Fund managers from BlackRock, Rathbones, Royal London and more reassess gold after recent volatility, with views diverging on positioning.

A volatile start to 2026 has punctured gold’s extraordinary ascent, with questions raised as to whether the correction has further to run.

Long considered a reliable safe haven asset, gold tends to hold its value when markets, currencies or governments come under pressure, making it a favoured hedge during periods of economic or political uncertainty.

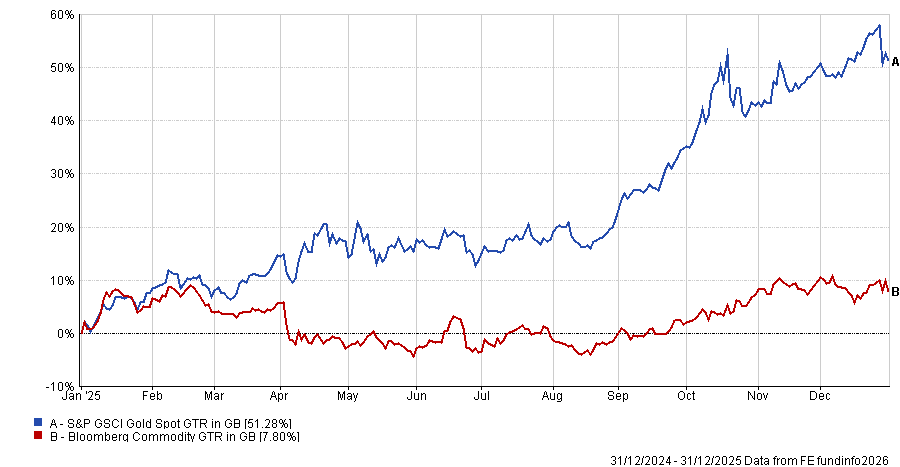

That reputation was firmly reinforced in 2025, with heavy central bank buying, interest rate cuts, currency weakness and persistent geopolitical tension propelling the metal more than 60% higher over the year, vastly outperforming most commodity peers.

Gold price performance vs commodities in 2025

Source: FE Analytics

Going into 2026, it seemed like nothing was going to halt gold’s meteoric rise as it surged past the $5,000 barrier, with the world stage beset by ongoing geopolitical tension – from the US military operation to capture Venezuelan president Nicolás Maduro, to escalating unrest in Iran and renewed tensions over US ambitions in Greenland.

But that momentum abruptly reversed on 31 January 2026 due to a shift in market sentiment largely driven by US president Donald Trump’s nomination of the hawkish Kevin Warsh as the next Federal Reserve chair.

Gold prices fell more than 9% to under $5,000 per ounce in one day, while silver slumped by 15% to around $72 an ounce. Some funds lost more than 15% in the sell-off.

The yellow metal has since found firmer footing, as a sudden tech sector sell‑off triggered by artificial intelligence (AI) related disruption fears pushed investors back into safe-haven assets.

As of 5 February, the gold price was sitting at around $4,800 per ounce – $500 higher than at the start of the year.

Despite the brief recovery, the key question for investors is whether this turmoil marks the start of a sustained correction or simply a brief reset. Below, Trustnet asked fund managers how they are positioning their portfolios in response.

Alastair Laing – Capital Gearing Trust

Alastair Laing, chief executive and co-manager of the £789.4m Capital Gearing Trust, said this period of sharp correction is “unsurprising”.

“It remains unclear whether this retrenchment is a consolidation in a bull market or the start of a bear market,” he said.

“However, the recent extreme weakness in cryptocurrency markets illustrates that once a momentum market does go into reverse, the losses can be sudden and significant.”

He noted that retail investors are driving much of the pricing, making it difficult to understand the demand drivers.

“This illustrates both the attractions and issues with gold and silver as a store of wealth, as it has no fundamental value pricing and is just a matter of faith rather than analysis,” he said.

Laing added that history is “replete” with examples of stores of wealth that have largely lost their worth, citing defaulted bonds, tulip bulbs, cowrie shells and bolts of silk as examples.

