SILVER has entered 2026 on a volatile yet structurally significant footing, after one of its strongest rallies in decades. In the last quarter of 2025, prices surged sharply, driven by a combination of supply tightness in physical markets, strong industrial demand and heightened geopolitical risks.

While the technical rebound in the last couple of weeks did not in any way negate the broader upward trend, it forced markets to confront an uncomfortable question: whether technological substitution, particularly in solar and advanced manufacturing, could cap demand growth just as prices test historically elevated levels.

To understand where silver stands today, it is important to revisit the structural shifts that emerged during 2024-2025. The period attributed to the AI boom marked a clear structural shift with prices propelled by persistent supply deficits, shrinking above-ground inventories, and a surge in demand from renewable energy, electronics, and emerging AI-linked applications.

Unlike earlier cycles that were largely speculative, the 2025 rally was anchored in physical tightness, reflected in elevated premiums across Asian markets and growing stress in deliverable inventories. At the same time, expectations of US rate cuts, a softer dollar, and repeated geopolitical flashpoints amplified silver’s appeal as both an industrial metal and a defensive asset.

However, the demand outlook is now facing fresh scrutiny. Recent announcements from China’s solar sector have raised legitimate questions about silver’s future role in one of its largest demand engines. LONGi Green Energy has confirmed that it will begin substituting base metals for silver in its solar cell production from the second quarter of 2026, citing cost pressures amid record-high silver prices.

Other major manufacturers, including Jinko Solar and Shanghai Aiko, have signalled similar intentions. While the industry has been working towards efficiency gains for some time, elevated silver prices have clearly accelerated the push toward alternative materials.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

In our view, the pace of silver demand growth from the solar sector is likely to slow, and in certain segments, could even flatten or decline. However, whether or not the industry can find a reliable substitute in base metals to replace silver, without hurting efficiency, is questionable.

Importantly, a slowdown in solar-related demand does not equate to a collapse in overall silver demand. Silver’s industrial footprint is far broader than photovoltaics alone. Electronics, medical applications, automotive systems, and advanced manufacturing continue to absorb substantial volumes.

While some AI and semiconductor manufacturers are exploring copper as a substitute, the silver market should also be wary that the rapid evolution of technology also leaves room for entirely new applications. In that sense, the long-term demand picture remains more dynamic than deterministic.

On the supply side, constraints remain a defining feature of the silver market. Mine production has struggled to respond meaningfully to higher prices, partly because nearly three-quarters of global silver output is produced as a by-product of base metal mining. As a result, supply is relatively inelastic and cannot be scaled up quickly in response to rising demand.

Reports indicate that physical silver is becoming increasingly difficult to source in Singapore as well as across the globe, with demand for physical bars and coins remaining strong despite sharply elevated premiums. Retailers are struggling to secure fresh supplies amid waitlists stretching into multiple months and a tightening market, after silver emerged as a standout performer among commodities in 2025.

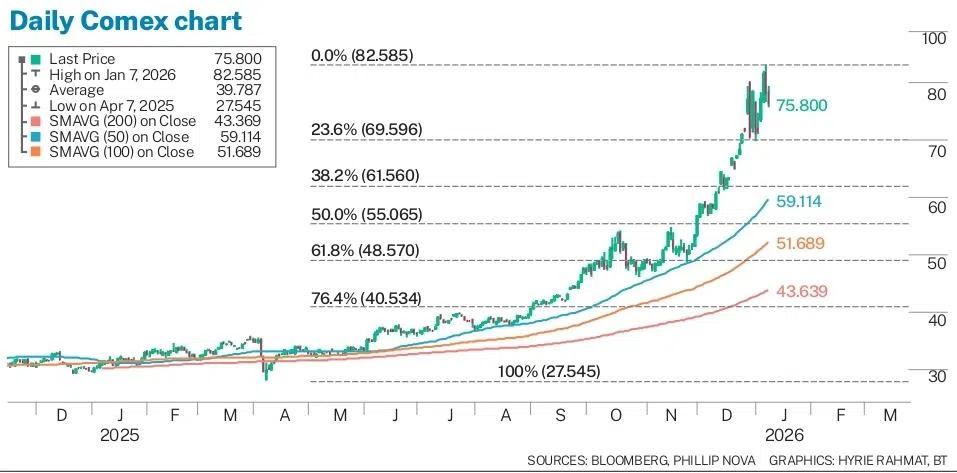

From a technical perspective, silver’s recent surge reflects a decisive breakout from long-term consolidation patterns, supported by strong momentum and volume. While short-term indicators suggest overbought conditions at recent highs, the broader trend remains constructive as long as prices hold above key breakout zones.

On the upside, a potential double-top formation is emerging, and a decisive break above US$85 is needed to stay on course with the bullish trend. If we plot Fibonacci retracement levels on Comex silver futures from the April 2025 lows to the current highs, silver has rebounded precisely to the 23.6 per cent retracement level near US$70 per ounce, which should now act as an immediate support zone.

On the downside, pullbacks toward the 38.2 and 50 per cent Fibonacci levels (a zone between US$62–55 per ounce), which also coincide with the 50- and 100-day moving averages, may offer tactical opportunities. However, volatility is likely to remain elevated as markets digest shifting demand expectations and macro signals.

Looking ahead, investors should monitor three key factors closely: the pace and effectiveness of silver substitution in solar manufacturing, evidence of new industrial demand streams, and ongoing signals from physical markets, where premiums and inventory trends will provide early clues about real-world tightness.

Silver’s narrative is no longer a simple one-way bet, but neither is it losing its structural relevance. Instead, it is evolving into a more complex, two-speed market, where supply struggles to match demand, and price action remains sensitive to both innovation and uncertainty.

The writer is senior market analyst at Phillip Nova

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.