LME copper hit an all-time high of 13,300 per tonne ($6.03/lb) on

Jan. 6, marking a 50% year-on-year increase.

Along with all the usual applications for copper — in

construction, transportation and telecommunications — demand

is being driven by ongoing electrification and decarbonization of

the transportation system and the exponential growth in battery

storage.

Furthermore, copper is vital to artificial intelligence and the

infrastructure that supports AI. The associated increase in data

centers is causing an explosion in electricity demand, requiring

substantial copper for new infrastructure and power transmission.

This all boils down to everything driving the world’s

economies needs more copper, in the face of persistent constraints

on mine supply.

Supply crunch

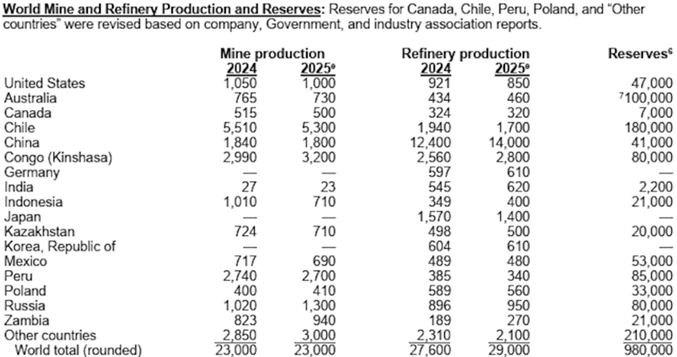

While the copper market was roughly balanced in 2025, meaning that

refined production met consumption, mine supply was severely

disrupted and will likely create a deficit in 2026, states the International Institute for Strategic Studies

(IISS).

A significant long-term deficit is projected, potentially exceeding

6 million tonnes annually by the early 2030s. Total output from

copper mines in 2025 was 23 million tonnes, according to the

USGS.

Google AI identified key trends in copper supply in 2026:

-

Structural Deficit: The industry is moving into a structural

shortage as demand outpaces new mine development.

-

Production Constraints: Despite high demand, mine supply

growth for 2026 is estimated to be low, at around +1.4% (roughly

500,000 tonnes).

-

Record Prices: Concerns over tight supply and strong demand sent

spot copper prices to record highs, exceeding $14,000 per

tonne at the beginning of 2026.

-

Key Producers: Chile (19%), Peru (10%), Australia (10%),

Russia (8%), and Congo (8%) hold the largest reserves.

-

Shortage Drivers: A projected 50% increase in demand from

current levels by 2030, accelerated by energy transition and AI,

necessitates an estimated 8Mtpa of new mining capacity by 2035.

-

Recycling Impact: Roughly 30% of global copper demand is

currently met via recycling, which is crucial for filling the

gap.

-

Geopolitical Risk: A high concentration of smelting and

refining capacity in China (40-50%) poses supply chain risks.

-

Operational Disruptions: Significant issues, such as the

shutdown of major mines (e.g., Indonesia’s Grasberg) through

Q2 2026 are tightening the market.

-

Investment Needed: Over $210 billion in capital

investment is required by 2035 to meet demand, according

to Wood Mackenzie.

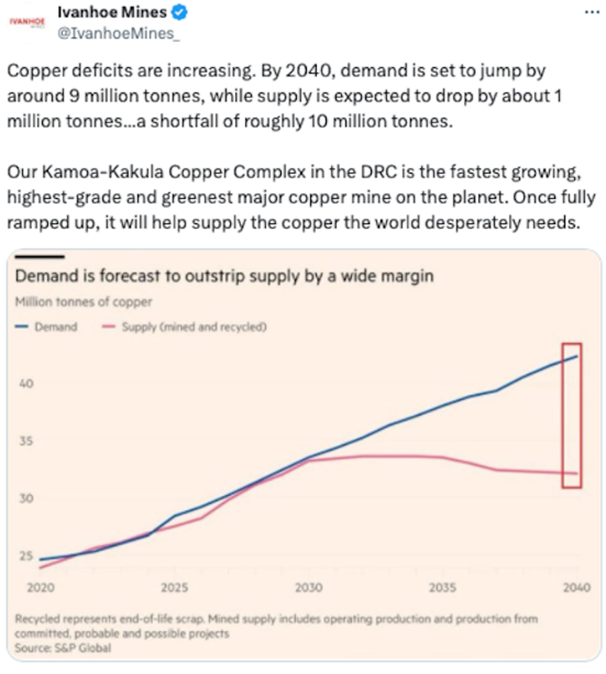

A new study released on Jan. 8 by S&P Global Market Intelligence and

S&P Global Energy found that copper supply is expected to fall

10Mt short of demand by 2040, putting at risk industries such as

artificial intelligence, defense spending and electrification.

