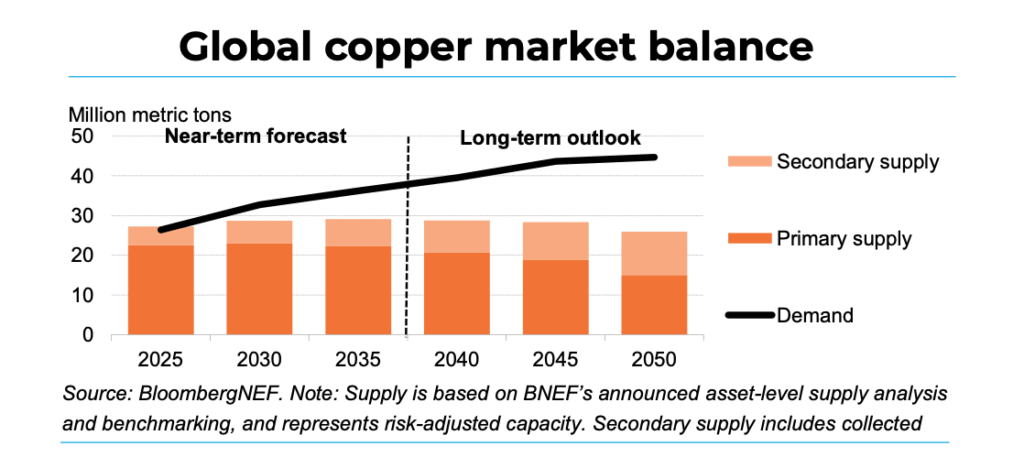

Copper is heading into a structural deficit from 2026 as demand from electrification accelerates faster than new supply, according to BloombergNEF, with geopolitical intervention now the single biggest force shaping metals markets.

In its December report, Transition Metals Outlook 2025 BloombergNEF says copper faces the most acute pressure among transition metals, driven by rapid growth in data centres, grid expansion and electric-vehicle adoption. Energy-transition demand for copper is set to triple by 2045, pushing the market into persistent deficit unless investment and recycling ramp up.

Kwasi Ampofo, head of metals and mining at BloombergNEF, told MINING.COM the imbalance reflects rising demand colliding with slow project delivery. “Copper, platinum and palladium have experienced very slow capacity addition at a time where demand is growing,” he said, calling them the commodities under the greatest near-term pressure.

Supply constraints are already visible. Disruptions in Chile (Quebrada Blanca, El Teniente), Indonesia (Grasberg) and Peru (Las Bambas, Constancia), paired with slow permitting, have tightened the market. BloombergNEF estimates the copper shortfall could reach 19 million tonnes by 2050 without new mines or significant gains in scrap collection.

Short-term price moves

Prices are up 35% so far this year and heading for their largest gain since 2009. While the copper-shortage debate often blurs short-term price moves with long-term fundamentals, Ampofo said BloombergNEF’s outlook is grounded in structural supply-demand trends. Bringing new supply online this decade will require sustained investment to expand existing projects, streamlined permitting and better recycling systems.

