Gold is outperforming the S&P 500 in 2024.

Shares of gold miner Newmont (NEM -1.69%) fell 14.7% on Thursday after the company reported third-quarter 2024 results. The sell-off may seem strange, given gold prices are still hovering around an all-time high.

Here’s what’s driving the sell-off in the dividend stock and why there may be better options for investing in gold than mining stocks.

Image source: Getty Images.

Newmont couldn’t live up to the hype

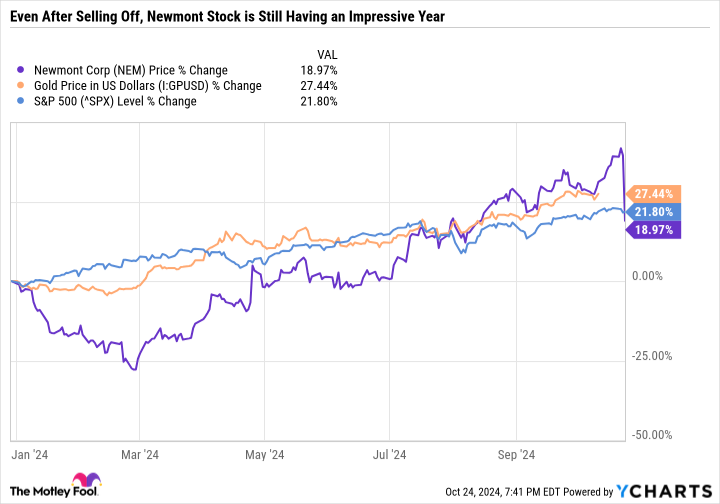

2024 has been a phenomenal year for gold stocks and most mining stocks. In fact, until the recent sell-off, shares of Newmont and the price of gold were both outperforming the S&P 500 index (SNPINDEX: ^GSPC) year to date — which is impressive considering it has been an excellent year for the broader market. Even after the recent pullback, Newmont stock is still up 19% year to date.

The main issue is that expectations got ahead of reality. In the short term, it can be difficult for gold miners to keep pace with the price of gold because they have to spend more to produce more, and capital spending plans are usually made based on midcycle expectations rather than overextending at the top of a cycle.

Analysts expected Newmont to book $0.86 in adjusted earnings per share (EPS), but it only notched $0.81 in adjusted EPS. Still, Newmont’s results were incredibly impressive and included $760 million in free cash flow (FCF). However, third-quarter sales grew 4.6% quarter over quarter compared to a 7.1% increase in costs applicable to sales. Costs outpacing sales growth is never a good sign because it can lead to lower margins and worse-than-expected earnings growth.

Newmont bought back $500 million in stock during the quarter and returned $786 million to shareholders through stock repurchases and dividend payments — which was more than the FCF it earned for the quarter. Newmont’s dividend payment can vary based on the performance of the business, but it currently sits at $0.25 per share per quarter. Some investors may have preferred Newmont to pay a higher dividend than buy back stock. After all, Newmont’s average price paid per share was $53.16 — which is higher than the closing price of the stock after Thursday’s sell-off.

Still, the sell-off in Newmont is probably due more to the stock price getting ahead of itself than poor results. There’s a lot to like from Newmont’s results and its fourth-quarter guidance. As of Oct. 23, the stock was up over 50% in the past year compared to a 34.3% increase in the price of gold. Newmont had a huge surge in October before the recent sell-off. So, there was a lot of pressure on Newmont to deliver a perfect quarter, which it didn’t do.

Other ways to invest in gold

Miners can be a great way to invest in gold if they can manage costs and invest in efficient mines. As mentioned, Newmont was a better investment over the last year than gold or the S&P 500 until the recent sell-off. And since Newmont pays dividends, it offers a way to earn passive income from gold, whereas buying gold bullion doesn’t pay dividends.

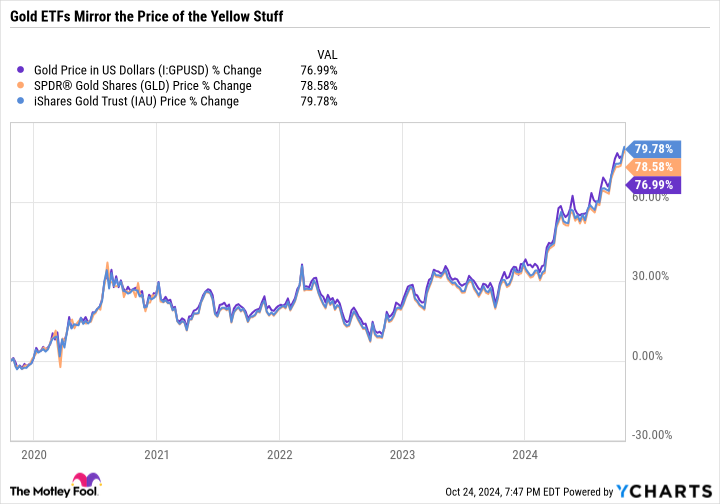

However, a simpler way of investing in gold than mining stocks is to buy an exchange-traded fund (ETF) such as SPDR Gold Shares (GLD 0.21%) or the iShares Gold Trust (IAU 0.23%). As you can see in the following chart, both ETFs have closely followed the price of gold.

Gold Price in US Dollars data by YCharts

Both financial products use a custodian to hold their physical gold, so their value is backed by tangible assets. The iShares Gold Trust has an expense ratio of 0.25%, or $2.50 per $1,000 invested compared to a 0.4% expense ratio for SPDR Gold Shares. Both expense ratios are reasonable considering buying gold usually involves paying a fee above the spot price, not to mention there are storage and security costs involved if you want to hold gold safely rather than under your mattress.

Invest in gold in a way that works for you

Investors may want to invest in gold for a variety of reasons. But the simplest is that it is an alternative asset to stocks and bonds that can do well amid times of uncertainty. It is also a store of value that doesn’t depend on the U.S. dollar or the U.S. economy.

If the main reason you’re thinking about gold is its proven value, even during economic turbulence, then it makes more sense just to buy shares in a gold ETF than go with a gold mining stock with way more variables. However, if you already own gold bullion or a gold ETF and are looking for an additional way to invest in the yellow stuff, then researching gold miners could make sense. There are also gold miners’ ETFs, such as the VanEck Gold Miners ETF, in which Newmont is, unsurprisingly, the top holding.

In sum, it’s best to approach investing in gold in a way that suits your objectives and your liquidity needs. And for most folks, a gold mining ETF is probably a better buy than Newmont.

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.