Property tax: Delaware’s outdated system explained

Why is property tax at the center of a lawsuit about school funding? Reporter Xerxes Wilson makes it easy to understand the system’s issues.

Jenna Miller, The News Journal

- Property reassessments in Delaware are mostly complete and the window to appeal the values is closed.

- Municipalities and school districts have pledged to not make any more money off of the tax rolls.

- Wilmington’s government and residents are not happy with the reassessment figures.

Congratulations, or sorry: Your property value has been reassessed.

And in the coming weeks, as your property tax bill hits your mailbox, that new dollar amount may have an impact on your bottom line.

Property tax assessments were stagnant statewide for decades until 2020, when a Delaware court ruling determined that property values and the state’s reassessment process as a whole were unconstitutional. By now, the reassessment process in all three counties is largely finished despite months of residents appealing their new values. The true effects are about to be felt.

Counties, municipalities and school districts are planning on being “revenue neutral” from the assessment changes, which means they won’t make any more money off of the new values themselves. Many are adjusting their tax rates to make that happen. Wilmington, for example, is enacting a one-year property tax rate to keep itself at the same level.

But not everyone is happy about the changes, especially in Delaware’s largest city.

Take David Chen, whose Trolley Square home got assessed for double its value at more than $600,000.

After talking with his neighbors, he realized the entire neighborhood had jumped similarly. Confused, he hired an independent appraiser who returned a value of $440,000.

“If you look at it on a broad scale, it seems OK, but then you have my case where it’s over $200,000 more than what an essentially independent appraiser assesses it at,” he said. “And then when you kind of zoom into the pockets of wrongness, you see, some areas are very, very off.”

All three counties used a national, third-party contractor, Tyler Technologies, to do their assessments. Kent County has already gone through a fiscal year with the new values, while Sussex County and New Castle County are using the values for this year’s property taxes, which are set to hit mailboxes this summer.

During the process, Tyler Technologies and county assessment review boards were flooded with appeals to change initial values, especially for properties that saw large increases. In New Castle County, there were about 5,200 appeals.

The company, which has appraised more than 33 million parcels nationwide, said in an email that there are a lot of factors that influence the value of a property and that the assessments they performed met applicable industry standards, meaning they believe they did them correctly.

While the reassessments were originally pitched as a way of balancing property values that would result in on-third increasing, one-third staying relatively stable, and one-thrid decreasing in taxes, it’s unclear how that all shook out. When asked about how each county fared, Tyler Technologies stressed that comparing the counties is not “relevant or informative.”

Everyone’s property values or taxes will look different, and that doesn’t mean that they’re rising. Many properties could have stayed at a similar value or even decreased, which was why properties needed to be reassessed in the first place.

The path forward for taxpayers is getting clearer − even if they’re not happy with it − but there are still unanswered questions.

What happens next?

Properties have been assessed and the majority of those values have been certified. Any remaining appeals are ongoing, but they are being handled on a case-by-case basis. Counties, school districts and municipalities say they are largely avoiding pocketing extra revenue from any changes to the tax rolls.

Kent and Sussex counties’ newly assessed property values reflect the market rate of July 2023. New Castle County just certified its new values in May, and its values represent July 2024. Kent County used the new values in 2024.

If you’re in New Castle County, expect to see your property tax bill in July. The informal appeal period was extended to the end of March, and those are still being handled individually.

Sussex bills are coming in August.

State law requires properties now be reassessed every five years, creating a cadence that could lessen the sticker shock over time.

Can I appeal my property values?

Not for this year, but the appeals process will open back up for tax bills in the next fiscal year, which starts in July. These values are locked in until the next county reassessment. Homeowners can appeal their assessed value every year.

Appeals in New Castle County that were submitted before March 31 are still being reviewed, but new appeals cannot be submitted at this point.

Susan Durham, Kent County’s finance director, said property owners can appeal their assessment each year. But, if they’ve filed an appeal before, they must provide new evidence at the next appeal.

In Sussex, you can appeal the property assessments in March 2026. This year’s window for appeals has closed and final hearings are wrapping up.

