In the 21st century, technology-based industries are built on a foundation of metals. Among them, high-purity precious metals and rare materials are at the heart of modern technological advancements, from semiconductors and electric vehicles to green energy and aerospace technologies. However, the limited availability of these resources and the complexity of mining them have made stable supply and sustainable use critical challenges for global industries.

SungEel HiMetal is looking to close the loop and has focused on technological innovation from its inception to address these issues. Founded 25 years ago with the development of recovery technologies for extracting gold and silver from electronic waste, the company has evolved into South Korea’s leading player in refining and recycling precious metals from the semiconductor and petrochemical industries.

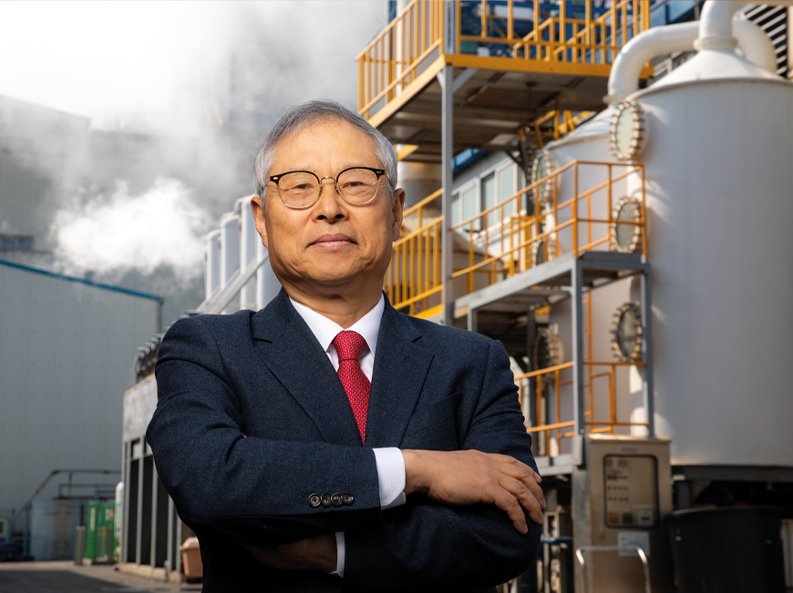

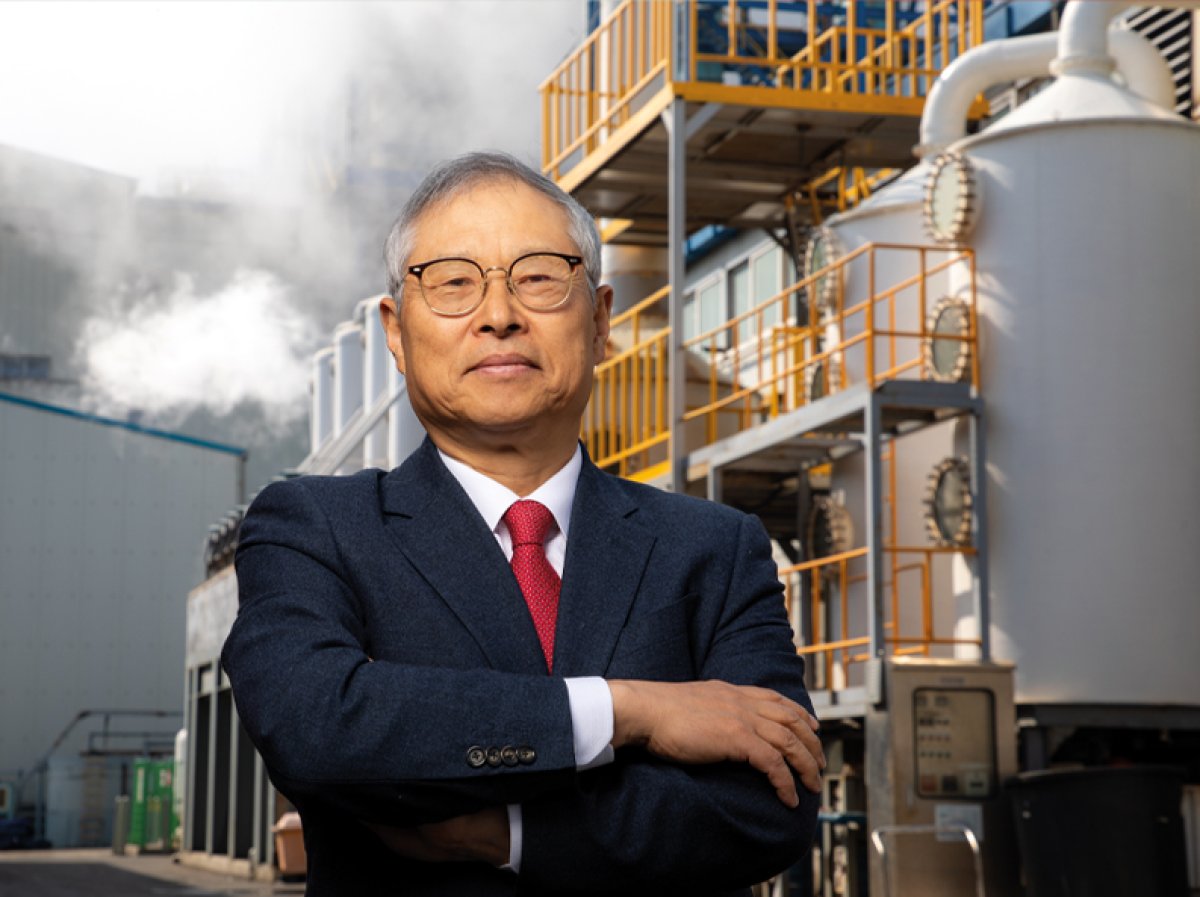

SungEel HiMetal envisions a future where technology overcomes resource limitations and drives a truly sustainable circular economy. CEO S.P. Hong says that global manufacturing is subject to raw material price fluctuations, increasing global environmental regulations and broader technological access challenges. SungEel HiMetal offers a solution to these challenges that demands a proactive approach. “Handled correctly, these challenges can be transformed into new opportunities for growth, and I’m confident we have what it takes to make that happen,” Hong says.

Despite the concept of a circular economy arriving in Korea relatively later than in the United States or Europe, Korea has a wide-ranging manufacturing and industrial base, forming the backbone of its economy. According to S.P. Hong, processes involving e-scraps (electronic waste), spent catalysts from oil refinery and petrochemicals suit SungEel HiMetal’s business practices. Working with leading semiconductor companies, SungEel HiMetal recovers precious metals used in its clients’ manufacturing processes, refines them to high purity and supplies the resulting materials back to the parts manufacturers. Likewise, with oil refineries and petrochemicals, it recovers the precious metals in spent catalysts and turns them back to customers. “That kind of circular approach is one of our biggest strengths, helping us build long-term partnerships with clients and establish a genuinely sustainable business model—a real circular economy,” Hong explains. The company meets a variety of customer demands with personalized solutions, which Hong believes will resonate on the world stage. Hong explains, “By focusing on a virtuous circle of precious and rare metal recovery, high-purity refining, compound production and distribution to relevant industries, we combine metal recycling, refining and value-added solutions into one integrated approach.”

