The short answer is no, well, not yet, at least. There’s little to no chance that bitcoin will fully replace gold in 2025. But the fact is that the crypto king is gaining ground, challenging gold’s dominance. Yet, gold’s historical reliability and bitcoin’s volatility keep this debate alive.

To fully understand whether or not bitcoin can replace gold as a safe-haven asset, it’s essential to look beyond historical performance and volatility as standalone factors. Gold’s long history has built investor trust due to its resilience during crises, but bitcoin’s emerging narrative revolves around technological innovation and institutional adoption. However, volatility remains a key challenge for bitcoin. Sharp price swings raise questions about its reliability as a haven, especially when investors seek stability during uncertain times.

With this in mind, can it truly match the proven resilience of gold, or will it simply redefine what modern investors consider a store of value?

Market dynamics and volatility: Why they matter for safe-haven status

To understand whether bitcoin can replace gold as a haven, we must look at historical performance and volatility, but not as isolated concepts. Together, they tell the story of trust and resilience.

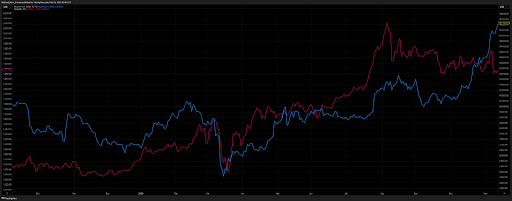

Gold’s long-standing status as a haven stems from its performance during global crises. During the 2008 financial meltdown, gold prices surged as investors sought protection from collapsing markets. During the COVID-19 pandemic, for example, gold hit an all-time high of around 2,070 USD per ounce, reinforcing its role as a stabilizer.

Bitcoin’s story is more volatile. In March 2020, it plunged nearly 50% in a single day amid market panic, while gold steadily increased. Yet, bitcoin’s rapid recovery afterward shows its growing resilience. In 2021, it reached nearly 69,000 USD, boosted by institutional adoption. However, it faced a sharp decline in 2022 due to tightening global monetary policies. This ability to rebound suggests bitcoin’s long-term potential.

Why does this matter? Havens need to offer consistency during downturns. Gold’s slower and more predictable price movements provide this assurance. Bitcoin’s sharp swings, however, make investors cautious. That said, as big players enter the bitcoin market, volatility could ease—potentially paving the way for bitcoin to claim its place as a digital haven.

Safe-haven potential: Can Bitcoin truly replace Gold?

Gold’s status as a haven comes from its ability to store value consistently, especially during crises. For bitcoin to earn the same level of trust, it must prove it can hold value when markets turn volatile. So far, bitcoin has been reactive—mirroring risk assets more than acting as a hedge. Its correlation with equities during market downturns raises questions about its safe-haven potential.

However, bitcoin’s fixed supply of 21 million coins sets it apart. Unlike fiat currencies, which can be devalued through excessive printing, bitcoin offers protection against inflation—a trait that aligns with gold. As institutional adoption continues, bitcoin’s volatility could decrease, making it a more stable store of value.

Technology vs. tradition: What sets bitcoin and gold apart?

At their core, both represent two different eras of value storage:

- Gold: Tangible, requires physical storage, universally accepted, and historically proven.

- Bitcoin: Digital, decentralized, and allows seamless global transactions but faces regulatory risks and remains vulnerable to technological shifts.

While gold’s tangibility reassures traditional investors, bitcoin’s digital nature appeals to those looking for borderless, efficient value transfers. The future might not be about one replacing the other but how they complement each other in diversified portfolios.

What lies ahead in 2025?

Bitcoin’s performance depends largely on regulatory clarity, institutional adoption, and broader market sentiment. If bitcoin continues along its traditional cycle—two years bearish, four years bullish—2025 could mark another period of growth, potentially strengthening its safe-haven narrative.

Gold, however, will likely remain a cornerstone of stability. Its reputation as a crisis hedge is challenging to replace. As central banks continue to hold gold reserves, the precious metal’s dominance as a haven seems secure.

Trading bitcoin and gold with confidence

Whether bitcoin will replace gold as the ultimate haven remains uncertain. However, one thing is clear: both assets offer unique opportunities. Bitcoin’s growth trajectory might not dethrone gold anytime soon, but it is carving out its own space in the market.

For traders, the question isn’t just about which asset will win the safe-haven title—but how to capitalize on both. With both assets playing crucial roles, traders need a flexible and efficient platform. As one of the world’s largest retail brokers, Exness ensures traders can access these markets with better-than-market conditions, including the tightest and most stable spreads* for gold and Bitcoin CFDs on the market, even during high volatility regardless of trade size. Traders also can benefit from Exness’ swap-free trading, something especially popular among those holding crypto positions overnight.