Investor Insight

With assets located in a historic copper mining district in Chile that boasts high-grade mineralization and low-cost operations, Red Metal Resources represents a compelling investment opportunity and lots of potential for increasing shareholder value.

Overview

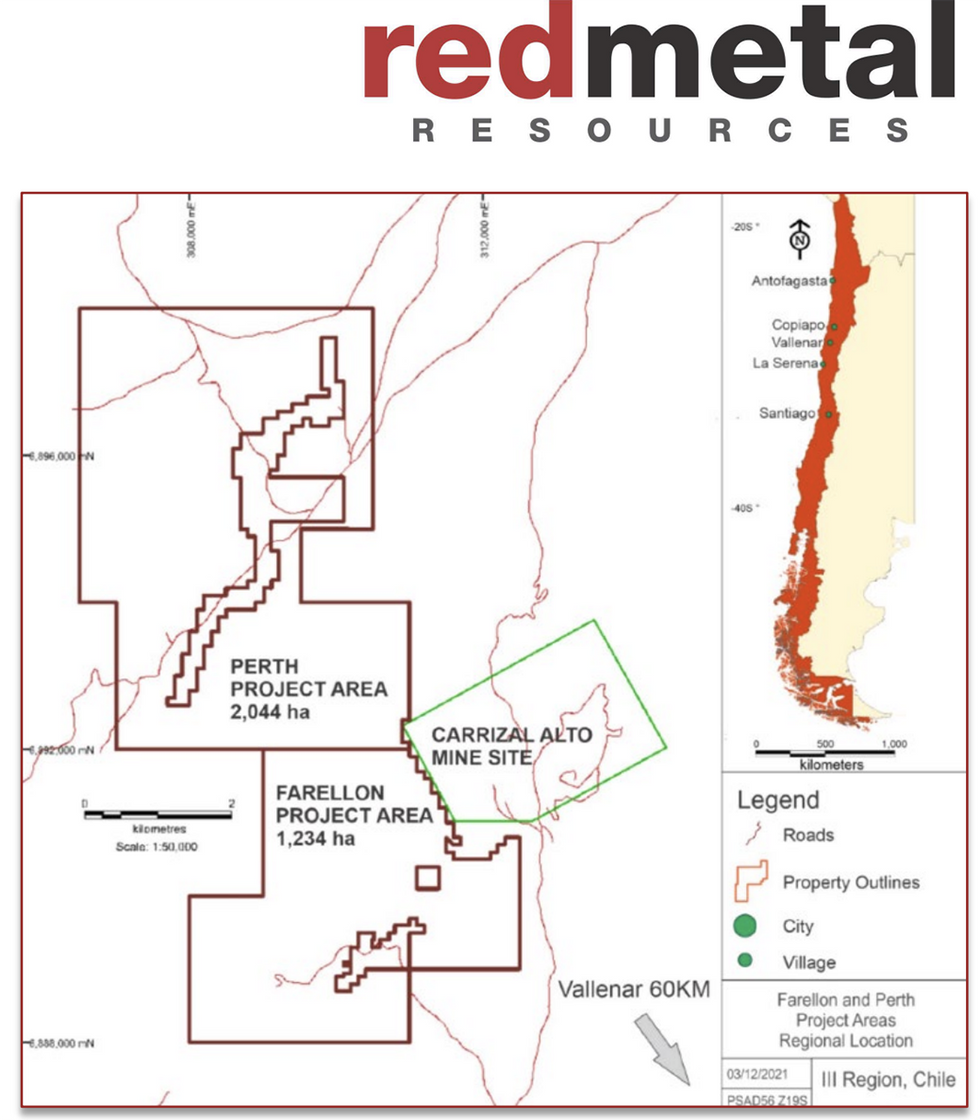

Red Metal Resources (CSE:RMES) is a Canadian-listed junior mining company specializing in copper exploration, with a particular focus on Chile’s Carrizal Alto mining district in the Atacama Region. The company’s exploration targets, mainly the Farellon and Perth projects, are well-positioned to benefit from Chile’s globally significant copper sector.