Capital Gearing Trust has a very low weighting in gold – around 1% – and no allocation to silver. Laing said the volatility of gold precludes a more meaningful weighting in a more conservative portfolio but that it can nonetheless be a valuable addition in small size.

Trevor Greetham – Royal London Asset Management

Trevor Greetham, head of multi-asset at Royal London Asset Management, said his multi-asset funds went long on gold in 2025 – a decision which proved to be their “most profitable tactical trade” over the year.

He nonetheless agreed that a price correction was due, noting they “took profits” during the early part of the sell-off.

“As hot money leaves the asset class, we expect gold’s role as a geopolitical hedge to reassert itself,” Greetham said. “We are now waiting for volatility to die down before reassessing.”

In the longer term, he said possible triggers for the gold price weakening include if Trump loses control of Congress in November’s mid-term elections, as this would constrain his future actions.

“It seems unlikely things will quieten down in the meantime,” he said.

David Coombs and Will McIntosh-Whyte – Rathbones

David Coombs, head of multi-asset investments at Rathbones, said he views gold primarily as a diversifier that can behave differently from equities and bonds during times of financial market stress.

“Arguably, it is less attractive when yields on sovereign debt are high, which is why the scale of the moves in 2025 were a surprise to us,” he said.

Will McIntosh-Whyte, co-manager of the Rathbone multi-asset portfolios, added that they have designed a structure that gives their multi-asset portfolios exposure to the gold price while providing some protection on the downside.

“Specifically, it is a five-year product which will give us an upside on gold, but the return is essentially capped at a 15% annual return,” he said. “Should the gold price crack like it has, the product has capital protection.”

Looking ahead over the course of 2026, McIntosh-Whyte said that Fed chair nominee Warsh’s “inflation hawk” status may be evolving.

“Warsh has more recently argued that productivity gains from AI and deregulation will act as a natural disinflationary force, aligning him more closely with the [Trump] administration’s push for significantly lower interest rates,” he said.

This, paired with ongoing geopolitical uncertainty, means gold “is likely to consolidate and remain a core diversifier for investors”, according to McIntosh-Whyte.

George Cotton – J. Safra Sarasin

For George Cotton, portfolio manager of the JSS Transition Enhanced Commodities fund, the situation is symptomatic of previous commodity bull cycles.

“In these cycles, bull markets tended to gradually rotate between different sectors and segments, with precious metals typically reacting to monetary policy before concrete policy actions were implemented,” he said.

Cotton said he aims to emphasise the benefits of diversification and rebalancing in his strategies, recycling gains from winners back into “neglected parts of the commodity space”.

Hakan Kaya – Neuberger Berman

Hakan Kaya, commodities portfolio manager at Neuberger Berman, also said the gold sell-off is “better understood as a volatility event rather than a change in direction”.

“This kind of air pocket feels unsettling, but it is typical of structural bull markets and not a sign that they have ended,” he said.

Kaya said the underlying regime has not changed, as there is no evidence that central banks have changed their strategic gold accumulation behaviour, that geopolitical risk has disappeared or that fiscal pressures have eased.

“Gold remains a monetary asset first and a trade second, and that distinction matters when markets become disorderly because, when liquidity dries up and paper positions are flushed out, gold is ultimately anchored by central banks, sovereign reserves and long-term holders who are less price sensitive than financial traders,” Kaya said.

Evy Hambro – BlackRock

Evy Hambro, co-manager of the BlackRock World Mining Trust, said that, as a medium to long-term investor, he typically tries to look through short-term moves.

Even if gold and silver prices are flat through the rest of 2026, average daily prices this year will still be up around 36% and 104% respectively for gold and silver compared to 2025, he noted.

The BlackRock World Mining Trust was positive on gold, silver and related equities throughout 2025. Hambro said it was the trust’s largest sub-sector exposure and “had a meaningful positive impact on portfolio returns”.

He said he still prefers precious metals over fiat currencies over the long-term and expects the government debt issue to get worse in the coming years, adding there is “further room to run for the currency aversion trade”.

“Gold remains our largest sub-sector exposure at around 39% and we are overweight versus our reference index, reflecting our conviction in gold producers’ delivering free cashflow for growth,” he said, adding they currently have no plans to trim gold exposure in the trust.