If you appeal to your county’s board of appeals, the burden of proof is yours to carry. You need to provide a value you believe is more correct.

Why was my property reassessed?

Because the Delaware Chancery Court said so.

In 2020, the court ruled that Delaware’s assessment values were unconstitutional. The ruling was the first step in the process that will end in your mailbox this summer.

Wilmington and school district officials were among the loudest advocates for a redo of the state’s tax rolls before the ruling was handed down.

That’s because the 1980s were the last time New Castle and Kent counties had done their property tax assessments. Sussex County hadn’t assessed its properties since 1974. Vice Chancellor of the Chancery Court J. Travis Laster wrote in his ruling that properties were not equally taxed, violating the state Constitution.

The assessed values need to be at “fair market value,” according to state law.

The assessment process took New Castle County longer to pull off because of the size and density of the county – more than 220,000 parcels needed to be reassessed.

In Kent County, the court-ordered property reassessment was finished in 2023, and the appeals process was wrapped up in 2024. The new assessments are based on fair market value as of July 1, 2023. Working with assessment company Tyler Technologies, county staff members reviewed valuations of over 89,000 parcels and sent notices of the new assessments by mail to every property owner.

“Where we found inaccurate information, our staff made corrections,” Kent County commissioners said in a joint statement.

A total of 3,316 property owners requested reviews of 4,274 properties in Kent County. Some owners had multiple properties. After that, 256 owners appealed.

Appealing again were 79 owners who went to the Kent County Board of Assessment, some with multiple properties. Owners could then appeal to Kent County Superior Court.

One of the most common reasons for an above-average increase in assessed value was that information such as home additions or other improvements was never recorded, Kent County commissioners said.

Appeals in Sussex are finished, and the County Council is working on a lower tax rate to balance out increasing property values.

What are the county tax rates?

County tax rates make up a small part of your bill. Most of your property taxes will go to municipalities and school districts. Counties also have to adjust their rates to remain revenue-neutral.

- New Castle County: The proposed rate, yet to be approved by the council, is 15.96 cents per $100 of assessed values for residential properties, 24.12 cents per $100 for nonresidential.

- Kent County: 5.72 cents per $100 of assessed value

- Sussex County: Their proposed rate, yet to be approved by the council, is 2.14 cents per $100. If approved, it will take effect in July.

How do the schools fit into this?