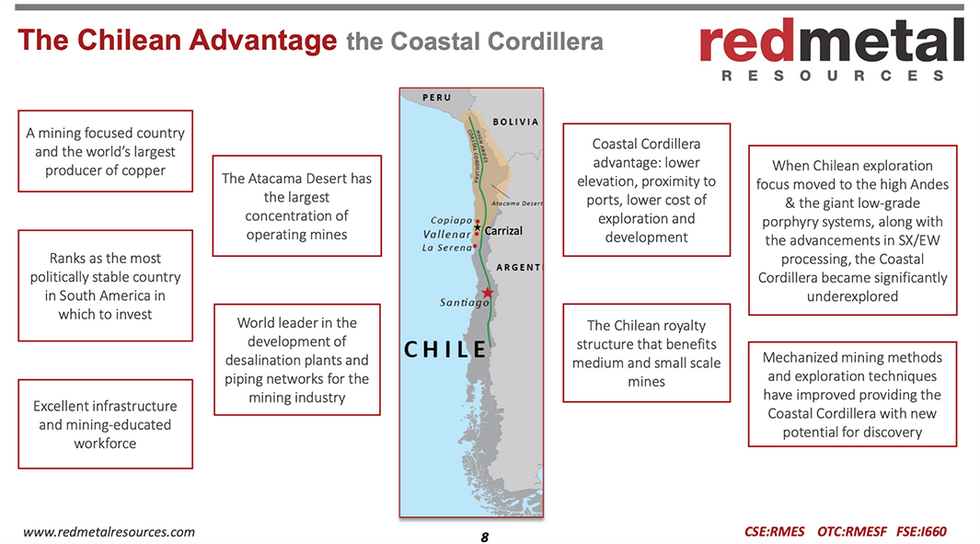

Chile is the largest producer of copper worldwide, accounting for nearly 28 percent of the global supply. Given the country’s favorable mining policies, experienced workforce, and well-established infrastructure, Red Metal Resources is well-placed to leverage these advantages as it advances its projects in this prolific region.

The company’s Carrizal property comprises two key project areas: the Farellon project in the south and the Perth project in the north. The renowned Carrizal Alto mining district has a rich history of copper and gold production dating back to the 19th century. Historically, the district was one of Chile’s most productive copper regions, situated within Chile’s prolific Coastal Cordillera belt, which boasts high-grade copper mineralization and low-elevation, cost-effective operations. Red Metal Resources is working to rejuvenate Carrizal’s legacy by bringing modern exploration techniques to the region’s underexplored deposits.

Red Metal Resources’ management team brings together a blend of technical and business expertise, driving the company toward its goal of contributing to the growing global demand for copper and clean energy transition. The company also benefits from a board of directors and advisors with substantial experience in capital markets, exploration, and the Chilean mining industry. This combination of technical expertise and business acumen is critical for Red Metal Resources as it seeks to advance its projects from exploration to potential production.

Prolific mining district

The Carrizal Alto mining district, located in Chile’s Atacama Desert, is known for its mineral wealth, particularly copper, gold and cobalt. The district’s mining history dates back to the early 19th century when it became one of the most important copper production regions in Chile.

One of the key advantages of the Carrizal Alto district is its favorable geographic position. The area is located at a low elevation of around 500 meters above sea level, which reduces the logistical challenges often associated with exploration in higher-altitude regions. Additionally, the district is well-connected by infrastructure, including highways and proximity to major urban centers. The property is situated just 150 kilometers south of Copiapó, 25 kilometers from the coast, and only 20 kilometers west of the Pan-American Highway. This close access to infrastructure allows for easier transportation of equipment and supplies, as well as streamlined access to labor and other resources.

The Carrizal Alto district offers a blend of historical mining data and modern exploration potential. While the region was heavily mined in the 19th and early 20th centuries, much of the area remains underexplored using modern methods. Today, the district is experiencing a revival, thanks in part to Red Metal Resources’ exploration efforts. The company’s Carrizal property spans 3,278 hectares, comprising 21 secure mining claims, and comprises two projects: Farellon and Perth.

Company Highlights

- Red Metal Resources holds 3,278 hectares across 21 secure mining claims within the Carrizal Alto mining district in the prolific Coastal Cordillera.

- The company’s Carrizal property comprises two projects – Farellon and Perth – located in an area with a rich history of copper and gold production.

