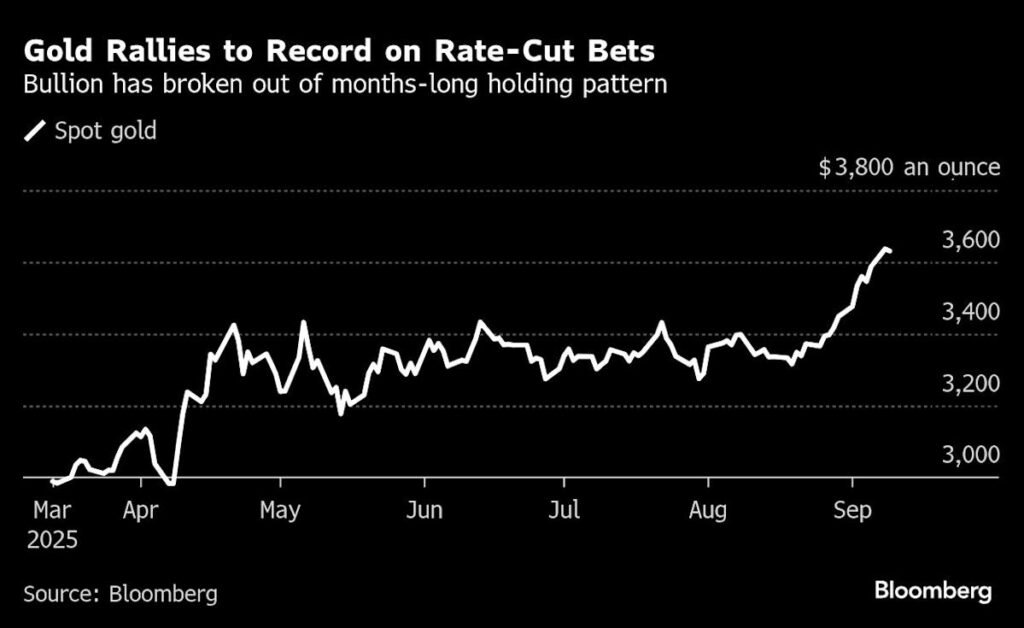

(Bloomberg) — Gold reached another record on Tuesday, with its rally stoked by a surge in bets for a wave of Federal Reserve rate cuts this year.

Bullion gained as much as 0.3% to a fresh all-time high of more than $3,647 an ounce, beating the previous peak on Monday. It climbed 2.5% in the previous two sessions after unexpectedly weak US payrolls data on Friday prompted traders to price in three rate cuts this year, including a quarter-point cut at the Fed’s meeting next week. Gold tends to benefit from lower borrowing cost as it doesn’t pay interest.

Most Read from Bloomberg

Whether gold can continue to ride the rate-cut rally could hinge on a benchmark revision of US jobs data due later Tuesday, along with the tone of US producer and consumer inflation figures on Wednesday and Thursday. Market reaction to the auctions of short- and long-term Treasuries will also be watched.

Gold has climbed nearly 40% this year on central bank purchases and rate-cut speculation, along with stronger haven demand due to heightened geopolitical tensions and worries about the impact of President Donald Trump’s tariff regime on the global economy. The US leader’s attacks on the Fed’s independence have also helped extend gold’s three-year long rally.

Analysts and investors widely expect more gains for gold. Goldman Sachs Group Inc. has said the precious metal could rally to nearly $5,000 an ounce if investors shift just a small portion of holdings from Treasuries into bullion on signs of more political interference into the central bank.

Exchange-traded funds have piled into bullion since last month’s Jackson Hole conference, where Federal Reserve Chair Jerome Powell signaled willingness to ease monetary policy. Inflows on Monday were the highest in almost three months. Still, total ETF holdings of the bullion are still lower than the highs seen during Covid-19 and the outbreak of Russia-Ukraine war, showing more room for gains.

Bullion was trading at $3,645.61 an ounce as of 9:51 a.m. Singapore time. The Bloomberg Dollar Spot Index was steady. Silver was flat, while palladium and platinum gained.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.