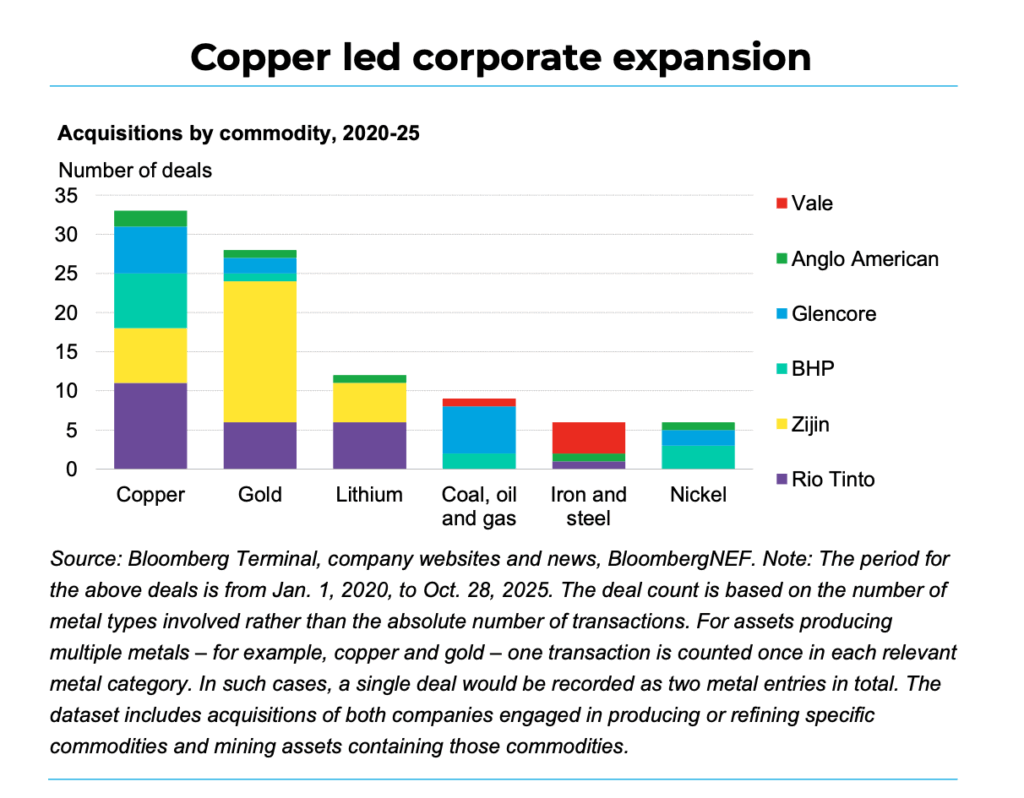

That long-term view is increasingly shared by miners. BloombergNEF notes renewed capital spending and consolidation across producers including Anglo American (LON:AAL), BHP (ASX:BHP), Glencore (LON:GLEN), Rio Tinto (ASX:RIO), Vale (NYSE:VALE) and Zijin (HKEX:2899). Ampofo said the surge in mergers and acquisitions signals copper’s growing strategic value, a conclusion the firm’s analysis supports.

The others

While copper dominates near-term concerns, the report highlights diverging paths across other metals.

Aluminium supply remains heavily concentrated in China, which produces half the world’s output. A government cap aimed at curbing emissions has left little room to grow, and BNEF says the ceiling’s constraint on supply could persist unless raised. China’s share declines to 37% by 2050 in the Economic Transition Scenario, while India more than doubles production over the next decade.

Graphite demand rises from 2.7 million tonnes in 2025 to 6.7 million tonnes in 2050, driven by its central role in lithium-ion battery anodes. The market is expected to slip into technical deficit in 2032 as secondary supply from retired batteries fails to match the slowdown in primary-supply growth.

Lithium supply, by contrast, continues to grow. Total capacity could hit 4.4 million tonnes of lithium carbonate equivalent by 2035, up from 1.5 million tonnes in 2025, supported by new South American and African projects, maturing direct-extraction technologies and rising secondary supply. Prices remain low after falling from a 2022 peak of $80,000 per tonne, though recent disruptions and subsidy reductions have triggered a modest recovery.

Manganese supply remains broadly aligned with demand through 2050 thanks to stable ore availability and dominant use in steelmaking, which accounts for 97% of consumption. Short-term risks persist due to logistics challenges in South Africa and Gabon’s planned 2029 export ban.

Cobalt prices have rebounded after the Democratic Republic of Congo imposed a four-month export ban in February, later replaced with a quota system that caps annual exports at 96,600 tonnes for 2026–27, a 50% cut from 2024 levels. Prices climbed 128% from February to October as the market tightened.

China’s dominance

Despite broad investment in critical-minerals supply chains, China retains dominance across most midstream refining, especially in aluminium, graphite, manganese, cobalt, nickel and rare earths. Europe and the US remain heavily exposed in graphite, manganese, nickel and lithium, while Japan and South Korea rely on diversified imports and recycling.

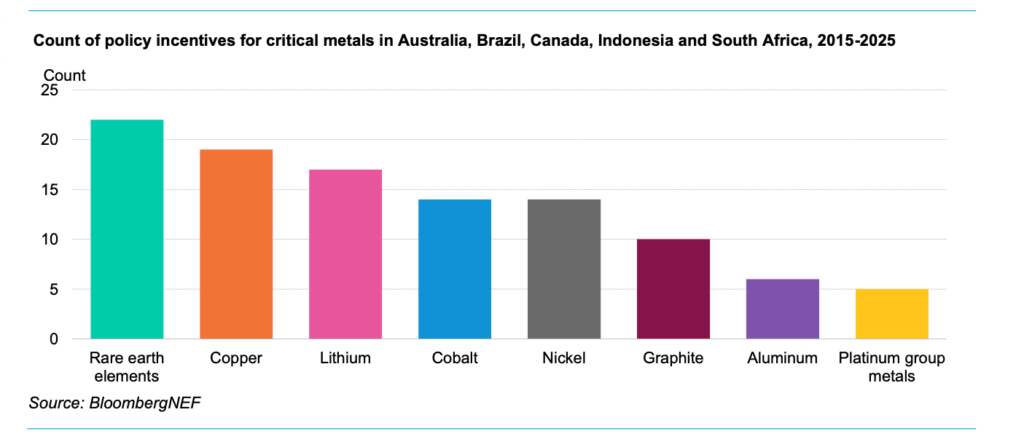

Geopolitics now underpins many of those strategies. Ampofo said government involvement can unlock capital but also heightens the risk of conflict, and warned that subsidies alone will not resolve supply-chain concentration. Looking ahead, he said price signals in 2026 will be critical, either encouraging new supply or curbing demand through substitution.

The report also underscores the need to decarbonize metals used in clean-energy infrastructure. Steel, aluminium and copper carry the highest embodied emissions, and while solar and wind projects offset those emissions within months of operation, BloombergNEF cautions that slow progress upstream could lengthen the carbon payback period.