- The Farellon project has over 9,000 metres of drilling, identifying 1.5 kilometres of mineralized strike length with potential for an additional 3.5 kilometres.

- In 2022, a high-grade surface sample from Farellon returned 5.77 percent copper, 1.55 percent cobalt, and 0.11 g/t gold.

- Management and insiders control approximately 35 percent of the company’s shares, aligning their interests with investors.

Key Project

Farellon Copper Project

The Farellon project is Red Metal Resources’ flagship asset, located in the southern portion of the Carrizal Alto mining district. The project is a high-grade iron-oxide-copper-gold vein deposit that has been the focus of much of the company’s exploration activities. The mineralization at Farellon is primarily hosted in quartz-calcite veins that contain chalcopyrite, bornite and chalcocite sulphide mineralization. These veins range from 3 to 6 meters in width, with a halo of lower-grade mineralization extending 15 to 20 meters around the veins.

Farellon is located adjacent to the historic Carrizal Alto mine, one of Chile’s most prolific copper mines during the 19th century. The mineralized veins on the Farellon property are believed to be part of the same geological structure that hosted the mineralization at the Carrizal Alto mine. Historical mining in the area provides valuable insights into the region’s geology, which Red Metal Resources is leveraging to guide its exploration strategy.

To date, the company has completed over 9,000 meters of drilling at Farellon, identifying a mineralized strike length of approximately 1.5 kilometers. The mineralization remains open along strike for an additional 3.5 kilometers, and at depth, indicating significant exploration upside. In 2022, the company completed a 2,010-meter diamond drilling program that extended the known mineralization at depth and identified a parallel structure, the Gorda Vein, which adds further exploration potential.

Recent surface geochemistry work has also highlighted several new targets for follow-up sampling and drilling. One high-grade sample, taken 2 kilometers north of the Farellon drilling, returned values of 5.77 percent copper, 1.55 percent cobalt, and 0.11 grams per ton (g/t) gold, further underscoring the potential for additional high-grade mineralization on the property. These exploration results position Farellon as a highly prospective project with the potential to develop into a significant copper-gold-cobalt resource.

