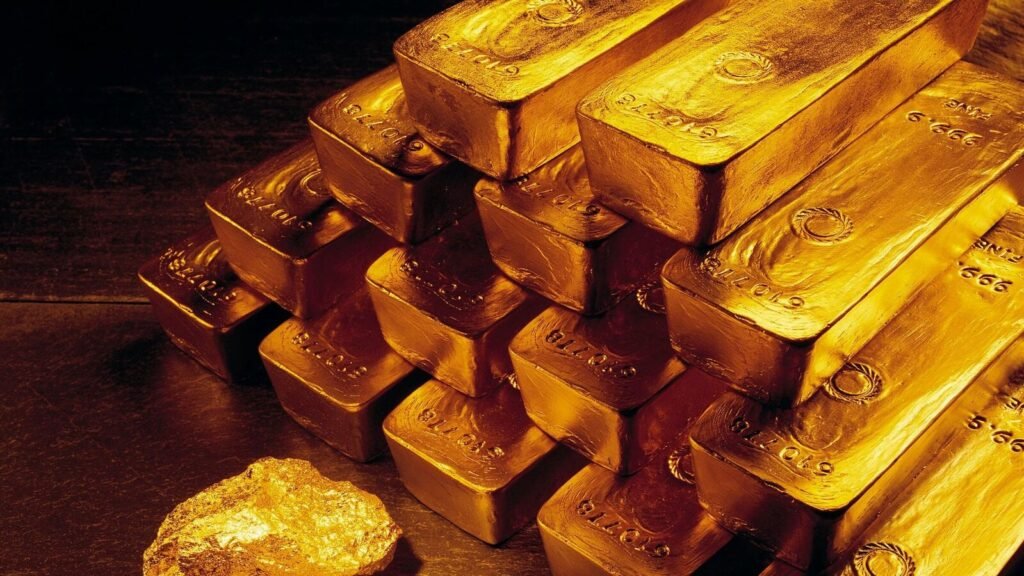

Gold prices dropped over 2% on Friday as the dollar strengthened and investors took profits following bullion’s record high earlier in the week, driven by increasing expectations of U.S. interest rate cuts in September.

By 1422 GMT, spot gold had decreased 1.8% to $2,401.49 per ounce. Earlier, on Wednesday, gold reached an all-time high of $2,483.60. Meanwhile, U.S. gold futures fell about 2.2% to $2,403.70.

“Gold made an impressive 3% surge during the week, breaking May’s all-time highs. However, it then retreated to the downside, selling off throughout the second half of the week. Pullbacks after making new highs have been a typical pattern for gold in recent months, with similar retreats in May, April, March, and December. The highs were followed by a pullback, which subsided within about two weeks, leading to a stabilisation of the price and a return to the upside. However, bull markets do not last forever, and traders should look for signs that this bullish trend is reversing. We pay attention to the following warning signals,” said Alex Kuptsikevich, the FxPro senior market analyst.

What’s weighing on gold prices?

The U.S. dollar gained 0.1% against other currencies, and benchmark 10-year Treasury yields also increased, putting pressure on bullion.

Markets are now predicting a 98% likelihood of a rate cut by the U.S. Federal Reserve in September, as per the CME FedWatch Tool. Non-yielding bullion is typically more attractive in a low-interest-rate environment.

Federal Reserve Chair Jerome Powell stated earlier this week that recent inflation readings “add somewhat to confidence” that the pace of price increases is returning to the central bank’s target sustainably.

On the physical side, Asian gold demand was weak this week. Customers were reluctant to make new purchases despite significant discounts, instead opting to take advantage of record-high bullion prices.

Spot silver dropped about 3% to $29.17 per ounce, platinum decreased 0.2% to $965.90, and palladium fell 1.2% to $918.93. All three metals were on track for weekly declines.