This comes amid geopolitical and potential trade volatility stemming from Donald Trump’s threats of a flat 10% tariff on European countries that object to Greenland’s accession to the US, and who support it.

Trump threatened to impose tariffs on eight European countries that have resisted his plan to purchase Greenland, including France, Germany, and the United Kingdom. Beginning on February 1, the 10% tax will increase to 25% by June. The action increased demand for precious metals.

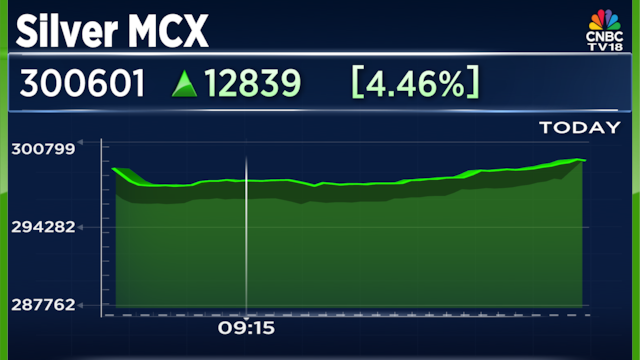

At the time of writing, Silver on MCX stood at ₹3,00,479 per kilogram, with a rise of 12,717 or around 4%.

CLSA On Silver

Speaking on the matter to CNBC-TV18, Laurence Balanco of CLSA said, “You’ve obviously seen the gold and silver recently start to accelerate their advance. Silver, we’ve already accelerated past our upside target, so we’re a bit more cautious on silver here, but still think you can add to the gold setup, looking at $5100 to $5200 on the upside.”

Gold and Aluminium In Focus

He also added that on gold, CLSA has an unmet measured target of $5100 to $5200.

With regard to aluminium, Balanco said that amongst the base metals, aluminium has been one of the key breakouts that we’ve seen there.

Further, he added, “We’re looking at $3500 on the upside, but we have also seen copper break out of the 21 to 2025 trading range, and on the LME copper futures, we’re looking at over $16,000 as an upside target there.”

Furthermore, Balanco also added, “So those will be the metals that we will be focused on playing these breakouts that we’ve seen in the fourth quarter of 2025, and we think will continue through 2026.”

It is not just silver; other precious metals are also on the rise, as spot gold has increased 1.6% to $4,668.76 per ounce, having previously peaked at $4,690.59. Silver reached a high of $94.1213 after rising 3.2% to $93.0211. Palladium and platinum were also rising.

Also Read: Bharat Coking Coal shares nearly double investor wealth on listing; jump 97%