hadynyah

From an investing perspective, Peru is a really interesting emerging market to consider. Peru offers macroeconomic stability with strong fundamentals and longer-term growth potential. Peru enjoys robust buffers to adverse shocks, thanks to low public debt, large external reserves and favorable access to international capital markets. Peru generally has a very good track record of macroeconomic resilience with strong policy frameworks.

As a result, GDP is expected to grow at an average rate of 2.4 percent over the medium term, mainly supported by the exports from new mining projects. Inflation is also showing good prospects in Peru, with inflation expected to return to the 1-3 percent target range this year. This, coupled with long-term structural reforms to reinforce productivity and the business climate, which are an important part of Peru’s OECD accession process, mean opportunities for sustainable growth and returns.

Its resource-rich prosperity and unexplored growth potential make it a compelling destination in the world of emerging market investing. The chief resource that Peru benefits most off of? Good old Doctor Copper. If you’re looking for targeted exposure to Peru because of this, you may want to consider the iShares MSCI Peru ETF (NYSEARCA:EPU). This fund provides access to the largest and most liquid companies in Peru while also providing a direct vehicle to gain exposure to companies with significant research and development activities in Peru but not actually located there.

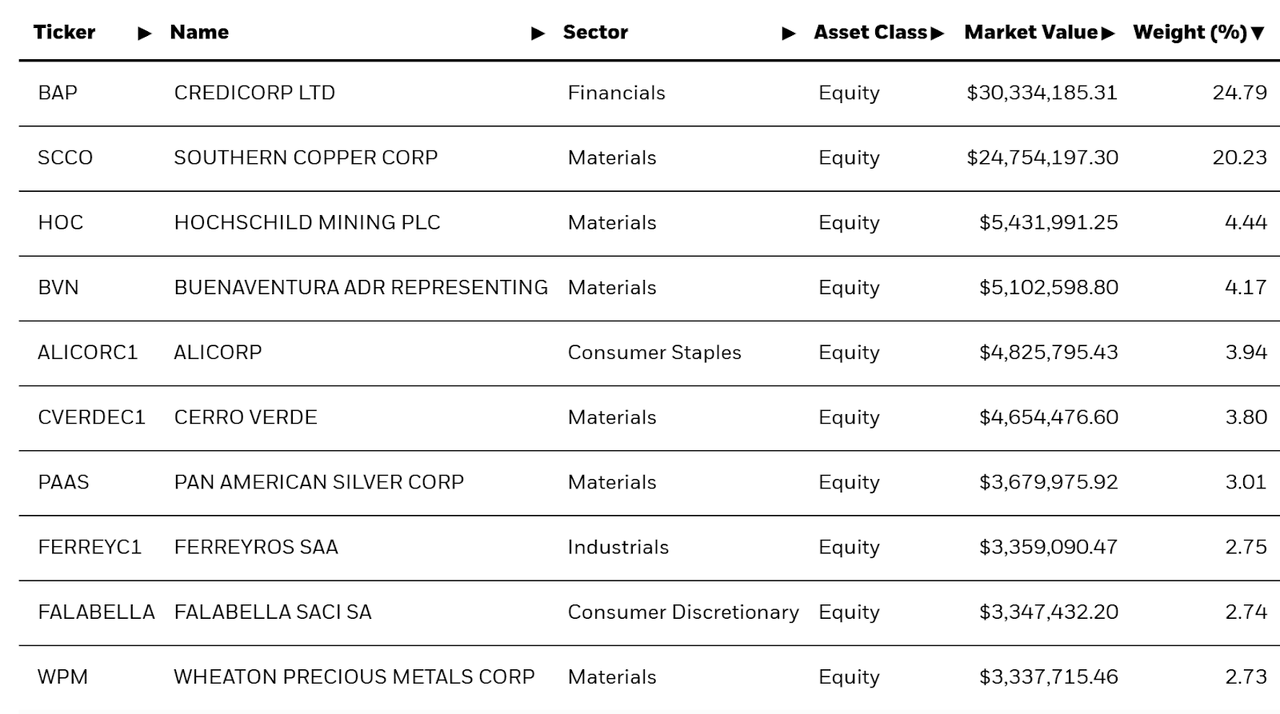

A Look At The Holdings

Something to keep in mind is that this is a VERY concentrated fund. As a matter of fact, the top 2 positions make up 45% of the portfolio. Be very mindful of this when considering a purchase.

What do these companies do? Credicorp Ltd. is Peru’s largest integrated financial conglomerate. Southern Copper Corporation is the Latin American mining giant that is one of the world’s top copper mining companies. Buenaventura ADR and Hochschild Mining PLC are both precious metals miners. Resource rich in the top holdings as you can tell, with many of the top stocks falling under the Materials sector classification.

