(Bloomberg) — China saw an explosive surge in gold trading last week as the metal hit successive records and Sino-US trade tensions rose.

Most Read from Bloomberg

The Shanghai Futures Exchange saw trading volumes of the precious metal hit the highest level in a year last week. That was thanks to investors and industry players — refineries, traders and retailers — that have ramped up hedging activities as global markets gyrate in response to trade policy changes in the US and China.

Demand for gold is strengthening, with investors seeking safety as a new trade war unfolds between the world’s top two economies. The precious metal could reach $4,000 an ounce next year — about 25% above current levels — amid a wave of purchasing by central banks and recession risks, according to Goldman Sachs Group Inc.

The buying frenzy in China has seen prices move to a premium of around $20 an ounce over international prices, reversing a discount it saw for the majority of the past year when domestic demand was weak, according to Bloomberg calculations.

The country’s central bank added around 2.8 tons in March, the fifth monthly addition in a row, and heightened global tensions may spur more bullion purchases. In 2019, the People’s Bank of China added more than 100 tons of gold in reserves after relations with the US worsened during US President Donald Trump’s first term.

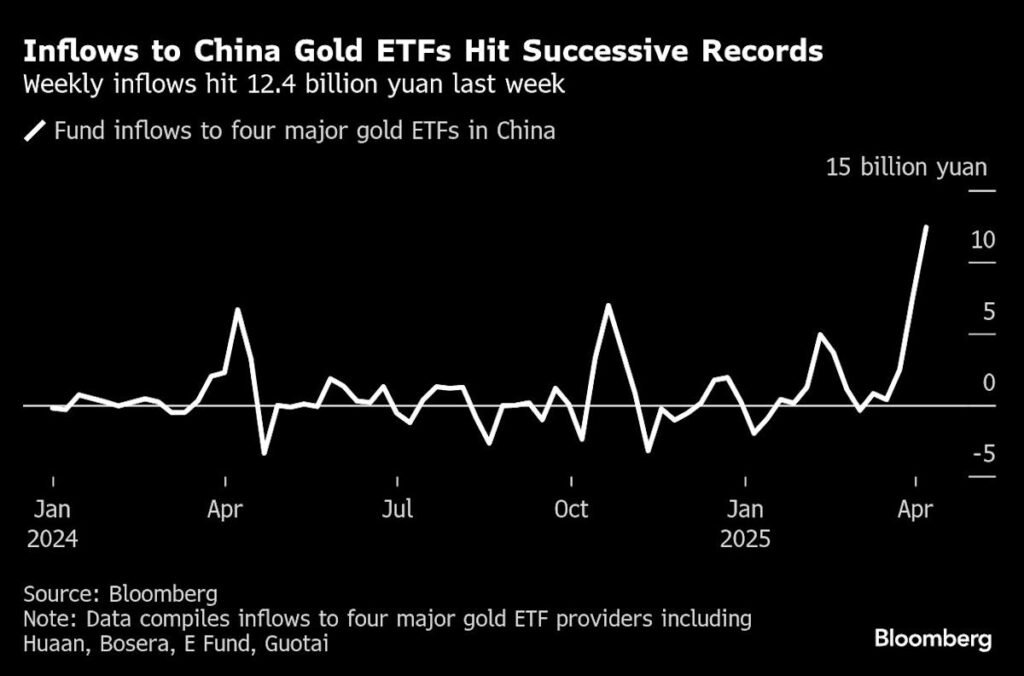

Bullion-backed exchange-traded funds have also become a popular investment option in a market that traditionally favors physical holdings. Inflows to onshore ETFs, driven by retail investors, have set new records week after week. Last week’s flow topped 12.4 billion yuan ($1.7 billion), almost doubling the previous week’s peak.

Such a “multi-layered demand base helps support and stabilize gold prices even amid external volatility,” said Aron Chan, gold strategist at State Street Global Advisors. “This demand is less speculative and more strategic or culturally embedded, which means it is stickier and more resilient.”

Much of the onshore strength comes from the demand for investment bars, inflows to ETFs, and banks’ gold accumulation plans – an investment product that allows retail investors to accumulate gold on a regular basis, said Zijie Wu, a Shenzhen-based analyst at Jinrui Futures Co.

“Investors continue to favor gold as a safe-haven asset and long-term portfolio diversifier, as domestic bonds and equities come under pressure,” Wu said. “I expect investment and hedging demand in China to remain resilient” as policy flip-flops in the US create more uncertainty, he added.