Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

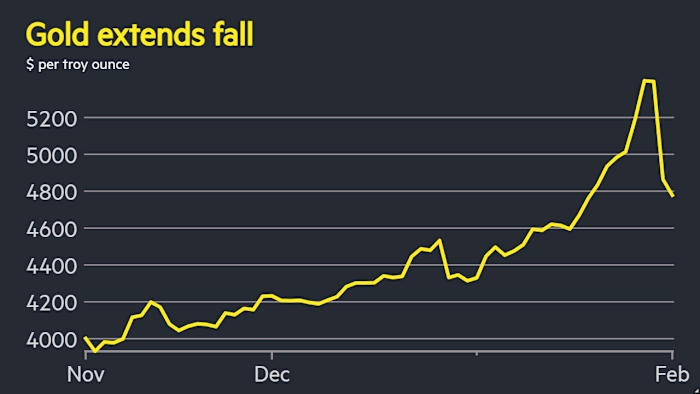

Gold and silver fell on Monday as the reversal of a record-breaking rally in precious metals extended into a second week.

Gold, which on Friday suffered its biggest one-day drop in more than 40 years, fell as much as 9 per cent in early trading, before rebounding to leave it down 4.1 per cent on the day at $4,665. Silver, which also saw its largest drop since the early 1980s on Friday, tumbled as much as 15 per cent on Monday, before recovering back up to $78.98, down 6.7 per cent on the day.

Both precious metals had stormed through milestones in recent weeks in a blistering rally, as geopolitical tensions and fears for the independence of the US Federal Reserve sent investors in search of haven assets.

But US President Donald Trump’s nomination on Friday of Kevin Warsh — a former Fed governor viewed as an orthodox choice — as the central bank’s next chair allayed fears that Jay Powell’s successor would go easier on inflation, a worry that had fuelled gains in precious metals.

“Price increases in precious metals had become extreme in January,” indicating “very stretched positioning”, said John Roe, head of multi-asset funds at Legal & General’s £1.1tn fund management arm.

The stretched positions created the conditions for price drops as investors “try to exit at the same time”.

CME Group, the world’s largest operator of derivatives exchanges, on Friday said it would raise margin requirements on gold and silver futures following the steep fall in prices.

Investors said the drops in precious metals prices were being accentuated by the tougher margin requirements and an unwinding of the borrowing that had driven the record rally.

“The past week in gold looks like a classic bout of excessive positioning build-up after a strong run, that is met by a washout when a problem arrives with the narrative,” said Seb Barker, chief market strategist at hedge fund Marshall Wace, identifying the Warsh nomination as that shift. However, he added that the “underlying bull case for gold still looks in place for us”.

Rising demand from private investors buying exchange traded funds and physical bullion had added to the rally. Investors have looked to gold as a hedge against mounting concerns over increased fiscal spending in developed economies as well as geopolitical uncertainty.

This heavy participation by retail investors, which included the use of leveraged products such as short-dated options, was exacerbating the sell-off on Monday, traders said.

“In that set-up, markets can feel stable on the way up, because dips get bought, but fragile on the way down,” said Valerie Noel, head of trading at Syz Group.

Asian stocks fell, with South Korea’s Kospi the hardest hit, closing down 5.3 per cent.

Investors were having “to replenish a lot of margin on [their] precious metal trades”, which had weighed on Asian stocks, said Hao Hong, chief investment officer of Lotus Asset Management.

Oil was sharply lower, with Brent crude, the global benchmark, down 4.8 per cent at $66.01 a barrel. Copper and aluminium, industrial metals that were swept up in the recent rally, were down 2 per cent and 3 per cent respectively.

Raymond Cheng, chief investment officer for North Asia at Standard Chartered, said gold trading at $4,650 was “an opportunity to add” the metal amid uncertainty about government spending in the US.

“We think the Trump risk premium is still warranted,” said Cheng. “He will stay as the US president no matter who the Fed chair [is]. His fiscal policy will remain expansionary.”

South Africa’s benchmark stock index, which is heavily exposed to the mining industry, tumbled as much as 6.9 per cent before recovering to stand 1 per cent down on the day.

“Markets that go up this much don’t correct sideways,” said Prashant Bhayani, chief investment officer for Asia at BNP Paribas Wealth Management. “It’s no different from meme stocks.”

Additional reporting by Camilla Hodgson. Data visualisation by Jonathan Vincent