The exploration camp at the Eskay Creek gold project in British Columbia. Credit: Skeena Resources

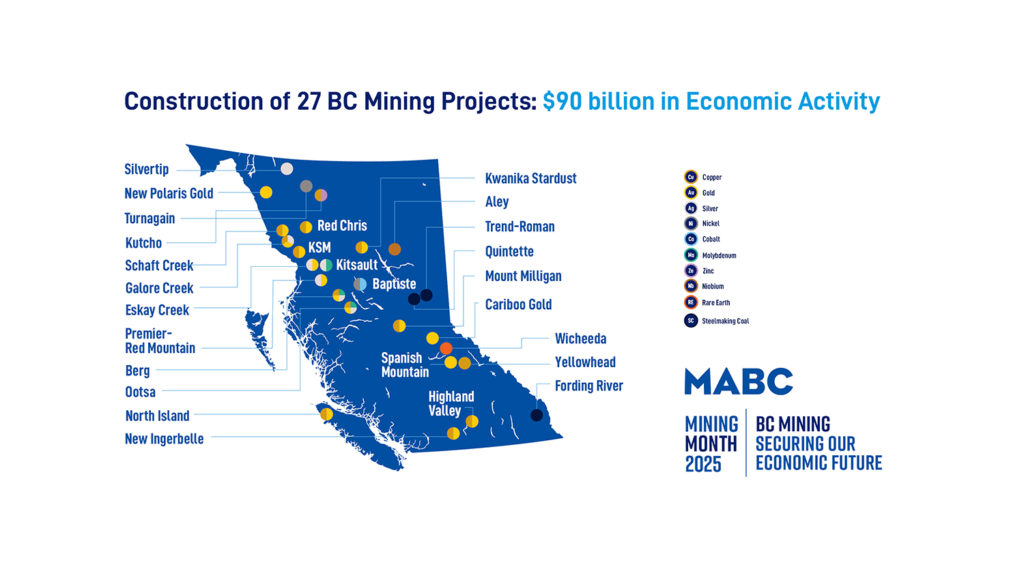

A total of 27 mining projects representing C$90 billion ($65 billion) in economic activity have the potential to deliver major benefits for the province of British Columbia and Canada at a time of global instability, a slowing provincial economy and mounting fiscal challenges, according to report released Thursday by the Mining Association of BC (MABC).

MABC’s 2025 Economic Impact Study assesses the potential economic impact of 18 proposed critical mineral mines, six precious metal mines and three steelmaking coal mines.

The independent study examines 27 mining projects in advanced stages of development. Of the 27 projects assessed, 21 are new mining projects and six are extensions to existing mines.

BC mineral producers have among the lowest carbon footprints globally and are world leading suppliers of responsibly-produced materials, according to the report, essential for technologies like EV batteries, smartphones, MRI scanners, wind turbines and jet engines.

The study concludes the near-term economic impact of project construction represents over C$41 billion in near-term investment, thousands of jobs that will generate C$27 billion in labour income, and more than C$12 billion in tax revenues.

Mine construction would result in C$20 billion worth of goods and services being purchased from mine suppliers across the province, MABC said.

The study estimates the operation of these mines over several decades could reach C$984 billion in economic activity.

“BC has the minerals, precious metals and steelmaking coal the world needs. Mining has the potential to drive a new wave of economic growth – creating jobs, strengthening local and First Nations communities, and generating revenues for government services,” MABC CEO Michael Goehring said in a news release.

But British Columbia’s mining projects face challenging permitting backlogs. Last year, the province’s exploration sector had over 60 critical mineral projects waiting for permits in a C$38 billion ($27 billion) pileup of economic opportunities.

“BC and Canada must take urgent and bold action to assert our economic sovereignty amidst global trade disruptions and the potential for escalating trade wars. Persistent permitting delays must be addressed to accelerate the development of mining,” Goehring said.

Last year, Canada and British Columbia announced an investment of C$195 million ($142 million) into critical minerals infrastructure in northwest BC, aimed at bolstering development and safety within the region.

“The responsible development of BC’s critical minerals, precious metals, and steelmaking coal resources can secure BC’s economic future, resiliency and long-term prosperity. It’s time to get more mines built,” said Goehring.

The full report is here.