The shortage would be 23.8% shy of the projected demand of 42Mt,

even as copper recycling doubles to 10Mt. AOTH research has found

that copper supply has not been able to meet demand without

recycling for the past several years.

“Here, in short, is the quandary: copper is the great

enabler of electrification, but the accelerating pace of

electrification is an increasing challenge for copper,”

Daniel Yergin, vice chairman at S&P Global, who co-chaired

the study, said in a statement. “Economic demand, grid

expansion, renewable generation, AI computation, digital

industries, electric vehicles and defense are scaling all at

once — and supply is not on track to

keep pace.”

Without significant changes to supply, global copper production is

projected to peak at 33Mt in 2030 before declining, while demand is

expected to surge 50% from current levels, according to the study.

An additional 10Mt of primary supply will be required by 2040. But

without significant investment, primary production could reach just

22Mt, a million tonnes below current levels.

Among the supply constraints identified by the report are declining

ore grades, rising energy and labor costs, complex extraction

conditions and lengthy permitting times. The average timeline from discovery to production spans 17

years.

Supply chain concentration adds another layer of risk, says S&P

Global, with just six countries responsible for around two-thirds of

mine production. China is both a miner and a refiner, with the

country accounting for approximately 40% of global smelting capacity

and 66% of copper concentrate imports. This makes the global supply

vulnerable to supply shocks and trade barriers, the report

said.

An earlier (November 2025) blog post by Wood Mackenzie brings its forecast five years ahead of S&P Global, with

the consultancy expecting global demand for copper to surge 24% and

reach 43Mtpa by 2035.

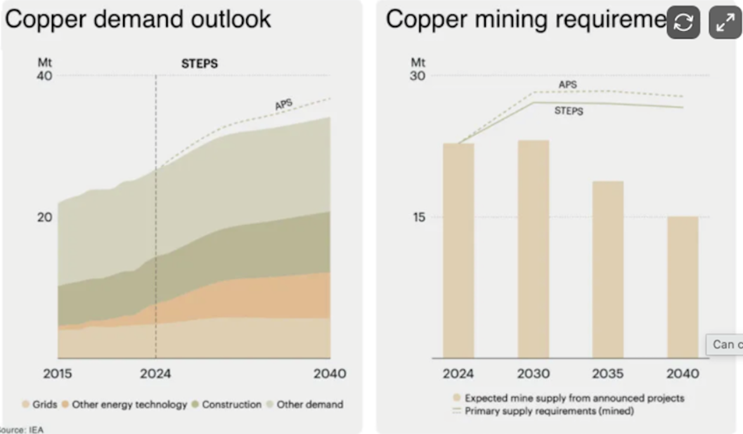

It says four emerging demand disruptors will add 3Mtpa, almost

doubling growth from traditional sectors. The four sectors underpinning a stronger outlook for the copper

market are: the rapid expansion of data centers; geopolitical

tensions ratcheting up spending on defense and boosting

infrastructure resilience; low-carbon energy projects consuming

record amounts of copper; and Southeast Asia and India becoming

major consumers of copper as they rapidly industrialize.

Data centers: Gluttons for power, water and minerals Part I

Data centers: Gluttons for power, water and minerals Part II

I previously wrote about data centers as gluttons for power, water

and minerals. The capex on data centers by tech companies intent on

staying ahead of the AI boom is truly remarkable. According to Statista,

Last year alone, Meta, Alphabet, Amazon and Microsoft spent more

than $400 billion in capital expenditure, most of it dedicated to

building the data centers that are the foundation of all AI

applications. That’s more than double the amount spent in

2023 and yet, there is no end in sight to what experts are calling

the “AI arms race”. According to the companies’

latest CapEx spending forecasts, their joint investments will

easily exceed $600 billion this year, with Amazon alone expecting

to spend $200 billion on “seminal opportunities like AI,

chips, robotics, and low earth orbit satellites.”