Perth Project

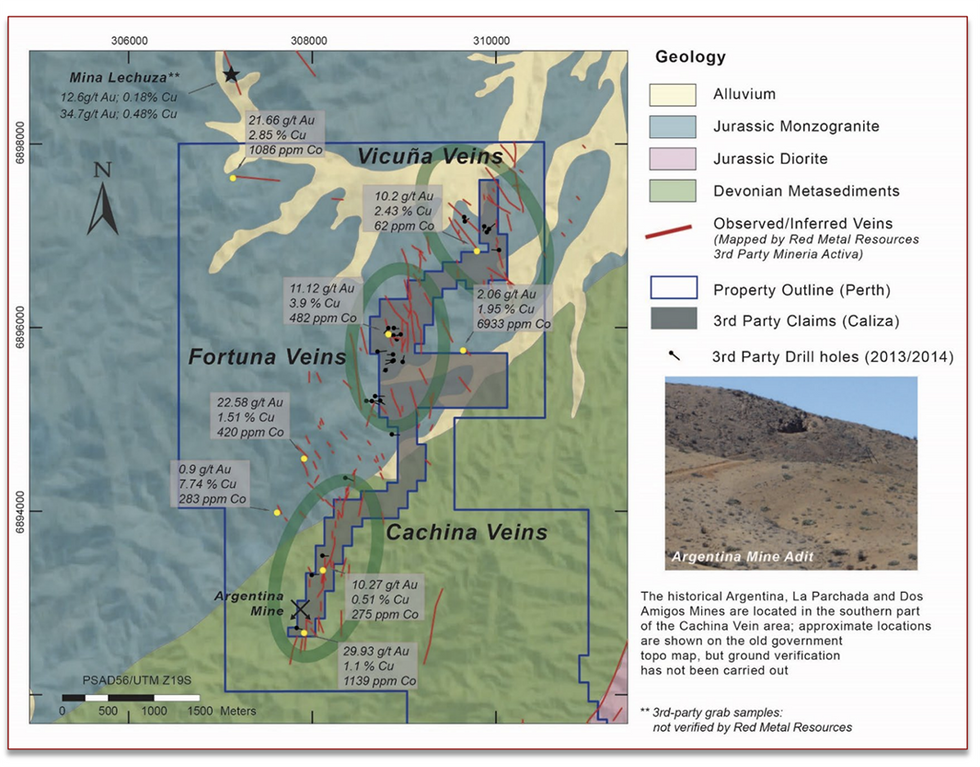

The Perth project, located in the northern portion of the Carrizal Alto district, is Red Metal Resources’ second major exploration asset. The project holds considerable potential for copper-gold-cobalt mineralization. Perth is characterized by fault-related quartz veins that have been mapped and sampled across the property. Historical prospecting and mapping programs have identified 12 veins, with an average thickness of 2 meters and some zones reaching up to 6 meters in width.

Exploration at Perth has yielded promising results, with 48 surface samples returning gold values greater than 1 g/t, 46 samples returning copper grades exceeding 1 percent, and 19 samples showing cobalt values above 0.05 percent. These early-stage exploration results are encouraging and suggest that the Perth project has the potential to host significant copper-gold-cobalt mineralization.

Red Metal Resources plans to conduct additional exploration at Perth to better understand the extent of the mineralization and to prioritize drill targets for future campaigns. While the project is at an earlier stage compared to Farellon, it offers an important opportunity for the company to expand its resource base within the Carrizal Alto District.

Management Team

Caitlin Jeffs – President and CEO

Caitlin Jeffs is a founding partner of Fladgate Exploration Consulting in Thunder Bay, Ontario, the largest, full service, mineral exploration consulting firm in Northwestern Ontario. She has over 20 years of mineral exploration experience in gold and base metal exploration with junior and major resource companies, including Placer Dome and Goldcorp. Jeffs is also a director of Kesselrun Resources and TomaGold.

John Da Costa – CFO

John Da Costa has 30 years of accounting experience managing and reporting for Canadian public companies, and 10 years with US public companies. He worked with a Canadian public company operating in Chile in the late 1990s and has experience with Chilean subsidiaries. He is the founder and president of Da Costa Management, providing management and accounting services to both public and private companies in the US and Canada since 2003.

Brian Gusko – VP Finance

Brian Gusko has an MBA from the University of Calgary and attended the European Summer School of Advanced Management. Gusko has over 15 years’ experience in capital markets and has helped raise over $75 million for various enterprises. He has served on the board and as chief financial officer of various private and public companies. Gusko has assisted with the interlisting of more than 10 companies on the Frankfurt Stock Exchange and has helped numerous companies access German capital markets. He has worked as chief financial officer at several private and public companies. The last company he helped take public on the CSE had a market capitalization of over $200 million at the time of listing.

Michael Thompson – VP Exploration and Director

Michael Thompson received his Honours B.Sc. in Geology from the University of Toronto in 1997, and has since worked for several junior and major companies in both gold and base metal exploration, including Teck Cominco, Tri Origin Exploration, Placer Dome CLA, and Goldcorp. He specializes in structural interpretation of gold deposits as well as management of large exploration programs. He is a founding partner and 33 percent owner of Fladgate Exploration Consulting in Thunder Bay, Ontario.

Marian Myers – Project Manager and Director

Marian Myers has an M.Sc (Geology) from the University of the Witwatersrand, South Africa, and has 35 years’ experience working for a wide array of major and junior mining companies including Gold Fields, Anglo American, AngloGold, Balmoral Resources and Cardero Resource. Myer’s breadth of international experience has taken her from her home town near Johannesburg, South Africa to work on projects in Ghana, Zimbabwe, Australia, Alaska, Peru, Chile and now, Canada, where she resides in Vancouver. She specializes in the GIS integration of geochemical, geophysical and geological information, including historical data sets with expertise in QA/QC procedures, field data collection supervision, and assessment and technical report development.

Cody McFarlane – Director

Based in Santiago, Chile, Cody McFarlane is managing partner of Axiom Legal, an international and multidisciplinary law firm specializing in cross border transactions between Australia, Canada and Latin America. McFarlane brings extensive experience in the mining and regulatory environment in Chile.