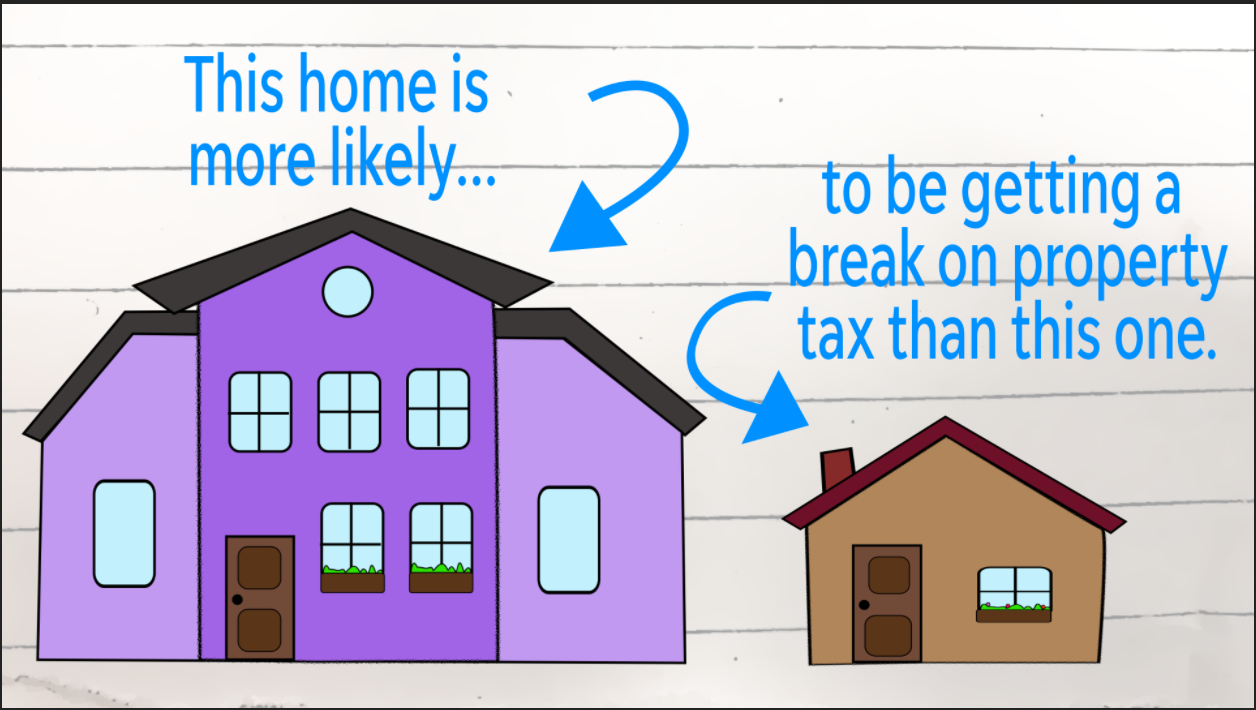

One of the main beneficiaries of the updated tax rolls could be the state’s school districts. One of the few ways for school districts can increase their budget is through a referendum to raise the tax rate, which is a tough sell in the best of times.

Brandywine School District CFO Daniel McCoy said his school district is remaining revenue neutral, like many others. This is despite the ability to have a 10% boost in revenue, which state law allows.

McCoy said Brandywine will do whatever it can to avoid that 10% bump and plans on adjusting the tax rate in a referendum to set the new revenue-neutral tax rates. Year two of a previously approved referendum will be factored in on top of the revenue-neutral tax rate. McCoy plans on having a budget ready to present in June, before being finalized in July.

“They pretty much said that we do everything that we could to not utilize the 10%,” he said.

Red Clay School District, in a statement, said it is also “committed to not using the reassessment process to raise additional revenue.” The total assessed value in their district has grown, and their proposed tax rate will decrease. Most taxpayers will still see a bump in their tax bills following a successful referendum in 2024.

Because school budgets have not yet been finalized, it remains to be seen how school district budgets shake out with the new values and tax rates.

Why is Wilmington upset over the reassessments?

The Wilmington City Council unanimously passed a resolution calling for the decertification of the city’s new property values because they perceive them as inequitable. It’s a response to Tyler Technologies’ final report on New Castle County, which said some key metrics in Wilmington’s appraisals do not meet industry standards.

One major shift in Wilmington and New Castle County at large is the shift of the tax base. Residential properties now make up most of the tax rolls compared to non-residential, which includes industrial and commercial.

Tyler Technologies’ report on assessments in New Castle County showed the process went pretty smoothly, except within Wilmington’s borders.

A key metric for appraisals is the coefficient of dispersion, which measures uniformity. Tyler Technologies released a report on April 25, saying the metric measured in Wilmington is above accepted industry standards. In the rest of New Castle County, the metric falls within the standards.

The company said Wilmington’s properties are diverse in their age, condition and design. It said the metric for Wilmington is consistent with other areas with similarly varied housing stock.

That explanation does not work for Wilmington’s government. Mayor John Carney’s office and the City Council agree when they say values are “inequitable.” Residents also agree.

Kristina Pansa was in the same boat as Trolley Square homeowner David Chen. Her home in the Cool Springs neighborhood was assessed at $182,000, which is about $40,000 more than she thought it should be. She said her next-door neighbor’s property was assessed $200,000 higher than hers.

She appealed to Tyler successfully, unlike Chen, who hired his own appraiser and still has not achieved the value he wanted.

Tyler used land value and building value to construct the property values. Pansa said her property has a backyard, but newer units nearby with a single-car garage and no yard are being charged the same land rate.

Tyler’s land value calculations were “catastrophically off,” she said, before adding: “They did some really sloppy math.”

(This story has been updated with additional information.)

Shane Brennan covers Wilmington and other Delaware issues. Reach out with ideas, tips or feedback at slbrennan@delawareonline.com.