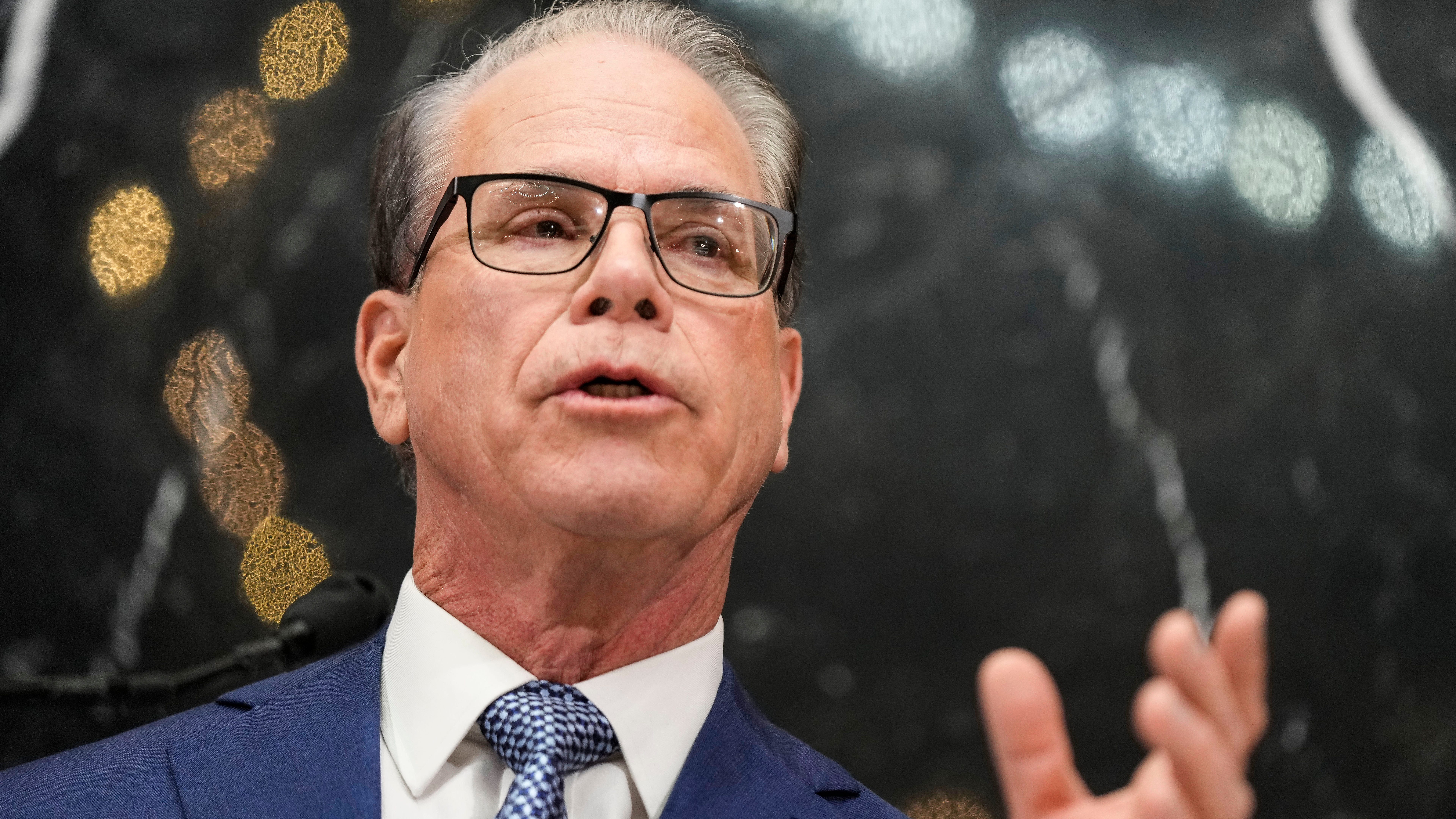

Recap of Gov. Braun’s State of the State speech at Indiana Statehouse

Indystar Statehouse reporter Kayla Dwyer recaps Gov. Braun’s State of the State Speech and other events that transpired Wednesday night.

On a quiet day last week at the Indiana Statehouse, Gov. Mike Braun rattled off bill numbers he considers “big wins for Hoosiers,” so far at the halfway point of the 2025 legislative session.

Braun pointed to legislation reforming health care pricing. He highlighted a bill curbing how pharmacy benefit managers might drive up prescription costs and another raising minimum salaries for teachers.

Then he came to Senate Bill 1.

The property tax relief proposal, a priority bill for Senate Republicans, is in a legislative limbo as it heads to the House for the second half of the session. While House and Senate Republicans, and the governor’s office, all appear interested in providing property tax relief to Hoosiers, they don’t seem to agree right now on how to do it. Braun threatened to veto the current bill that passed the Senate in February.

“What that (relief) looks like? Nobody knows,” said Lt. Gov. Micah Beckwith, who has advocated in favor of Braun’s original plan from the 2024 campaign trail. “That’s the million-dollar question.”

The pressure is on. Braun, in the initial months of his first term as governor, wants to deliver a key campaign promise to Hoosiers, but to do so needs to negotiate with state lawmakers, who all have their own priorities, and go against some mayors from within his own political party.

It’s a similar dance other first-year governors, eager to have an immediate impact, have faced. That includes former Gov. Mike Pence who pushed for an income tax cut during his first year in office by negotiating with hesitant state lawmakers.

