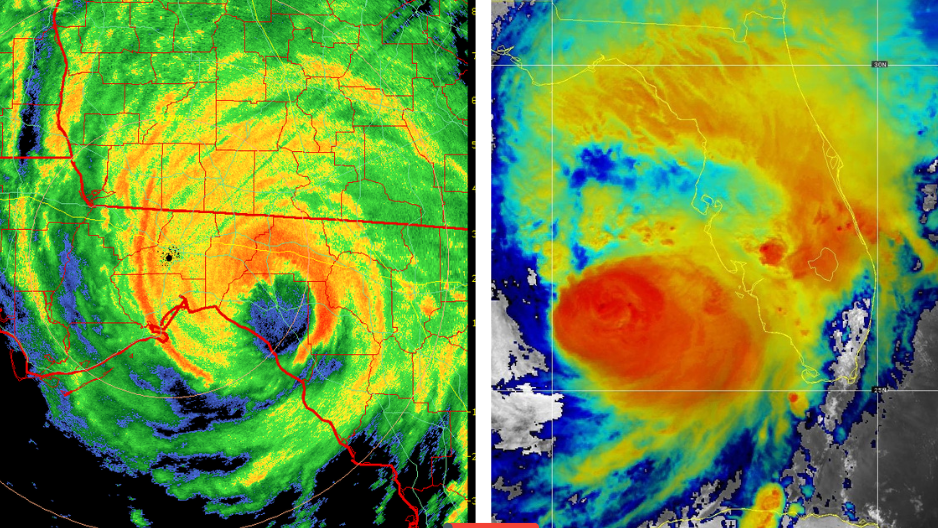

See a tornado that formed over Alligator Alley during Hurricane Milton

The tornado formed Tuesday, Oct. 9, 2024, over Alligator Alley near Weston in Broward County and moved north toward Belle Glade in Palm Beach County.

- Florida lawmakers aimed to curb rising property insurance costs and excessive litigation by changing lawsuit rules in 2022.

- Despite some insurers requesting rate decreases or maintaining current rates, premiums can still rise due to factors like inflation increasing home values.

- Attempts to roll back the 2022 lawsuit rule changes failed in the 2025 legislative session, but some lawmakers plan to try again.

Hobbling Florida homeowners’ right to sue their property insurer was sold to lawmakers as not only a way to end double-digit increases in property insurance rates but also a way to make them drop.

The tidal wave of litigation involving insurance claims has taken much of the blame for why Floridians pay some of the highest property insurance premiums in the country.

To curtail that, legislators in 2022 changed the rules for suing so that much of the incentive for attorneys to take these cases evaporated, although some suits are still being filed. But attorneys’ fees can no longer be added to a litigated insurance settlement. And that’s resulted in a dramatic drop in the number of lawsuits filed against property insurers.

That improvement is showing up in the number of insurers willing to underwrite Florida property, state officials say. The 13th and 14th insurers to enter the Florida market since the tort law changes went into effect were announced June 27. And new rates that insurers are filing with state insurance regulators are also dropping because of decreased litigation costs and drops in the cost of insurance that the companies must purchase in case of catastrophic levels of claims, Tim Cerio, CEO of the state’s largest insurer, Citizens Property Insurance Corp., told his board.

“In 2024 Florida had the lowest average homeowner premium increase right around 1% … that’s the lowest in the country … and as you all know, the immediate years before that we were either the highest or among the highest,” Cerio said. “That is a drastic change, and it shows the health of the market. It’s tremendously significant.”

That insurance costs are easing comes as news to Alan Bickford of St. James City on Pine Island in Lee County.

NOAA’s hurricane hunter aircraft hit by turbulence in Hurricane Milton

Bumpy flight into Hurricane Milton on NOAA’s WP-3D aircraft known as Miss Piggy on Oct. 8, 2024. Credit Nick Underwood

“In what country?” Bickford asked rhetorically. With his home paid off, he’s been considering dropping insurance altogether, despite hits from hurricanes Charley and Ian.

What to know about your insurance rates

Here are seven things to know your about property insurance rate:

- Trusted Resource Underwriters Exchange, which goes by the acronym TRUE, is the first insurer this year for which state insurance regulators have held a rate hearing. And, at that June 17 hearing, company officials asked regulators to allow rate increases of up to 31% for its multiperil homeowners’ insurance for tens of thousands of policyholders when they renew this year.

- In previous years, the Florida Office of Insurance Regulation has held as many as eight hearings for rate increases of 30% or more.

- Rate hearings are usually scheduled when insurance companies file for increases of 15% or more. In 2024, however, a hearing was held on People’s Trust Insurance Co.’s plan to increase its rates by 14.9% with regulators citing the need for transparency.

- Out of some 80 insurers in Florida, 27 in 2024 requested rate decreases in and 41 companies made that did not ask for a change, according to data Cerio cited from the state’s insurance regulation office.

-

Even when policyholders’ rates drop, premiums can still climb. When a home’s value increases due to inflation, for example, the total cost of insuring it — the premium — may increase, despite a dropping rate.

- Lawmakers disappointed with the effect of the 2022 tort law changes on insurance costs spurred an effort to roll back the new rules in the 2025 legislative session. Several bills that would again allow some attorney fees in litigated claims died in committee, but some lawmakers say they are going to try again.

- Ten property insurance companies went insolvent in Florida between 2019 and 2022.

Anne Geggis is the insurance reporter at The Palm Beach Post, part of the USA TODAY Florida Network. You can reach her at ageggis@gannett.com. Help support our journalism. Subscribe today