Silver has rallied once again, breaking through the significant $ 40-per-ounce resistance level. It’s the first time silver has eclipsed $40 since 2011.

Since last Friday (Aug. 29), silver has gained over 5 percent.

What is driving this latest bull run?

Follow the leader

Silver has followed gold higher over the last several days. The yellow metal surged to a record, breaking through the $3,500 level and pushing above $3,570 on Wednesday (Sept. 3).

Gold kicked off its rally last week after Federal Reserve Chairman Jerome Powell went dovish during his Jackson Hole speech, signaling a rate cut in September. The Fed Chair acknowledged downside employment risks “may warrant adjusting our policy stance” from its “current restrictive setting,” he said at his final annual speech in Jackson Hole, Wyo.

Lower rates are considered bullish for the metals, given that they are non-yielding assets. A lower rate environment means a lower opportunity cost for holding them.

There has also been a move into safe havens. Last week, a federal judge held that most of President Trump’s tariffs were unconstitutional. That has created a significant level of uncertainty in the markets.

Worries about Fed independence and some soft economic data contributed to the pivot to safe havens as well.

This is taking place in an environment that was already cautious. September and October have historically been rough months for stocks. While it may be nothing more than a self-fulfilling prophecy, the number of times it’s been mentioned in the mainstream financial media indicates it is on people’s minds.

Tight Silver supply

More fundamentally, silver is getting a boost from tight silver supplies, particularly a decline in liquidity in the London market.

This started last summer when tariff worries drove a significant amount of metal out of London and into the U.S. According to Metals Focus, “Although silver was confirmed as being tariff-exempt in April, lingering trade uncertainties in particular, seem to have limited the return of silver to London.”

This occurred in a silver supply environment that was already tight. Demand outstripped the silver supply for the fourth consecutive year in 2024. The structural market deficit came in at 148.9 million ounces. That drove the four-year market shortfall to 678 million ounces, the equivalent of 10 months of mining supply in 2024.

When demand outstrips mining and recycling output, industrial users of the metal are forced to wade into the market to access existing stocks of silver. This pushes the price higher.

Industrial demand set a record for the fourth straight year in 2024.

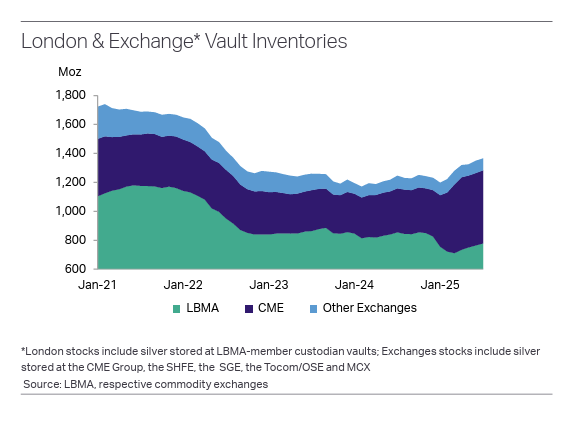

Even before the tariff-related outflows, physical silver was already moving out of London. Silver holdings peaked in 2021 at 1,180 million ounces. That was down 30 percent by the end of last year.

We’ve also seen outflows of silver from COMEX and Shanghai Futures Exchange vaults. Metals Focus notes that “release of these above-ground stocks has helped keep the physical market well supplied in recent years.”

Strong demand for physical silver in India has contributed to this drawdown in silver stocks. Silver jewelry and investment demand have remained strong despite a series of record highs in rupee terms. Demand is expected to remain robust as the country enters into wedding and festival season.

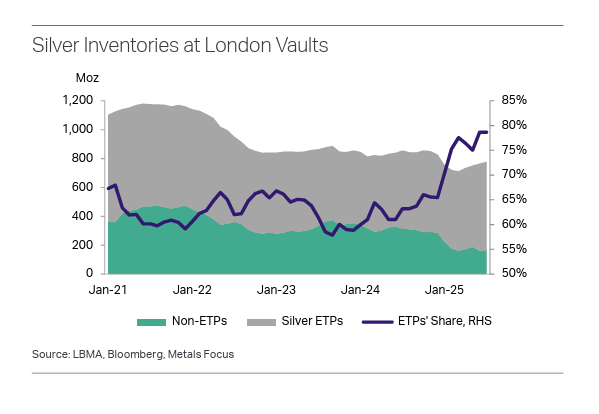

Metals Focus pointed out that even though there is plenty of silver in London, about 80 percent of it is held against physically backed silver ETFs. That’s the highest share since LMBA vault data became available in 2016.

“In other words, only 20 percent of London stocks (less than 170Moz) were available for lending or mobilization at end-July. With further ETP inflows recorded in August, this may help explain why physical supply has remained relatively tight.”

U.S. investors still on the sidelines

While silver supplies continue to tighten, there is still plenty of untapped demand in the marketplace.

Despite rising prices, investor activity has remained subdued in key sectors, particularly in the U.S.

Both the CME and the Shanghai Futures Exchange reported declines in the number of silver futures contracts. Meanwhile, CFTC reports show that as of the end of August, net managed money longs were about 1/3 below June’s highs.

According to Metals Focus, “This decline in investor positioning can be partly attributed to elevated macroeconomic and geopolitical uncertainties throughout the year, which have diverted attention towards gold.”

Lower investor interest has also manifested in the physical market. Silver coin and bar sales have shrunk so far this year.

Silver Institute data shows that weak demand in the physical silver investment market is almost entirely being driven by Americans. Asian demand has been robust – especially in India, as already noted. European silver demand has shown signs of recovery, although it is coming off a relatively low base.

However, in the U.S., we’ve seen investors taking advantage of higher prices and selling to take a dollar profit. This is similar to the dynamic in the gold market, where U.S. investors have also remained on the sidelines.

According to the Silver Institute, retail silver investment is down about 30 percent in the U.S.

When U.S. investors finally get into the game, it could drive silver prices even higher.

During a recent interview, Money Metals CEO Stefan Gleason called $40 a key level, saying that with gold prices at record levels, silver will become an increasingly attractive option.

“People will start looking at silver as a bargain, and even though it’s at $45 or $50 or $55, I think it’s going to gain momentum, and especially if it gets over that $50 price, I do think that we’re going to be challenging the $50 level by next year. So, we’ll see. And then if it breaks – and I think it breaks through that – it’s going to go quite a bit higher from there.”

Metals Focus also remains bullish on silver.

“Looking ahead, the factors constraining liquidity in the London market are likely to persist in the short-term, and so will continue to deliver price support. The investment case for silver (and gold) is also expected to remain compelling well into 2026. Anticipated interest rate cuts by the Fed from September onwards should reduce the opportunity cost of holding precious metals. Additionally, a global economic slowdown, concerns over the Fed’s independence, and rising anxiety about US debt levels should all support gold, and by extension, this will spill over into silver and drive further investment and eventually also price appreciation.”

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.