Silver prices have smashed through their all-time high, nearing £80.05 ($109.35) per ounce, as investors flock to the metal amid escalating trade tensions sparked by US President Donald Trump‘s tariff threats.

The surge marks a dramatic escalation in safe-haven demand, with silver up 5% in a single day and nearly 50% over the past month. This comes as gold also hits records above £3,660 ($5,000) per ounce, reflecting broader market unease.

Market Surge Amid Economic Uncertainty

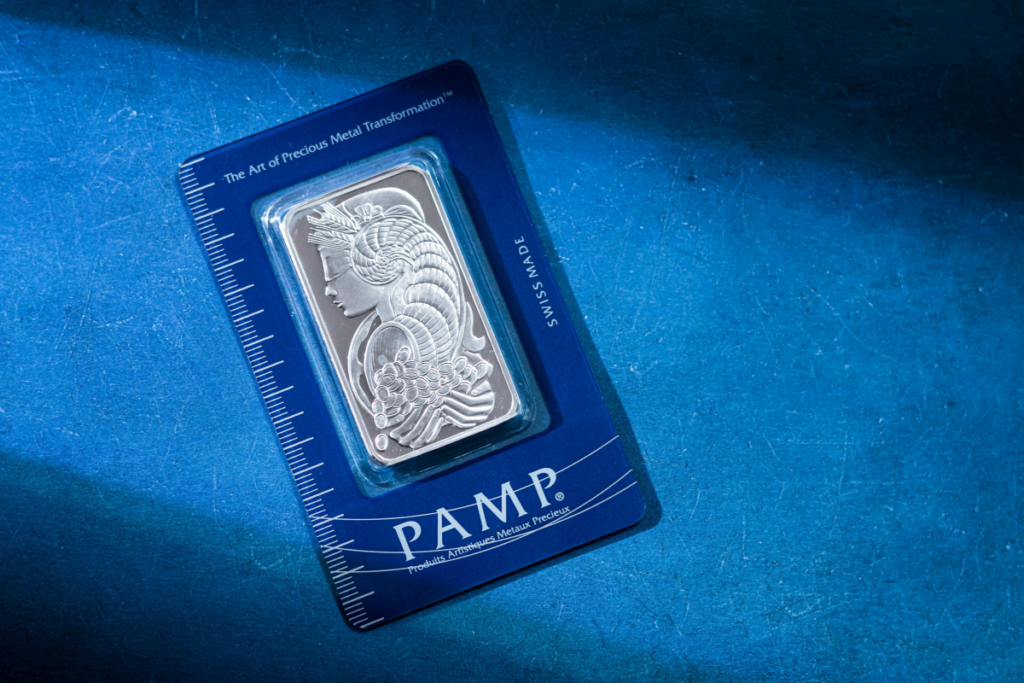

The all-time high for silver has been propelled by a combination of macroeconomic factors and supply constraints. Prices stood at £79.14 ($108.11) per ounce as of 26 January 2026, following a 259% year-over-year gain that outpaces even gold’s impressive rally. Investors are piling in, drawn by silver’s dual role as a precious metal and industrial commodity, with demand from solar panels and electronics adding pressure.

A historic short squeeze has amplified the move, as traders caught wrong-footed scramble to cover positions. Hardly a surprise, given the metal’s volatility in times of stress. Retail buying in China and India has surged, with buyers shifting to larger 1kg bars amid physical shortages.

Meanwhile, a softer US dollar, influenced by Federal Reserve rate cut expectations, has made silver more attractive to international holders. Analysts note this rally echoes 2011’s peak, but with stronger fundamentals today.

Trump’s Tariff Threats Ignite Trade Risks

At the heart of the spike are President Trump’s aggressive tariff announcements, which have rattled global markets. He threatened 100% tariffs on Canada should it proceed with a trade deal with China, a move that could disrupt North American supply chains critical for silver mining.

More broadly, tariffs on eight European nations—including France, Germany, and the UK—over their opposition to US plans for Greenland have heightened geopolitical strains. These threats revive the ‘Sell America‘ trade, prompting investors to seek refuge in metals. Silver, heavily used in green technologies, faces added risks from potential export curbs, as China tightens controls on key minerals.

Silver and platinum are finally catching up to gold. Investors avoided buying those metals as they expected gold to fall. They’ve now accepted that gold’s rally is here to stay. Investors also avoided mining stocks for the same reason. They’re next for an explosive catch-up run.

— Peter Schiff (@PeterSchiff) December 26, 2025

‘Silver and platinum are finally catching up to gold. Investors avoided buying those metals as they expected gold to fall,’ remarked investor Peter Schiff, forecasting further gains. The US-Europe tensions, including disputes over Greenland’s resources, have driven a flight to safety, with silver benefiting from its affordability compared to gold. Stock markets dipped in response, underscoring the wider economic fallout.

Supply and Demand Dynamics Tighten

Prolonged tightness in the physical market underpins the rally, with global silver supply struggling to keep pace. China’s export restrictions are intensifying concerns, potentially leading to shortages in electronics and renewables. Demand from electric vehicles and solar installations is projected to hit records, per industry forecasts.

Citi analysts have updated their outlook, ‘targeting $100 by April’—a level already surpassed amid the frenzy.

Silver just touched $94.61, a 6% vertical rip. The catalyst? Trump’s Greenland tariff threats against 8 EU nations. With safe-haven demand exploding, Citi is now targeting $100 by April.

— ACY Securities (@ACY_Securities) January 20, 2026

On X, user @cdrturtle noted silver ‘going up $109 right now,’ highlighting the rapid ascent driven by bank shorts and dollar erosion.

Silver going up $109 right now, banks caught in major pm shorts. Troubles ahead very soon. Dollar erosion. Perhaps Europe, China, Japan going to increase their dump of t bonds.

— Terry Brown (@cdrturtle) January 26, 2026

As forecasts eye averages between £66 ($90) and £88 ($120) for the year, silver’s momentum shows no immediate signs of easing, though analysts warn of overbought conditions amid ongoing trade uncertainties. The record-breaking silver price as of 26 January 2026 underscores the persistent global risks weighing on markets.