Miners moved quite sharply higher – just as the general stock market did, but…

All eyes on the Dollar

There are only two charts that really matter right now – and they both feature the USD Index.

On the above chart, we see that the USD Index corrected half of the recent rally as well as the breakout above the mid-July high. The USD Index is moving back up, which means that the test of the support levels was successful.

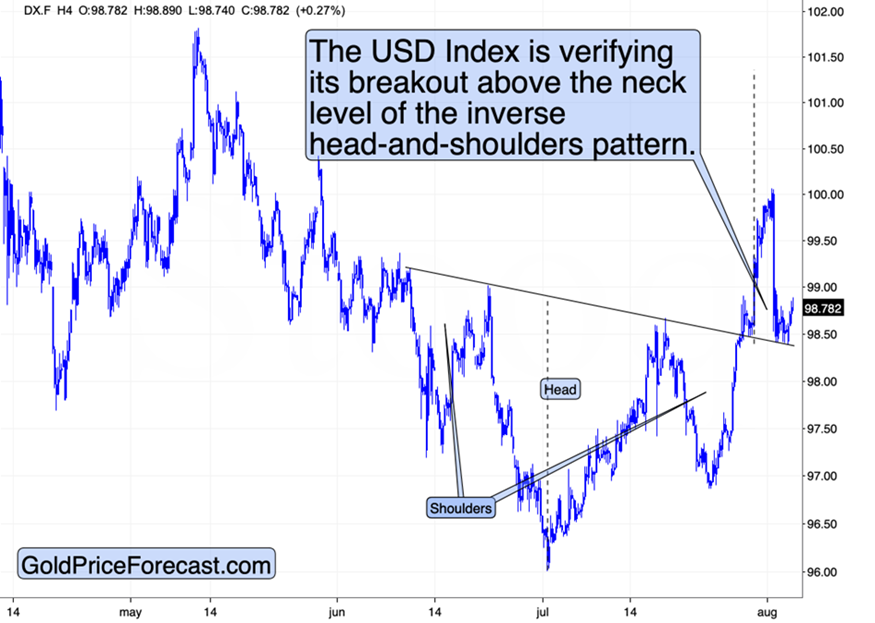

The above chart shows that the short-term inverse head-and-shoulders formation was verified. This, in turn, means that while the early-August slide was sharp and – perhaps to some – scary, it didn’t change a single thing regarding USD’s very bullish outlook.

Those formations tend to be verified in this way – by the price moving back to the neck level that was previously broken. This test serves as a proof that the breakout was not accidental. The USD Index passed this test.

Based on this verification, the outlook is even more bullish than it was when the USD Index was just after the breakout above this formation in late July. A bigger rally is just ahead.

This is precisely why this is the only chart that matters right now. Please move your attention back to the first chart. I already wrote about this before, but as things get volatile, it’s easy to forget about the context.

Peak chaos still holds

The thing is that the bigger moves in USD Index and GDXJ were aligned even if they didn’t move in tune with each other on a single day or a few of them.

This means that yesterday’s upswing in the GDXJ is very likely just a temporary phenomenon – just as the decline in the USD Index was. The lack of invalidation in case of the USD Index pretty much tells us exactly that.

And since it is the USD Index that drives the GDXJ and not the other way around, it is the major shift in the former that we saw in the previous weeks that really matters. Yes, gold, silver, platinum and copper can (and are likely) to decline based on the upcoming USD rally as well.

And the best part? It’s early and you can still profit from it, especially that the Peak Chaos theory remains intact.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!