Therein lies the competitive advantages of SungEel HiMetal: comprehensive technological solutions, foresight and agility. From its earliest days, the company quickly jumped from e-scrap to batteries and, later, catalyst recycling for the oil refinery and petrochemical industry. Hong says that markets are constantly in flux, changing rapidly regardless of industry verticals. “That’s why, as a smaller company, we stay nimble and quick on our feet, constantly watching out for the next big resource that’s vital for metal recycling,” he says. Electronics manufacturers in particular are cognizant of metal prices fluctuations and look for cheaper alternatives that shorten the cycle of switching from one material to another when prices rise. “That means a metal recycling company like SungEel HiMetal has to keep a close eye on new materials and develop preemptive recycling technologies to stay ahead,” he says.

To achieve this, the company invests heavily in R&D to boost the recovery rate of difficult-to-recycle platinum group metals like rhodium, iridium and ruthenium. “These metals are crucial for future technologies, and by developing better ways to recycle them, we aim to become a leader in sustainable materials sourcing,” Hong states. Furthermore, Hong says the company is committed to minimizing the environmental impact of our recovery processes. This is evidenced by its contributions to national research for carbon emissions reduction, efforts to find substitutes for sodium cyanide in gold recovery and the development of NOx reduction methods. SungEel currently holds 35 registered technologies, with some already in use, and is awaiting approval of an additional 27 technologies.

Hong asserts that metal recycling is no longer optional—it’s necessary for humanity. These materials are, by definition, rare while also being finite. Eventually, critical materials must be sourced from cities instead of mines. SungEel HiMetal is committed to maintaining diverse sourcing lines in various markets to ensure that it is positioned to meet industry demand. As Hong puts it, “Over the past 25 years, we’ve lived with the vision that we turn finite resources to infinite, to contribute to the good of society.”

For more details, explore the website at: http://www.sungeel.com/?lang=en

This report has been paid for by a third party. The views and opinions expressed are not those of Newsweek and are not an endorsement of the products, services or persons mentioned.