The debate on the bill so far has also reflected the delicate nature of major property tax reform. While Hoosiers have seen skyrocketing assessments that have led to increases in their property tax bills, any action state lawmakers take could impact a major revenue source for local governments and school corporations.

Local leaders testified against Braun’s original proposal in SB 1 in February over concerns that the more than $4 billion in cuts over the next three years could impact their ability to provide services to residents in their communities. While Braun has recognized those concerns, he wants local governments to “prove” they haven’t experienced a “windfall” from rising property values.

But a Senate committee last month changed the bill to provide more support targeted toward groups like senior citizens and first-time home buyers, rather than focus on broad caps on increases for all. Braun has said the bill, which passed the Senate on Feb. 17, doesn’t provide enough broad relief to property taxpayers, while Sen. Pro Tempore Rod Bray, R-Martinsville, has pointed to cuts and “significant changes” under the bill that could provide more stability for Hoosiers.

Subscribe to our politics newsletter

“Obviously Senate Bill 1 is the biggest lift,” Bray said in late February. “But we’ve got about $1.4 billion in property tax property tax relief over the next three years, which we’re very pleased with.”

There is major work ahead, which will start on Wednesday when the House Committee on Ways and Means is scheduled to hold a hearing on SB 1. But Braun does not seem worried about the bill at this point.

“We’ll end up in, I think, a place that’s going to be a sweet happy medium,” he told reporters last week.

A Pence-era tax debate

It’s not unusual for a governor’s campaign promise, especially one about taxes, to become a major debate at the Statehouse. It happened 12 years ago during Pence’s first months as governor.

Pence campaigned for governor in 2012 on a 10% income tax cut for Hoosiers, but while he came into office as a Republican governor with GOP majorities in the House and Senate, lawmakers were not sold on his proposal.

Former Gov. Eric Holcomb also advocated for major tax changes — his centered on road funding — when he took office in 2017, but he largely deferred to the positions of state lawmakers on specifics. Holcomb still had disagreements with the Indiana General Assembly later in his tenure, including a 2021 lawsuit over the governor’s emergency powers.

But in 2013, former state Sen. Luke Kenley, who was the Senate’s chief budget architect at the time, said lawmakers were concerned about whether the state budget could take the hit from the tax cut Pence sought.

“We didn’t think that Indiana was in a position to be able to do that,” Kenley told IndyStar.

In his autobiography, “So Help Me God,” Pence said he debated the income tax cut with legislative leaders throughout the 2013 legislative session and for months saw no signs of movement.

Americans for Prosperity, the political organization run by billionaires Charles and David Koch, ran ads at the time targeting state lawmakers for their opposition to the income tax cut. (Likewise this legislative session, a nonprofit that supports Braun’s agenda has posted now-deleted ads on social media criticizing Senate Republicans that voted to water down SB 1 away from Braun’s original plan.)

It wasn’t until the final days of the 2013 session when movement happened on an income tax cut, Pence wrote in his book. He met with then-Speaker Brian Bosma, former Sen. Pro Tempore David Long and Kenley to hash out the details without legislative staff.

“I asked how we could get this done for the people who had elected us,” Pence wrote. “I told them that if I was successful, they would be, too. And they would have to face the voters the following year. The negotiations were straightforward. There were no threats, there was no cajoling. We regrouped, restarted the negotiations, and thirty-six hours later found our way to a compromise.”

That compromise included a 5% income tax cut and a gradual elimination of the state’s inheritance tax. But it took a time crunch for Pence and lawmakers to actually get there, which might be the case for Braun’s property tax plan in 2025, Kenley said.

“Everybody’s still being nice to each other,” Kenley said. “We haven’t reached the knife and gun club stage of the program.”

Property taxes are ripe for some kind of reform, said Kenley, who authored property tax legislation in 2008. He believes Braun and lawmakers are on the right track, but the pressure for a solution will increase as the end of session approaches.

“Somebody has to sit down and make a serious decision and that’s what they’re going to have to go through,” Kenley said. “It’s going to be a test not only of their policy-making skills, but their leadership skills in terms of how do we get along with each other.”

SB 1 in the second half

While lawmakers were home in their communities last week, Huston was at the Statehouse for what he has referred to as “bootcamp” on property taxes.

The House was focused on the state budget during the first half of the legislative session, which is now in the hands of the Senate. In addition to his own preparation, Huston has said Lizton Republican Jeff Thompson, who chairs the Committee on Ways and Means, will walk House Republicans through the ins and outs of property taxes.

Huston also had an hour-long meeting with Braun late Monday about property taxes, likely the first of many in the second half of the session to get the bill in “the right spot at the end,” Huston said.

“We want to get to the right place and we all want to find property tax relief for Hoosiers,” Huston told reporters in late February. “That’s our goal and that’s Gov. Braun’s goal, and I think we can get there.”

Bray said Senate Republicans are not “immovable” from the draft that passed their chamber in February, and any outstanding differences will be worked out in conference committees toward the end of the session.

Braun, though, said he will continue to advocate for the bill to land in the right place. On Friday, he met with Madison County residents at a small business in Anderson where they discussed workforce development and the impact of high property taxes.

“This is just half time of the game,” Braun said Monday after his meeting with Huston. “I feel real good that we’ll get to a place that keeps the local governments and our school districts in a healthy place, and we’re going to have definable tax relief for the taxpayers.”

Contact IndyStar state government and politics reporter Brittany Carloni at brittany.carloni@indystar.com. Follow her on Twitter/X @CarloniBrittany.