Woodmac notes that to meet forecasted copper demand, the industry

will need to bring new mines online at roughly twice the rate of a

decade ago. The problem is that greenfield mines/ new discoveries

are failing to keep pace.

It explains that Western miners remain cautious about committing

capital to new mine supply, even as prices rise.

Why Copper Incentive Pricing and increasing M&A matters to

owners of BC copper and gold projects

“This isn’t about geology. We identify a robust

pipeline of greenfield projects. The challenges, particularly for

Western miners, are far more about investment and risk

appetite,” the blog states.

Instead of investing in Greenfields exploration and development,

Western miners are instead focusing on sustaining output. However,

key constraints include strict capital discipline and heightened ESG

requirements.

Financial hurdles are also a consideration, says Woodmac, noting

that new copper mines require billions of dollars in upfront

capital and that Western miners typically rely on private debt,

“with providers imposing increasingly demanding conditions.

Some financing terms include stress tests at copper prices 20% to

30% below our forecasts.”

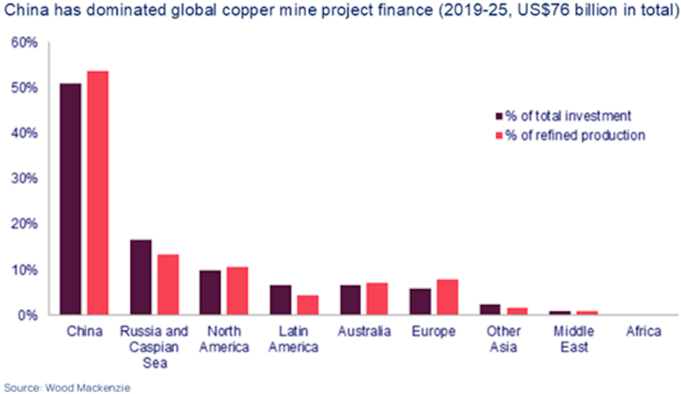

In contrast, “Chinese miners are seizing an opportunity to

fully integrate value chains and increase their influence over

global copper flows as demand accelerates.”

“Unlike their Western counterparts, Chinese miners have

aggressively pursued opportunities in higher-risk jurisdictions.

Of the US$76 billion invested globally in green and brownfield

copper supply between 2019 and 2025, around 50% came from Chinese

miners.”

This approach has enabled China to dominate copper and cobalt

production in the Democratic Republic of Congo, for example.

Wood Mackenzie estimates that 8Mtpa of new mining capacity, in

addition to 3.5Mt of copper scrap, will be required to balance the

market in 2035. The cost to deliver this supply growth is likely to

exceed $210 billion, compared to around $76 billion invested in

copper mining over the past six years.

Still more research into the copper supply comes from the International Institute for Strategic Studies, or IISS.

The institute says that disruptions to mine output, a collapse in

refining margins and stockpiling by the United States have pushed

the global copper market into a period of sustained strain.

Copper mining faces challenges in the form of resource nationalism,

environmental regulation, adverse weather and public opposition. Due

to these factors, it is likely that the market will move into a structural deficit in the 2030s. While 2025 mine disruptions such as the

Grasberg mud intrusion that has temporarily shut down the

second-largest copper mine in the world, and earthquake-caused

flooding at the Kamoa-Kakula mine in the DRC, will likely create a

market deficit in 2026, IISS does not expect a severe near-term

shortfall.

Production failures

We get a better idea of why mines aren’t hitting their

production targets by examining the situation in Chile. Other major

producers, including Peru, Indonesia and the DRC, are running into

trouble.

Bloomberg reports that Chile, the world’s top copper producer accounting

for 25% of global supply, saw output declines for each of the last

five months of 2025:

Chilean copper mines have been hit by setbacks at projects that

are key to tapping richer areas of deposits, while a mine run by

Capstone Copper Corp. struggled with a strike and the giant

Quebrada Blanca mine is battling waste-storage issues.

