- Gold trades at $3,380 as stronger US Dollar overshadows safe-haven demand.

- Trump mulls joining Israel in strikes on Iran, fueling geopolitical anxiety.

- Fed expected to hold rates steady; Dot Plot revisions may hint at fewer 2025 cuts.

Gold prices retreated below the $3,400 level on Tuesday despite deteriorating risk appetite as overall US Dollar (USD) strength drove the yellow metal lower. Nevertheless, the escalation of the Israel–Iran conflict would likely underpin the precious metal due to its safe-haven appeal. At the time of writing, XAU/USD trades at $3,380, down 0.05%.

Market mood is downbeat, but Bullion has failed to rally as the US Dollar stages a comeback. The US Dollar Index (DXY), which tracks the performance of the Dollar against six major currencies, is up 0.46% at 98.58.

On Monday, US President Donald Trump abruptly exited the G7 meeting in Canada due to developments in the Middle East. He posted on his social network that “Everyone should immediately evacuate Tehran,” in a clear signal of an escalation of the conflict that erupted last Friday.

Earlier news sources revealed that Trump is evaluating joining Israel to attack Iran. As of writing, Walla News/Axios, citing senior US officials, said that Trump is seriously considering attacking Iran and is holding a crucial meeting with his advisers.

Even though sentiment remains the main driver, economic data in the United States (US) was weaker. US Retail Sales in May were mixed with monthly figures contracting, while in the 12 months to May they rose. Industrial Production, revealed by the Federal Reserve (Fed), shrank in May.

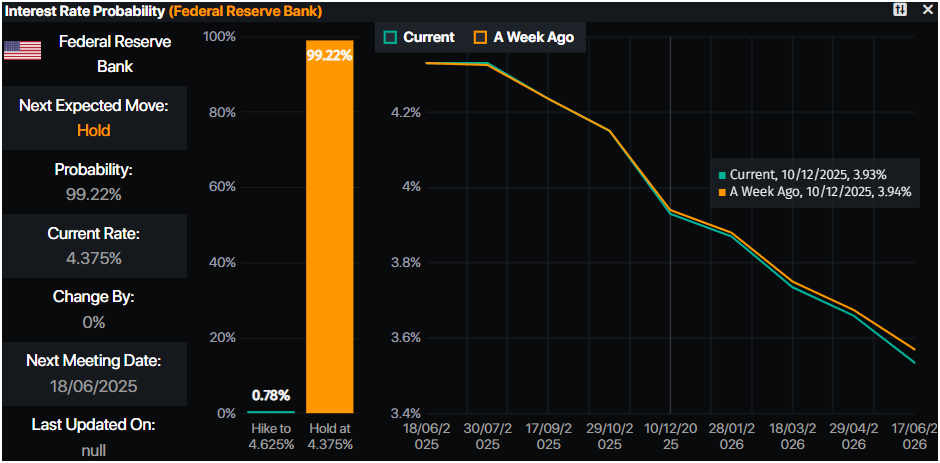

Traders are bracing for the Fed’s decision. Fed Chair Jerome Powell and other Fed governors began their “conclave” and are expected to hold rates unchanged. It is worth noting that policymakers would update their economic projections, which would signal the monetary policy path toward the second half of 2025.

Win Thin, Global Head of Market Strategy at BBH, revealed that he expects a dovish tilt by the Fed but noted that “we see some risks of a hawkish shift in the Dot Plots, as it would take only two officials to move from two cuts to one to get a similar move in the 2025 Dot.”

Daily digest market movers: Gold stays flat as rising geopolitical risks loom

- US Retail Sales fell sharply in May, dragged down by a notable decline in automobile purchases. The headline figure dropped by 0.9% MoM, underperforming expectations for a -0.7% decrease. On a YoY basis, sales climbed 3.3%, decelerating from April’s robust 5% gain.

- Meanwhile, US Industrial Production slipped by 0.2% in May, marking the second decline in three months. The data missed market forecasts for a modest 0.1% increase, signaling weakness in the manufacturing sector.

- The latest inflation reports in the US warrant further easing by the Fed. Any dovish hints by the US central bank could boost Gold prospects as the non-yielding metal fares well in lower interest rate environments.

- The World Gold Council published its central bank survey published annually, revealing that 95% of the 73 respondents expect an increase in Gold reserves over the next 12 months.

- US Treasury yields are diving as the US 10-year Treasury yield edges down nearly five-a-half basis points (bps) to 4.403%. US real yields followed suit, falling almost five bps to 2.103%.

- Money markets suggest that traders are pricing in 44 bps of easing toward the end of the year, according to Prime Market Terminal data.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price consolidates near $3,400 ahead of FOMC meeting

Gold price uptrend remains intact as price action remains constructive, achieving a successive series of higher highs and higher lows. Any retracements could be seen as an opportunity to buy the dip, as momentum measured by the Relative Strength Index (RSI) remains bullish.

With that said, the XAU/USD first resistance would be the $3,400 mark, followed by $3,450 and the record high of $3,500 in the near term.

Conversely, if XAU/USD stays below $3,400, the pullback could extend toward the $3,350 mark and possibly lower. The following key support levels would be the 50-day Simple Moving Average (SMA) at $3,293, followed by the April 3 high-turned-support at $3,167.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.