Gold bulls renewed their dominance over the precious metal’s price driving it to new record high levels. In today’s report we are to have a look at the market uncertainty underpinning the rise of gold’s price as well as geopolitical uncertainties and the upcoming Fed interest rate decision. For a rounder view we intend to conclude the report with a technical analysis of gold’s daily chart.

US-led market uncertainties underpinning the upward movement of Gold’s price

There is a wide range of market uncertainties stemming mostly from the US that tend to underpin the rise of gold’s price. Firstly we note that the weakening of the USD yesterday and during today’s Asian session which as per some analysts may have sparked the strengthening of gold’s price. We do not underestimate the possibility of the negative correlation of the two trading instruments, USD and gold, resurfacing, yet for the time being the overall picture seems to be blurry and we would require clearer diverging movement to adopt it, a scenario that could play out in the coming days. Also the uncertainty for the US economic outlook tends to be a factor increasing demand for the precious metal, thus creating safe haven inflows. It’s characteristic that the Atlanta Fed GDP rate for Q1 25, seems to improve since hitting a low point at 2.8% at the beginning of the month yet remains in contractionary territory. Should the market worries for the US economic outlook intensify, we may see gold’s price gaining further ground. Lastly we would also note, the ever-present trade wars, which tend to shed further uncertainty not only for the US but also for the global economic outlook. It’s characteristic how OECD has slashed its forecasts for growth in the economies of Canada and Mexico, which are primarily being affected by the Trump’s tariffs. We also note the tariffs imposed on European products entering the US and expect the issue to widen and intensify further before cooling off, a scenario that may in turn intensify market worries and also provide safe haven inflows for the shiny metal.

Fed expected to remain on hold, but will it remain hawkish?

On a monetary level, we highlight the Fed’s interest rate decision tomorrow as gold’s next big test. Fed Fund Futures (FFF) currently imply that the market expects the bank to remain on hold in tomorrow’s meeting providing a probability of 99% for such a scenario to materialise, thus rendering theinterest rate part of the decision as an open and shut case. Yet FFF also imply that the market has a more dovish orientation as it expects the bank to deliver another two rate cuts by the end of the year. Hence the next big question for gold traders, is to be the bank’s forward guidance, which is to be split in four elements, the accompanying statement, Fed Chairman Powell’s press conference, the new dot plot and the bank’s projections for the US economy. For the time being the bank is caught between conflicting fundamentals as on the one hand US inflation and the US employment market are easing implying that further easing of its monetary policy is advisable, yet on the other hand Trump’s tariffs and immigration policies could have an inflationary effect on the US economy before the end of the year. Should the bank maintain a hawkish stance taking the markets by surprise, gold’s price could come under pressure, while a more dovish inclination by the bank may allow the market’s expectations for more rate cuts to come to intensify thus supporting gold’s price.

Geopolitical tensions in the Middle East support Gold’s price

On a geopolitical level, we highlight the restart of military operations and especially Israeli airstrikes on Gaza as a possible factor attributing to the rise of golds’ price. Yesterday’s bombings left hundreds of dead and seem to have in effect cancelled the ceasefire agreement between Israel and Hamas. The latest bombings could cause Hamas to retaliate. For the time being, we see the case for the conflict to intensify a development that could enhance uncertainty in the area. Similarly the recent Houthi attacks against on a British oil tanker and the USS Harry S Truman aircraft carrier and its accompanying warships in the northern Red Sea are to intensify uncertainty in the area. We expect the US to intensify its air raids against Houthi positions at the current stage a development that targets primarily the international oil market, causing black gold’s price to rise, yet at the same time may also bring about more safe haven inflows for the precious metal.