Other disruptions included a rock burst at El Teniente last July

that caused 48,000 tons of lost production in 2025 and likely

another 25,000 tons in 2026; and contract workers that blockaded

access roads to Escondida — the world’s largest copper

mine — and the Zaldivar mine.

Another source, The Oregon Group, says that state-owned copper miner Codelco managed to eke out a

0.3% increase in 2025 over 2024, but notes that average copper

grades have fallen from 1.02% to 0.66% in 2025. That’s almost

a 50% reduction in grade.

Peru, the number 3 producer, also saw a number of setbacks. Output

last year declined 12% to 216,152 tonnes, owing to social unrest at

MMG’s Las Bambas mine and Hudbay Minerals’ Constancia.

At Constancia informal miners staged protests over stricter permit

rules, blocking key transport routes and disrupting operations.

Informal miners were also behind intermittent road blockages at Las

Bambas aimed at preventing ore-laden trucks from reaching the

coast.

I’ve already mentioned the ongoing closure of Grasberg in

Indonesia and the temporary halt in production at Ivanhoe

Mines’ Kamoa-Kakula complex in the DRC. Kamoa achieved its

388,838-ton guidance in 2025 but will have to push back its

500,000-ton target to 2027.

More bad news for the Congo’s copper: the country will reportedly “enforce a long-dormant rule requiring local

employee ownership for mines in a move that may rebalance shareholdings in some

of the world’s biggest copper and cobalt producers.

“In a letter dated Jan. 30 and addressed to miners of all

metals in the country, Mines Minister Louis Watum said firms must

demonstrate that 5% of their share capital is held by Congolese

employees.”

Zambia, African’s second-largest producer, missed its

million-ton government target in 2025, having to settle for 890,346

tonnes. According to The Daily Brief,

Growth at Mopani and Konkola was offset by a tailings dam

collapse in February 2025 and an 18% production decline at

the Trident mine due to lower grades. The country aims for 3

million tons by 2031, but current operational hurdles highlight

the difficulty of scaling in high-risk jurisdictions.

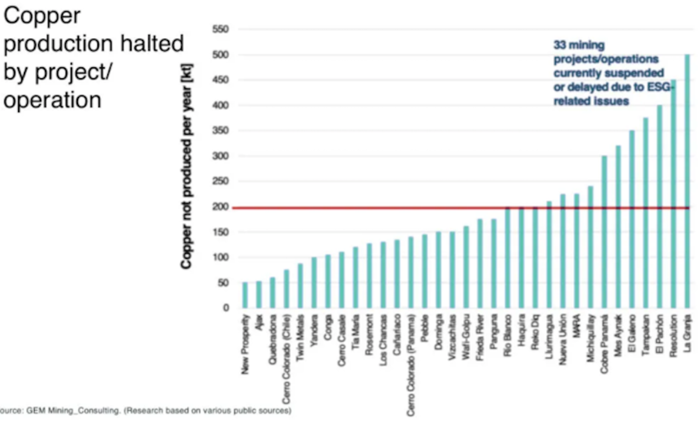

In total, an estimated 6.4 million tonnes of copper production

capacity, equal to more than 25% of global mine output, is stalled

or suspended due to environmental, social, and governance (ESG)

issues, a study by GEM Mining Consulting reveals.

Technical issues

Most of the low-hanging copper fruit has been identified and mined.

What’s mostly left is copper in hard-to-reach places with

little to no mining infrastructure and/or it’s in politically

risky jurisdictions where a mining project can be expropriated at

the whim of a government.

Decades ago, the best copper mines had grades of 1.5% or higher.

Today, many mines operate below 0.6%, meaning operators must dig up

twice the amount of rock to obtain the same amount of copper.

Climate is another problem. In Chile, most of the mines are in the

Atacama Desert, but copper processing is water intensive. Water is needed to separate copper from rock, keep the dust down,

and to cool equipment. Making matters worse, Chile is experiencing a

“megadrought” that has lasted over 15 years.

