- Gold price edged up for a second day ahead of Trump’s tariff deadline.

- Traders mull the impact of “liberation day” where Trump will implement reciprocal tariffs on all countries.

- Gold traders are looking for upside levels with $3,200 as the next nearby target.

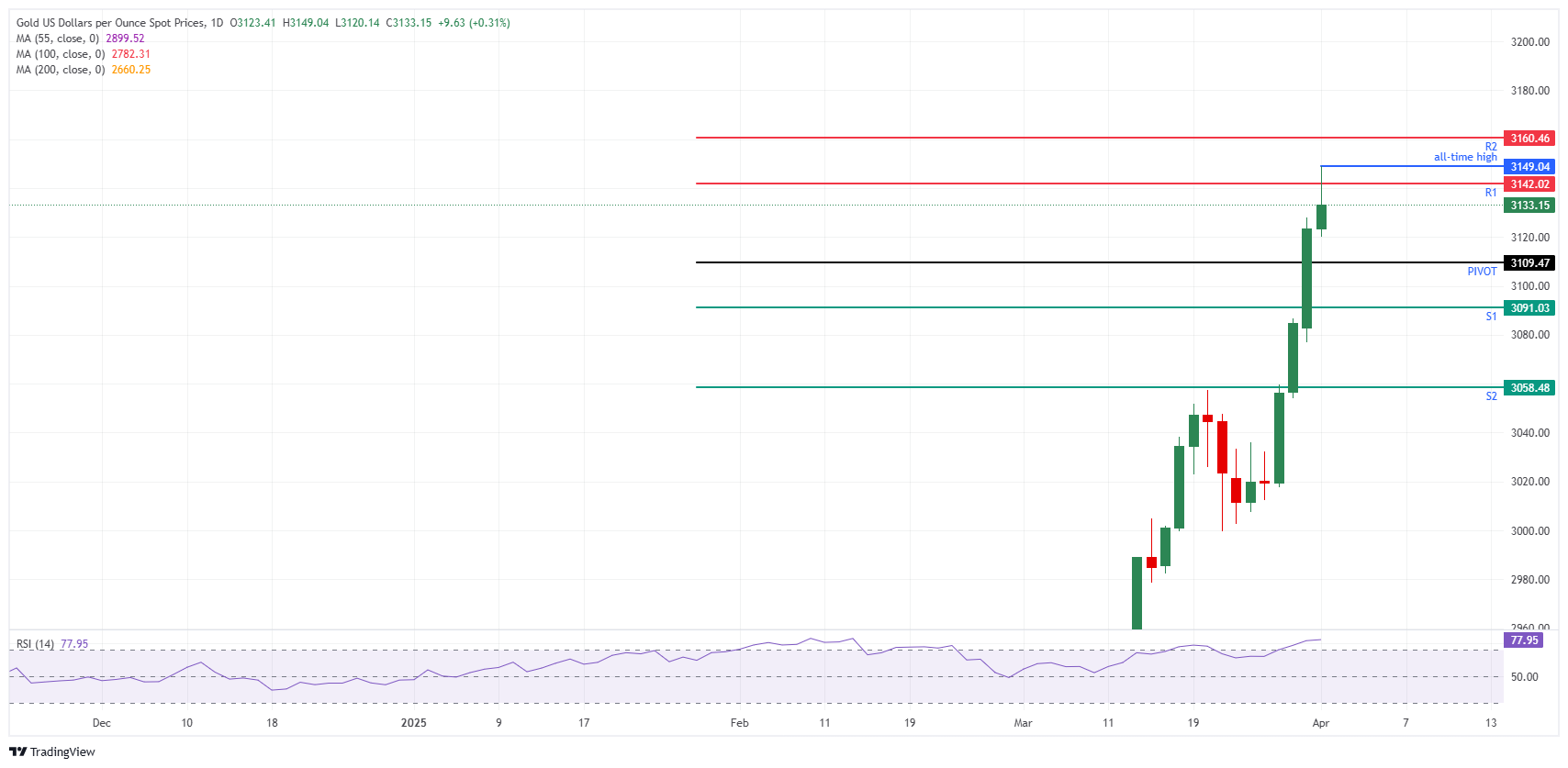

Gold price (XAU/USD) sees earlier gains fade and is holding on to a small intraday gain ahead of the US trading session on Tuesday, trading near $3,132. The precious metal trades slightly above $3,130 at the time of writing and the new all-time high was eked out at $3,149 this Tuesday. Investors are still seeking refuge in Gold’s market with United States (US) President Donald Trump set to announce reciprocal tariffs on Wednesday around 19:00 GMT.

Meanwhile, traders brace for a heavy trading week in terms of US economic data. In the runup towards the Nonfarm Payrolls release due on Friday, markets will wait for several data to be published. Overnight, during a CNBC interview, Richmond Federal Reserve (Fed) Bank President Thomas Barkin said the economic reading is wrapped in a thick fog and is unclear for policymakers to read where rates should go, while recession fears are still on the table, CNBC reports.

Daily digest market movers: African mining companies up 33%

- The surging Gold price has propelled South African mining Stocks to their best monthly performance on record, shielding the country’s benchmark index from the mayhem in global markets, Reuters reports. The South African mining Equities had their best monthly performance on record in March, with a 33% jump, driven by increasing Gold prices.

- The CME FedWatch tool sees chances for a rate cut in May decrease to 13.1% compared to near 18.1% on Monday. A rate cut in June is still the most plausible outcome, with only a 23.1% chance for rates to remain at current levels.

- Physical demand and a favorable macro backdrop are helping drive the Gold rally, according to Amy Gower, a commodity strategist at Morgan Stanley, which predicts prices may rise to $3,300 or $3,400 this year. That outlook coincides with forecasts from other major banks, with Goldman Sachs Group Inc. now looking for $3,300 by year-end, Bloomberg reports.

Gold Price Technical Analysis: This could be it for now

A small ‘parental advisory’ on the longevity of the Gold rally makes sense around now. With the main tailwind for the Goldrush set to be officially announced, the ‘buy the rumour, sell the fact’ rule of thumb should be considered. The risk could be that once the reciprocal tariffs take effect on Wednesday, only easing due to profit-taking in Gold could occur once separate trade agreements and partial unwinds take place.

On the upside, the daily R1 resistance at $3,142 has already been tested in Tuesday’s steep rally. The R2 resistance at $3,160 could still be targeted later in the US trading session as the European session sees Gold price action settle a touch. Further up, the broader upside target stands at $3,200.

On the downside, the daily Pivot Point at $3,109 should be strong enough to support any selling pressure. Further down, the S1 support at $3,091 is quite far, though it could still be tested without completely erasing the prior’s day move. Finally, the S2 support at $3,058 should ensure that Gold does not fall back below $3,000.

XAU/USD: Daily Chart

BRANDED CONTENT

Not all brokers provide the same benefits for Gold trading, making it essential to compare key features. Knowing each broker’s strengths will help you find the ideal fit for your trading strategy. Explore our detailed guide on the best Gold brokers.