Gold has finally broken its recent shackles and surged through resistance like a prisoner who never believed in walls to begin with. For weeks, the narrative of “overbought, overcrowded, overdone” was being hammered out on trading desks. But that sermon is now drowned out by the roar of ETF flows — laggards until now — suddenly waking up and charging headlong into the trade.

The move isn’t subtle. Gold has ripped to a fresh record high at $3,748, tallying five straight weekly gains in a market that looks less like an orderly climb and more like a vertical thrust. The spark? Fed rate cuts lighting a fire under macro funds, central banks continuing their quiet hoarding, and the retail and wealth management crowd scrambling to vault bullion. ETF inflows hit a three-year high on Friday, jumping nearly 1% in a single day. For a market that thrives on narrative, this was the missing piece: a sign that the gold bull is no longer just the domain of futures punters or macro diehards, but that real institutional credibility is entering the bloodstream.

At this stage, gold isn’t pausing to consolidate; it’s charging higher despite being the most overbought asset on the planet. Analysts may mutter about sideways chop, but the tape refuses to comply — it just presses onward. Silver, meanwhile, is showing the signs of something more electric, perhaps even a gamma squeeze. The surge in silver options volumes, with calls spiking to levels not seen since April last year, speaks of speculative froth but also of a broader recognition: the white metals are hitching themselves to gold’s runaway train.

What’s striking is the psychology. On the ground in New York last week, the gold crowd was in carnival mode. Every strategist was booked wall-to-wall; the appetite was insatiable. Not one meeting entertained the idea of shorting. Everyone is hunting the same prize: $4,000. And shallow pullbacks — normally the bread and butter for sellers — are being snuffed out before they even take shape. Profit-takers have stepped aside, physical demand has given way to financial demand, and momentum is being fueled by investors who once hesitated but are now desperate to find an entry.

This is what happens when a bull market matures into a stampede: the absence of doubters becomes the story itself. Gold, the year’s best-performing asset, has shed the weight of caution and strapped on jet fuel. Whether it’s a bubble in the making or simply the opening act of a multi-year structural revaluation, the current script is clear. The crowd has stopped asking “if” and now only argues about “when” $4,000 will print.

This was such a bullish inflection

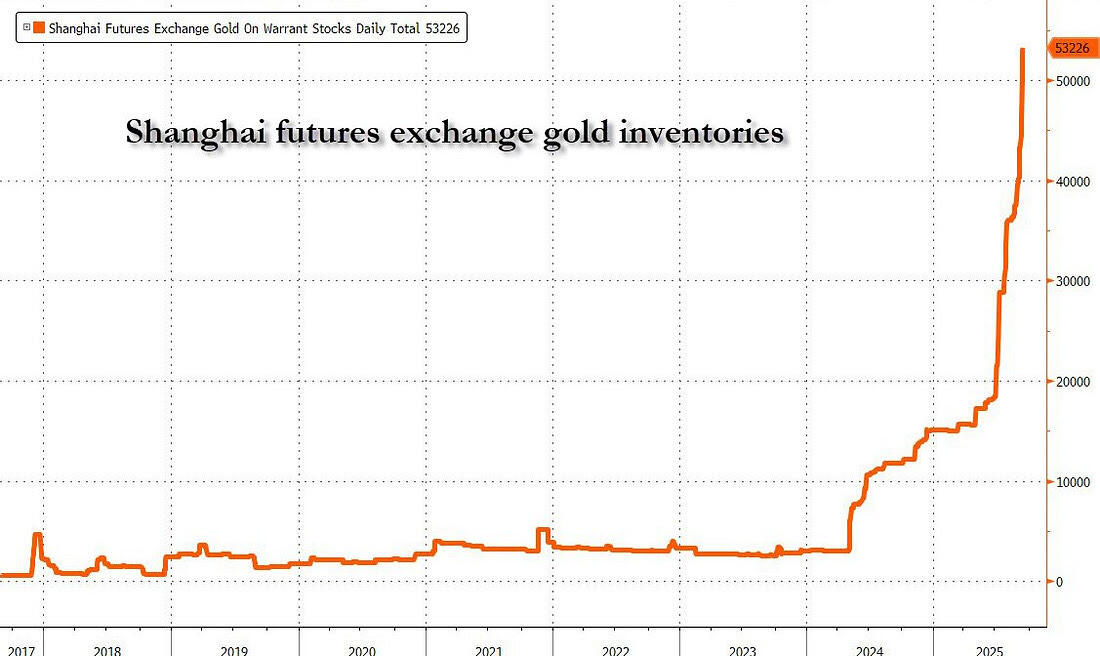

Gold blasted into new record highs, fueled not just by a weaker greenback but by persistent whispers that China is buying multiples(10X) more than it officially discloses.

H/T Shanghai Futures

When China is stockpiling gold at record levels ( and 10 X the reported level), it tells you everything you need to know. The world’s second-largest economy isn’t scrambling for shiny inert metal out of some cultural fascination with jewelry. They’re hedging against fiat dilution, plain and simple. When central banks and governments flood the system with liquidity, when debt towers over GDP, and when the reserve currency itself is being leaned on to fund perpetual deficits, the logical escape hatch is tangible assets. Gold isn’t a relic here — it’s the insurance policy against the slow erosion of purchasing power. China is simply reading the same playbook every trader does: when trust in paper wanes, bars beat bonds and the dollar.

Why doesn’t China fully disclose its gold buying? Simple — they don’t want the price to run away from them any faster than it already is. Every ton they quietly slip into reserves is another chunk off the market, but the minute they trumpet the scale, they bid against themselves. Better to buy in the shadows, let the market stay complacent, and keep accumulating before the rest of the world catches on. But now that the cat is out of the bag, is $3800 on the cards sooner than expected?