Some mines have had to cut production, while other are spending

billions of dollars to build desalination plants on the coast and

pump seawater hundreds of kilometers uphill into the mountains.

Market tightness and US stockpiling

A year ago, the copper market was shaken by the prospect of tariffs

on copper imported into the United States. However, industry fears

were quelled when in late July, President Trump announced 50%

tariffs only on semi-finished copper products, with refined copper

and the raw materials produced by mines — cathodes and

concentrates — provisionally excluded.

Meanwhile, stockpiling in the US has deprived the rest of the world

of available copper.

Between last February and late July, US copper imports soared, as

shippers strove to get their copper to the US ahead of the expected

tariffs. This increased stocks on the Chicago Mercantile Exchange

(CME), which elevated prices. For a few months, US copper prices

traded at a significant premium to LME prices.

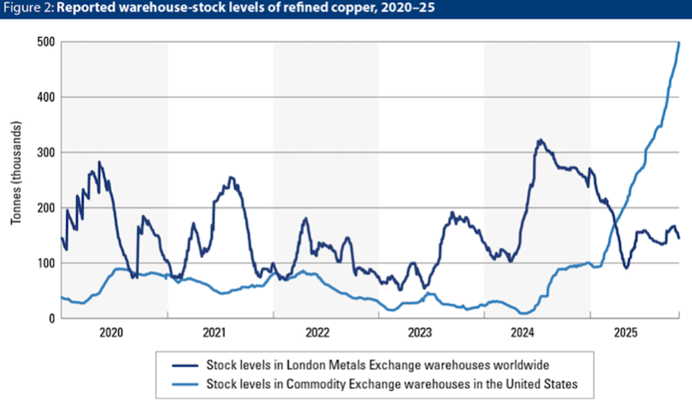

IISS notes the lingering threat of copper tariffs has meant that

US-held stocks continued to climb since July, and domestic prices

remained at a premium until the start of 2026, as the graph below

shows.

Source: London Stock Exchange Group

The country imported 1.7 million tonnes of copper last year,

according to the US Geological Survey, almost double the volume from

2024.

As for the stockpile, Bloomberg reports that copper held in exchange-approved warehouses, which back

futures contracts, have climbed relentlessly since early 2025. As of

Feb. 6, 2026, inventories stood at 589,081 tons, a more than

five-fold increase from a year earlier.

As mentioned, the copper flowing into the US has tightened supply

for the rest of the world. For example, copper fabricators in China

have struggled to source feedstock and are passing the higher costs

onto consumers, chilling industrial demand for the metal.

Between tight supply and mine disruptions, copper has soared to

record highs.

What would happen to the copper stockpile if US tariffs on refined

copper fail to materialize and copper floods the global market,

depressing prices?

While analysts and traders initially feared this could happen,

according to Bloomberg views have now shifted towards an even larger

stockpile, as the US government and companies look to protect the

country’s manufacturing base from scarce supply, volatile

prices and over-reliance on imports from China.

Copper was declared a critical mineral by the US in November 2025,

and the administration has plans to create a $12 billion stockpile

of critical minerals known as “Project Vault”.

The United States is also buying into mines directly. Recently

Glencore announced it is selling a 40% stake in its DRC copper and

cobalt mines to a US-backed critical minerals consortium.

Orion CMC will have the right to… direct the sale of the

relevant share of production from the assets to nominated buyers, in

accordance with the U.S.-DRC Strategic Partnership Agreement,

thereby securing critical minerals for the United States and its

partners, reads a Feb. 3 press release.

All of this is to try to loosen the chokehold China has on critical

minerals like cobalt and copper. But China is also stockpiling

critical minerals and has done for years. Earlier this month a metal

association in China called for the government to stockpile copper

— a necessary step to avoid concentrate shipments from being

disrupted and risking smelters from going idle. Remember, China

consumes half the world’s copper and processes 57% of global

refined supply.

