Stock image.

Robust investment demand for silver, its inclusion on the US critical minerals list, and a wave of momentum buying have propelled the white metal to a fresh record high, setting prices up to close out 2025 at more than double the level at which they began.

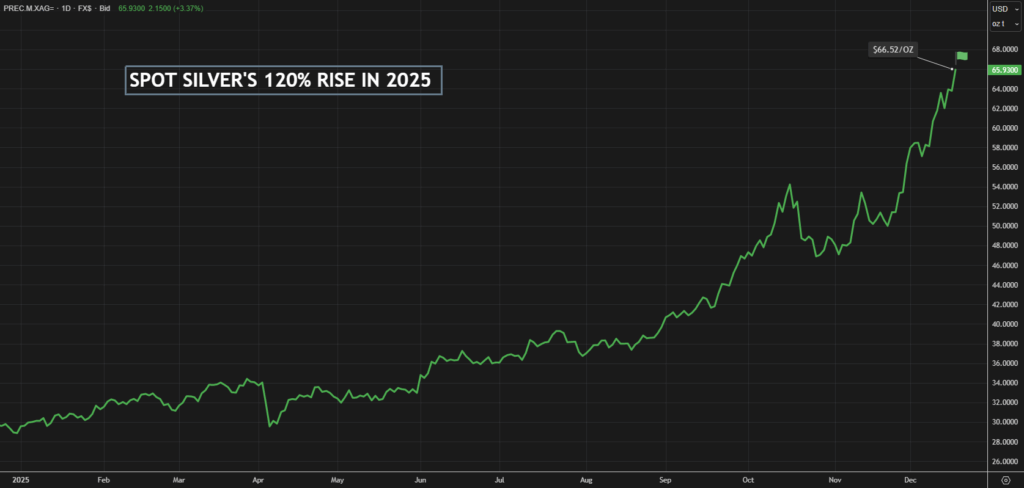

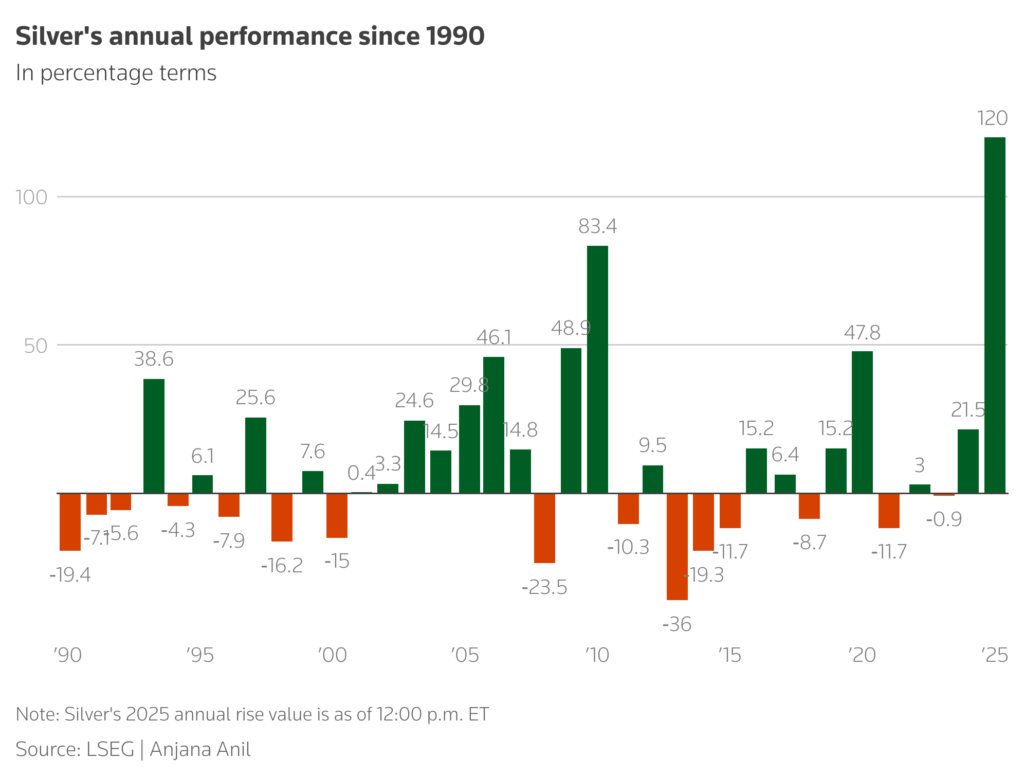

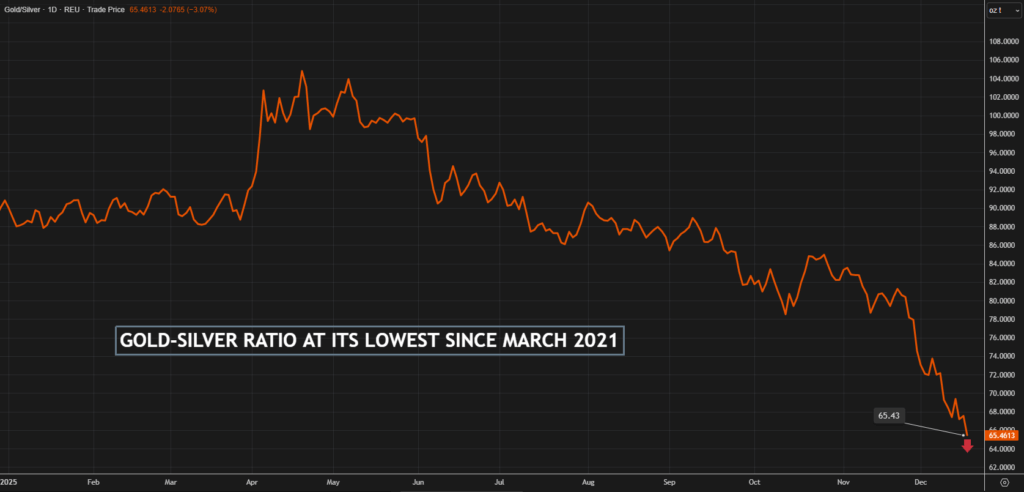

Silver, which surpassed the $65 per ounce threshold for the first time on Wednesday, has gained more than 120% this year and is poised for its best annual performance on record per LSEG data, which dates back to 1982. The metal is outperforming safe-haven gold, which is on track to climb 64% in 2025.

Spot prices hit a record high of $66.87/oz on Wednesday.

“(The rally) is very much investment-driven at the moment. It’s got that strong fundamental background behind it … but these prices are being driven by investment and by speculation,” said Rhona O’Connell, head of market analysis at StoneX.

Silver’s robust fundamental backdrop includes a persistent supply deficit, and healthy demand prospects from the artificial intelligence data center, solar cell and electric vehicle industries.

The metal also benefits from the same macroeconomic factors supporting gold, as well as safe-haven flows due to geopolitical and trade tensions.

Looking ahead, these factors, as well as less plentiful inventories outside the US, create “quite a supportive environment,” said Nitesh Shah, commodities strategist at WisdomTree.

“Silver prices could gain to something close to $75/oz for the end of next year,” he added.

The metal’s inclusion on the US critical minerals list has also supported prices. Concerns that silver could be hit by tariffs prompted a wave of outflows to the US earlier this year, leading to tight liquidity in the London spot market.

Demand from India and China, coupled with momentum buying, have added to this perfect storm for the metal, analysts said.

“When there is a strong price performance, this really lures Chinese traders into the market, as evidenced by increasing trading volumes and increasing open interest on the exchanges,” said Julius Baer analyst Carsten Menke.

Some analysts remain bullish on silver, expecting the metal to break the $70/oz milestone next year, especially if US interest rate cuts support the appetite for precious metals.

However, others cautioned that the historically volatile metal remains vulnerable to steep corrections, especially in correlation to gold.

“If gold moves in either direction by x%, one should expect silver to move in the same direction by 2x% or 2.5x% because it’s a smaller market, it’s more volatile,” said O’Connell.

(By Kavya Balaraman, Noel John and Arunima Kumar; Editing by Rod Nickel)