Sector Breakdown

Materials are the Tech of Peru. In other words – the largest allocation, making up nearly 50% of the fund.

Oh – and yeah, there is no Tech either. This is at its core a Materials fund, with Financials a distance second. I don’t mind this, actually, given that I’m, in general, bullish on commodities and think the Materials sector globally will benefit on the stock side as momentum gets entrenched.

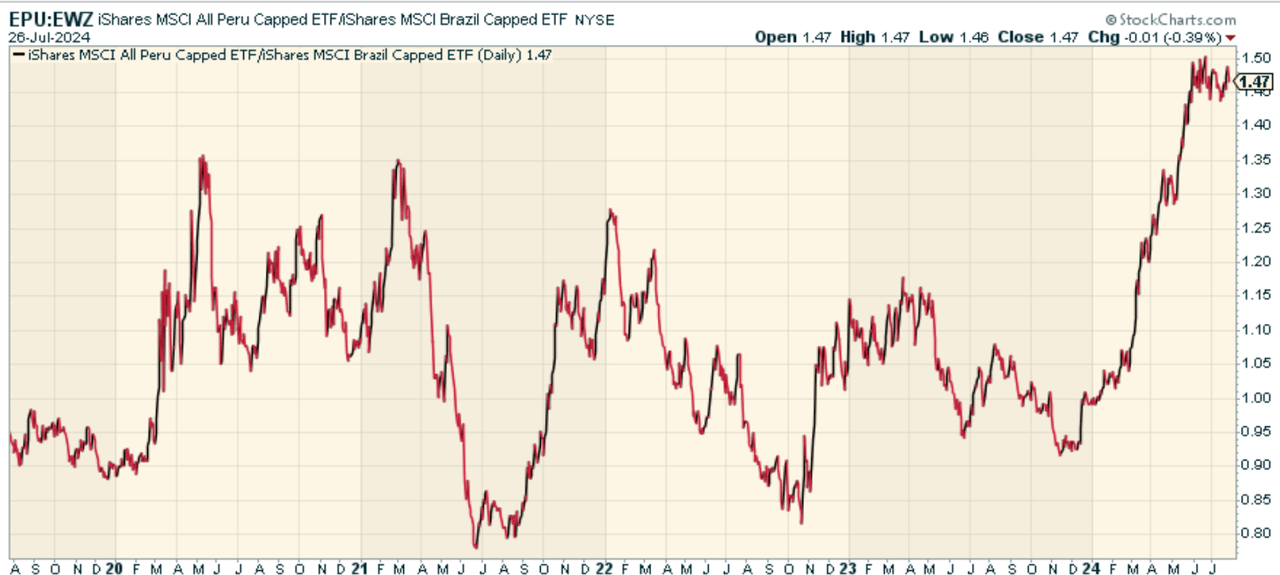

Peer Comparison

It’s worth comparing the fund to competing ETFs tracking the markets of neighboring countries, which are also seeing a surge in foreign capital. If we compare EPU to say the iShares MSCI Brazil ETF (EWZ), we find that EPU has meaningfully outperformed this year, but it’s been a rollercoaster ride in terms of relative strength. Not sure the momentum points to favoring Peru over Brazil.

Pros and Cons

On the positive side, EPU offers investors global access to a concentrated yet diversified portfolio of Peruvian equities — the first opportunity to own a basket of stocks with direct exposure to Peru’s resource-driven growth and the nation’s rapidly expanding domestic consumption. Its top-weighted holdings include well-established Peruvian companies, and it’s exposed to a sector (Materials) that I believe likely outperforms in the years ahead as the commodity cycle kicks back in.

But the fund’s concentration poses risks, especially with the top 2 holdings. In addition, should the price of copper or precious metals drop suddenly, for example, or should Peru’s political or economic situation take a turn for the worse, that would jeopardize the ETF’s returns.

Conclusion

The iShares MSCI Peru and Global Exposure ETF is a play for copper-bullish investors interested in gaining targeted exposure to an emerging market that continues to grow its resource-heavy economy, investing heavily in infrastructure while also realizing the opportunities that come with an increasing urbanization and a growing middle class. However, its large-cap, market-cap-weighted structure is very concentrated, with pronounced sector biases. I actually think it’s an interesting diversification and sector play. I think it’s worth considering an allocation too.

Get 50% Off The Lead-Lag Report

Get 50% Off The Lead-Lag Report

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Get 50% off for a limited time by visiting https://seekingalpha.com/affiliate_link/leadlag50percentoff.