Global central banks have been ramping up their gold reserves at an unprecedented pace. Since 2022, this trend has only accelerated, with gold holdings now surpassing the share of euros in global reserves, while the dollar’s dominance steadily declines.

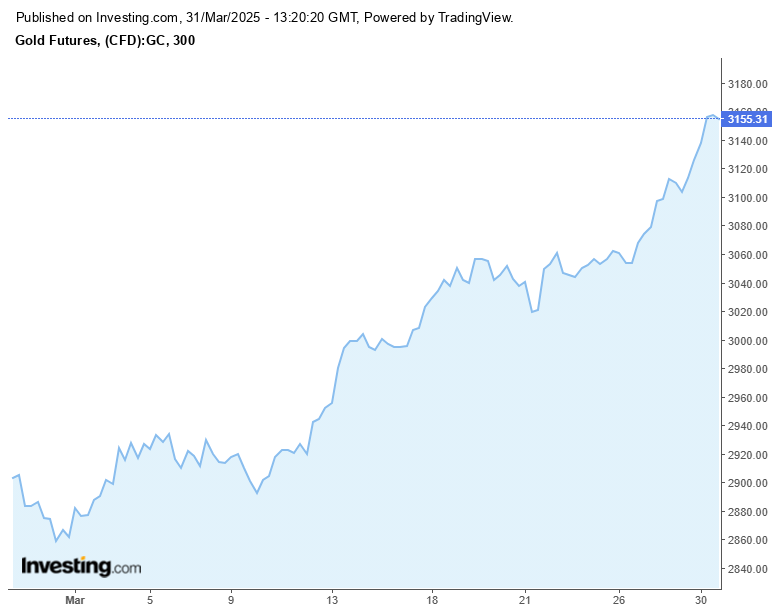

Meanwhile, have reached record highs, breaking the $3,100 mark. With this surge, a question arises: Could gold eventually replace the as the world’s primary reserve asset?

Why Is Gold Breaking New Records?

Gold has long been regarded as a “safe haven” asset, particularly during times of economic uncertainty. When market volatility increases, demand for gold rises as investors seek security beyond traditional equities and bonds.

Recently, a combination of geopolitical tensions, financial market fluctuations, and concerns over a potential U.S. recession have further fueled gold’s rally. The prospect of an economic slowdown in the U.S. is a major driver behind this trend as investors look to hedge against risks.

Another key factor is the shifting monetary policies of major central banks. Despite attempts to maintain a conservative stance, the trajectory toward lower has already begun. While the pace of rate cuts may vary, the long-term trend suggests that lower rates are inevitable. Historically, a low-rate environment benefits gold, making it an attractive alternative to yield-based assets.

As a result, gold’s role as a protective asset continues to strengthen, reinforcing its upward trajectory.

Is Gold Really Replacing the Dollar in Reserves?

Despite the impressive accumulation of gold reserves worldwide, it is premature to claim that gold is outright replacing the dollar. The shift appears more nuanced: a temporary decline in the dollar’s appeal rather than a direct substitution.

A major catalyst in this shift will be the monetary policy.

When the Fed lowers interest rates, it reduces the attractiveness of the U.S. dollar. Higher rates typically support the dollar by attracting foreign capital, while lower rates have the opposite effect, potentially driving investors toward alternative assets like gold.

Additionally, global trade dynamics are changing. More countries are conducting transactions in alternative currencies such as the and , reducing their reliance on the U.S. dollar. According to the World Gold Council, several nations, including China and India, are actively increasing their gold reserves to diversify away from the dollar’s dominance.

Currently, central banks worldwide hold an average of 10% of their reserves in gold, but forecasts suggest this could rise to over 30% in the coming years. Such a shift would provide ongoing support for gold prices.

However, while these trends signal a diversification away from the dollar, the U.S. currency remains the dominant force in global trade and finance. A complete replacement of the dollar by gold is highly unlikely in the foreseeable future.

Where Are Gold Prices Headed?

Looking ahead, one thing is clear: the current rally in gold prices is not just a short-term phenomenon- it marks a structural shift. The price of gold is expected to continue rising, reaching new record highs.

The $3,000 level, once seen as a psychological barrier, has now become a solid foundation for further growth. Analysts who previously forecast gold at $3,100 by year-end are now adjusting their projections higher. For instance, Goldman Sachs estimates gold could reach $3,300 by the end of 2025.

While short-term volatility and corrections are always possible, the broader trend indicates that gold is entering a new phase of sustained strength- one that could define global financial markets for years to come.