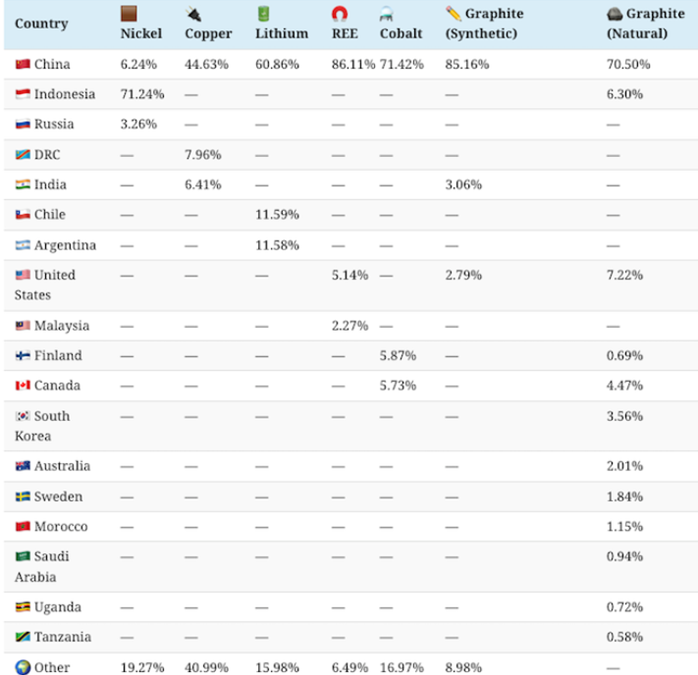

In fact, China is expected to have the largest share, at 60%, of

global refined critical metals supply by 2030. Although it should be

noted that copper refining is more diversified than, say, rare

earths elements, for which China controls 86.1% of refining,

compared to copper’s 44.6%.

Other refined minerals heavily weighted towards China include

lithium (60.8%), cobalt (71.4%), natural graphite (70.5%) and

synthetic graphite (85.1%), as shown in the table below.

M&A over Greenfields

According to the International Energy Agency, via Reuters, the capital expenditures (capex) required to get new supply up

and running in Latin America, the nexus of global copper production

(Chile, Peru), has increased 65% since 2020.

To build a

new 200,000-ton-a-year copper mine, the upper end is $6 billion.

That

implies up to $30,000 to build one ton of yearly copper production,

a figure miners are not, so far, buying into.

It’s

easy to see why miners are reluctant to build new mines and are

instead relying on mergers and acquisitions to increase their

reserves.

Recent examples include the merger between Anglo American and

Canada’s Teck Resources to form a new company, Anglo Teck; BHP

and Lundin Mining’s $38 billion joint venture to expand the

Filo del Sol Project in Chile/ Argentina; and MMG acquiring Cuprous

Capital to expand the Khoemacau copper mine in Botswana.

Codelco and Anglo American last September finalized an agreement to merge operations at their Los Bronces and Andina copper mines.

The Anglo-Teck merger made sense because Anglo’s Collahuasi

mine and Teck’s Quebrada Blanca mine are just 15 kilometers

apart in Chile’s Atacama Desert. By combining processing

facilities and sharing resources, they expect to produce more copper more efficiently.

Many copper mines are decades old and reaching the end of their

lives. Their owners can expand them vertically, such as

Newmont-Imperial Metals’ underground block cave operation at

their Red Chris mine in northwest British Columbia, try to find more

copper around the mine, or the most attractive option, buy other

copper miners’ and add their reserves to your own.

Copper mining companies prefer the last option rather than try to

find new mines. It’s the path of least resistance. It takes a

long time to build a new copper mine as mentioned the timeline from

discovery to production spans 17 years.

In the United States it’s upwards of 30 years, which is

frankly ridiculous. Permitting alone can take seven years. Even

after a mining company gets the required permits, environmental and

indigenous groups, or local governments, can challenge a project in

court, further delaying the process.

Take the Resolution project in Arizona. As one of the largest

undeveloped copper deposits in North America, Rio Tinto and BHP have

been trying to develop it for decades, spending $2 billion thus far.

But as the Daily Brief reports,

Due to legal challenges, environmental reviews, and political

battles, not a single gram has been mined.

This is

increasingly the norm, despite big deposits existing. Getting from

discovery to production is so slow and risky that many projects

never get built.

