Stock image.

Singapore’s Abaxx Exchange plans to introduce gold futures in the coming months, with prices setting fresh records this year as traders grapple with disruptions in key bullion hubs and increased haven demand.

The contracts — which will be physically deliverable in the Southeast Asian city-state — will seek to connect futures and physical markets in one location, tapping into Asia’s potential, according to David Greely, chief economist at the bourse, which is majority owned by Abaxx Technologies Inc.

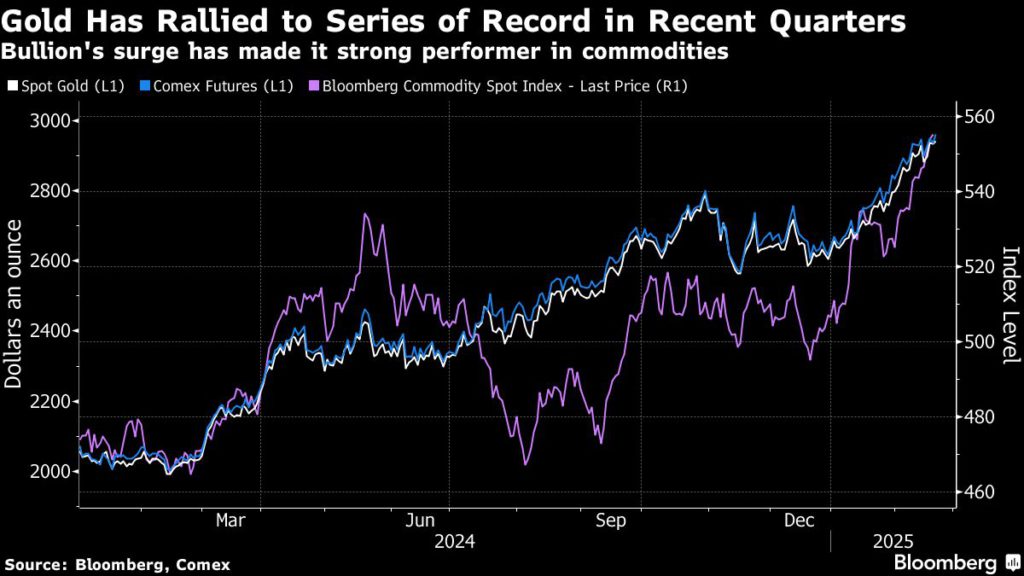

Gold has soared to successive peaks this year, building on a 27% surge in 2024 and making the precious metal one of the strongest performing major commodities. The gains have been underpinned by demand from central banks, as well as investors seeking a haven. In recent weeks, US President Donald Trump’s disruptive trade and foreign-policy moves have also boosted interest.

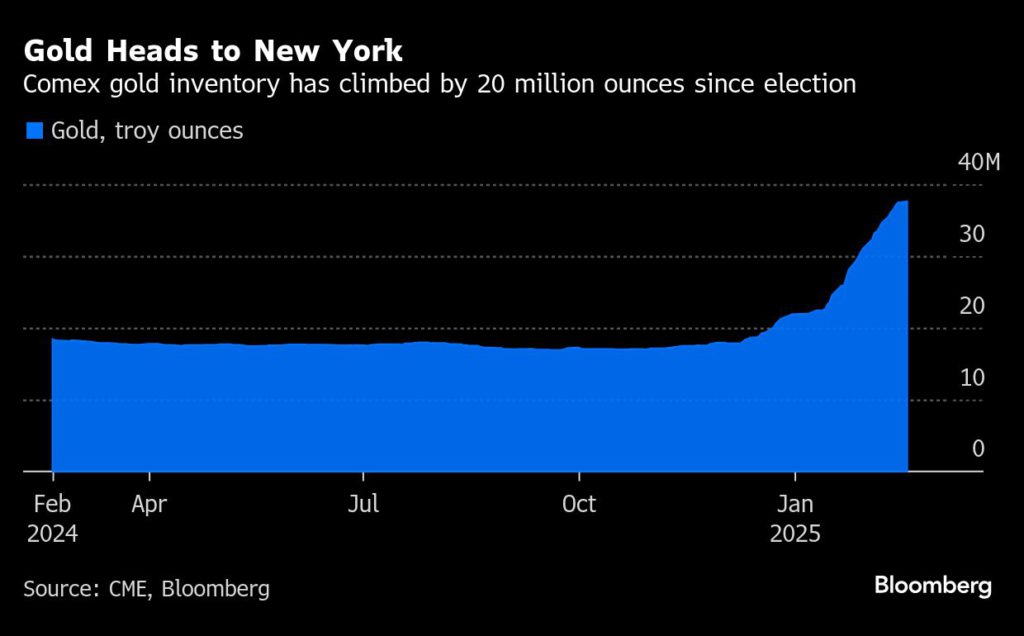

Prices on New York’s Comex — which trades futures — surged over international benchmarks including spot prices in London in recent weeks amid concerns gold may be hit with US tariffs. That discrepancy is rare, echoing a disconnect seen in the market during the pandemic. Amid the upheaval, there’s been a rush to send metal to the US, with record outflows from London vaults.

“Having futures in New York and the physical market in London allows events to drive the price in the futures market away from the spot market,” Greely said in an interview. “We saw that during Covid, and we’re seeing it now with the concerns over potential tariffs from President Trump.”

Singapore has long vied to establish itself as a hub for precious-metals trading, exempting investment-grade gold, silver and platinum from a goods-and-services tax in 2012. The city-state’s proximity to key markets in Asia — including China — presents a natural opportunity, according to Albert Cheng, chief executive officer of the Singapore Bullion Market Association, and who isn’t connected to Abaxx.

There’s a deep affinity in the region, including among high-net worth individuals, for physical metal. Asia is “a kilobar market — that’s not being matched in London and New York,” said Abaxx’s Greely, referring to ingots that weigh a kilogram. “The Asian market deserves its own marketplace, and we think Singapore is natural for that.”

Still, Singapore does not have anywhere near the volume of physical gold seen in London, where about 8,500 tons of metal underpin the historical center of the bullion market. That means Abaxx — or other potential entrants offering exchange-based products in Singapore — will have to ensure that they have suppliers that can provide liquidity to back their gold contracts, said Cheng.

Not all attempts to launch precious-metals products have been successful. Singapore Exchange Ltd. — which runs the local stock exchange, and also offers futures for commodities including iron ore — started gold futures in 2014, but pulled the contract about four years later after volumes slumped to zero.

At present, Abaxx offers liquefied natural gas, carbon and nickel-sulphate futures. The bourse is also set to expand offerings for battery materials to include lithium-carbonate contracts in March, as it seeks to meet the growing demand for electric-vehicle metals and risk management needs.

(By Annie Lee, Sybilla Gross and Yihui Xie)