Technical analysis

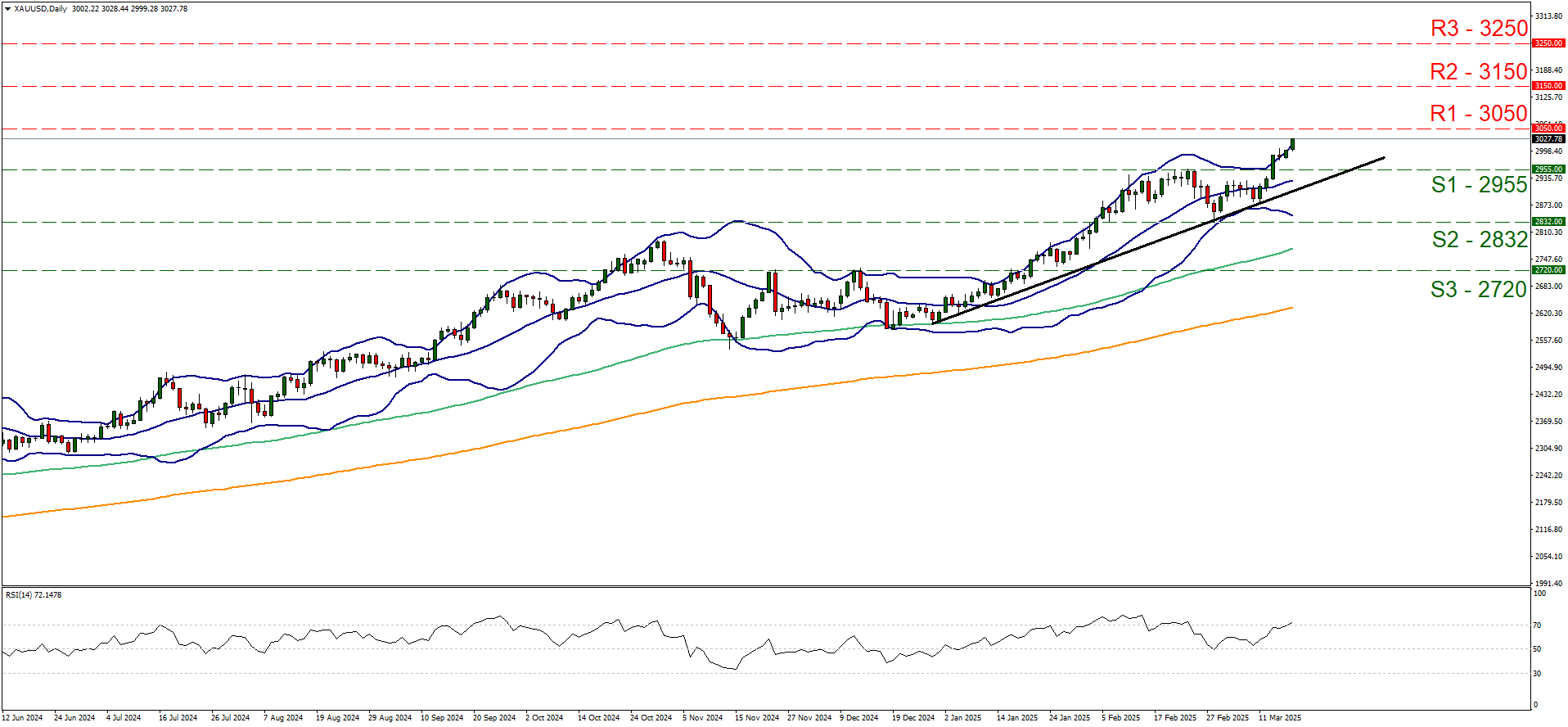

XAU/USD daily chart

-

Support: 2955 (S1), 2832 (S2),2720 (S3).

-

Resistance: 3050 (R1), 3150 (R2), 3250(R3).

Ona technical level since our last report, Gold’s price was able to break the 2955 (S1) resistance line, now turned to support. Gold’s price has not formed new higher highs by surpassing $3000 per Troy ounce and reaching new record high levels. As the upper boundary of the precious metal’s sideways motion has been broken, we abandon our bias for a sideways direction and renew our bullish outlook. We shift the upward trendline guiding the gold’s price since the end of the past year to the right and intend to maintain our bullish outlook as long as it remains intact. We also note that the RSI indicator is currently testing the reading of 70 implying a strong bullish market sentiment for the shiny metal, yet at the same time may imply that gold’s price may have reached overbought levels and may be ripe for a correction lower. Also the price action has reached and even slightly breached above the upper Bollinger band in another signal of a possible correction lower or a possible slow-down of the bulls. Should the bulls maintain control over gold’s price as expected, we set as the next possible target for the bulls the 3050 (R1) resistance line. On the flip side, a bearish outlook seems currently remote and for its adoption we would require gold’s price to reverse direction, break the 2955 (S1) support line, continue to break the prementioned upward trendline, in a first signal that the upward movement has been interrupted and continue even lower to break the 2832 (S2) support level, paving the way for the 2720 (S3) support barrier.