Unfortunately, M&A this does nothing to alleviate the global

copper supply deficit. It’s just shifting one pile of reserves

in one mining company to another. The global reserves total

doesn’t change. The deficit continues.

All it takes is one major copper mine to get shut down, and suddenly

we’re looking at deficits. Electrification, AI, and all the

above listed uses of copper are putting strains on the copper

supply.

The obvious solution is to find more copper.

What companies are saying

Ivanhoe Mines wrote that “Copper deficits are increasing. By 2040, demand

is set to jump by around 9 million tonnes, while supply is expected

to drop by about 1 million tonnes… a shortfall of roughly 10

million tonnes.”

On Feb. 5 Anglo American posted a 10% drop in production in 2025 to

695,000 tonnes, the lower end of its guidance, and cut its 2026

copper production forecast. Reuters reported the London-listed miner expects this year’s output of

between 700,000 and 760,000 tons, from a previous forecast of

760,000 to 820,000 tons, partly due to lower production from its

Collahuasi mine in Chile.

Anglo also said it expects to record around $200 million in charges

for the second half of 2025 related to rehabilitation provisions at

its Chile copper operations.

Despite operational problems, mining stocks are suddenly in vogue

again. A recent Bloomberg article said global miners have “shot to the top of fund

managers’ must-have list, as soaring metals demand and tight

supplies of key minerals hint at a new super-cycle in the

sector.”

With a nearly 90% gain since the start of 2025, MSCI’s

Metals and Mining Index has beaten semiconductors, global banks

and the Magnificent Seven cohort of technology stocks by a wide

margin. And the rally shows no sign of stalling, as the boom in

robotics, electric vehicles and AI data centers spurs metals

prices to ever new highs.

That’s particularly true of copper, which is key to the

energy transition and has surged 50% over the same period.

According to Bank of American’s monthly survey, European fund

managers now are 26% overweight on the sector, the highest in four

years, though well below the 38% net overweight in 2008.

Yet the sector looks undervalued. Bloomberg reports The Stoxx 600 Basic Resources index trades at a forward

price-to-book ratio of about 0.47 relative to the MSCI World

benchmark. That’s an about 20% discount to the long-term

0.59 ratio and well below prior cycle peaks above 0.7.

“This valuation gap persists even as the strategic

relevance of natural resources has risen materially,” Morgan

Stanley analysts led by Alain Gabriel wrote.

Conclusion

The picture emerging is a world that needs a lot more copper than it

currently produces.

Supply disruptions at several large copper mines have pushed the

market into deficit this year. Copper supply is expected to fall

10Mt short of demand by 2040, putting at risk industries such as

artificial intelligence, defense spending and electrification

— all of which are driving demand higher.

Wood Mackenzie estimates that 8Mtpa of new mining capacity, in

addition to 3.5Mt of copper scrap, will be required to balance the

market in 2035. The cost to deliver this supply growth is likely to

exceed $210 billion, compared to around $76 billion invested in

copper mining over the past six years.

But copper is getting more expensive to dig out of the ground. Ore

grades are declining, and water needed for mining is getting scarce,

especially in Chile, which is in a multi-year drought. Energy and

labor costs are also pushing expenditures higher.

Governments are starting to realize the problems in the copper

industry and have made copper a critical metal. The United States

and are countries have begun stockpiling copper, signaling a fear of

running out of the electrification metal. US stockpiling has further

tightened an already tight copper market.

Governments are investing in copper mines to gain some control over

the copper supply chain, which is vulnerable to disruptions.

Companies are merging to control what copper is left, taking the

path of least resistance by shifting reserves from one balance sheet

to another rather than taking the time and allocating funds to

discovering new copper deposits. It takes up to 30 years to develop

a new copper mine from discovery to production in regulation-heavy

jurisdictions like Canada and the United States. This must change,

or the copper supply deficit will only get worse.

I’ve been predicting it for years, but the scramble for copper

is finally here. And it’s just getting started.

Richard (Rick) Mills

aheadoftheherd.com

Investorideas.com

is the go-to platform for big investing ideas. From breaking stock

news to top-rated investing podcasts, we cover it all.

Mining stocks -Learn more about our news, PR and social media,

podcast and content services at Investorideas.com