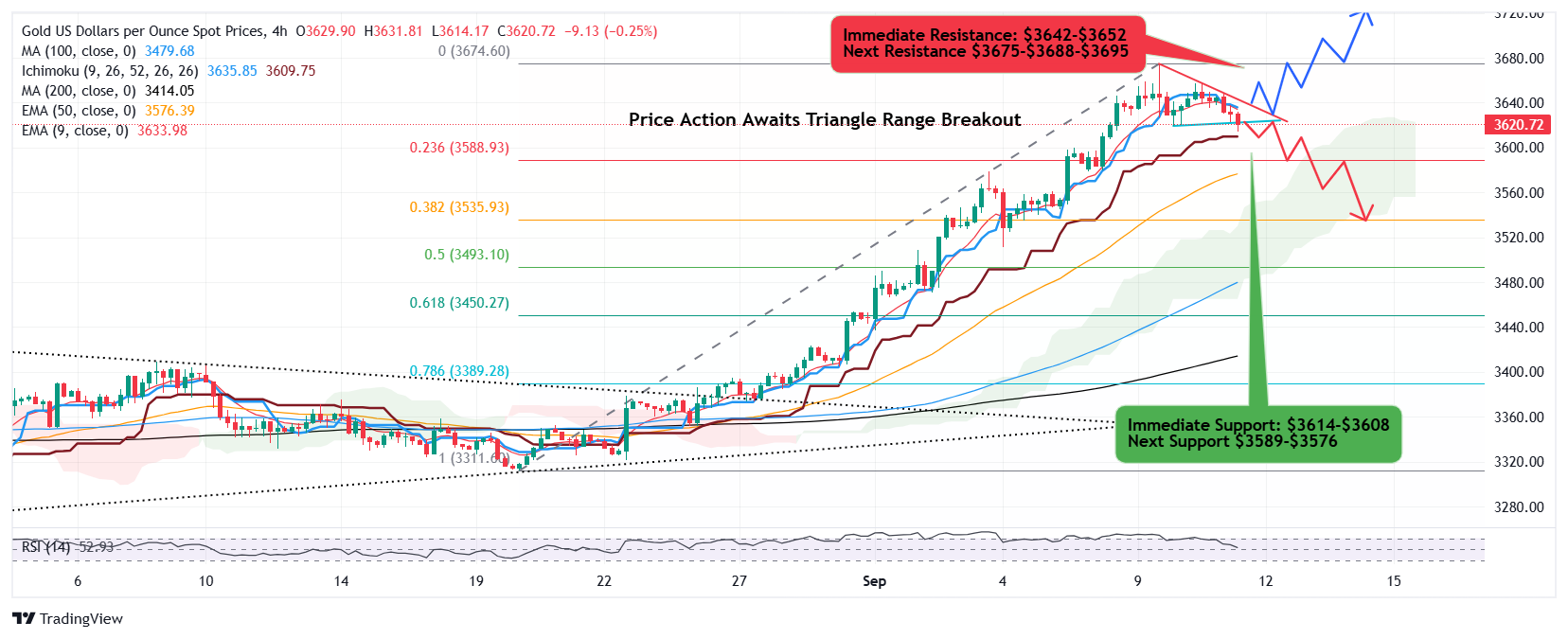

- Gold bullish rally takes a break after some retail profit booking from record $3675 high pushes the metal to $3614.

- Markets await key economic data releases, CPI and Jobless Claims.

- Dollar Index attempts recovery from 97.25, faces hurdle at 98.

- Mid East Geo Politics heats up as Israel launches decisive air strikes on Hamas leadership in Qatar.

- Gold trades sideways awaiting triggers for range breakout.

Key fundamental drivers

Back to back, disappointing Jobs data and PPI numbers have increased possibilities of rate cut by Fed.

Dollar Index continues to remain under pressure as rebound attempts from 97.25 facing challenge at 98.

Safe haven demand remains intact amidst Israel air attack on Hamas leadership in Qatar.

Trump tariff rhetoric keeps global economic sentiments fragile as the US president asks the European Union to step up tariff on India and China to put pressure on Russia though these measures are facing global criticism amidst frequent change of statements.

Weaker than expected economic data, weakening Dollar, Trade tariff concerns and geo political crisis together increase the possibilities of a 25 BPS rate cut by Fed which in turn boost safe haven demand for Gold as hedge against uncertainties.

What to watch during the day?

US Core and Headline CPI data.

US Initial Jobless Claims.

Dollar Index reaction to 98 Resistance and 97.25 Support.

US Treasury Yields.

Gold price reaction to $3610 Support and $3642 Resistance.

Overall bias and technical outlook

As key economic data are released, markets will show volatile price reaction on Dollar as well as Gold with strong price fluctuations and range breakout will extend price moves in the direction of breakout though multiple data releases also witness rampant liquidity sweeps.

The primary trend for Gold is strongly bullish in medium and long term and Gold looks extremely bullish with interest cut expectations, weak Dollar and safe haven demand.

In short term, there is a growing possibility of price correction from the record high towards support zone a potential retracement from resistance zone $3652-$3662 is likely to retest support base $3620-$3610 where buyers may resurface.

A decisive and strong selling and break and stability below key support $3610-$3605 will extend decline to $3589-$3577 below which next support sits at $3566-$3555.